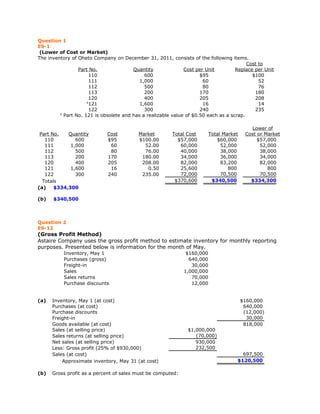

Lower of Cost or Market Inventory Calculation

- 1. Question 1 E9-1 (Lower of Cost or Market) The inventory of Oheto Company on December 31, 2011, consists of the following items. Cost to Part No. Quantity Cost per Unit Replace per Unit 110 600 $95 $100 111 1,000 60 52 112 500 80 76 113 200 170 180 120 400 205 208 a 121 1,600 16 14 122 300 240 235 a Part No. 121 is obsolete and has a realizable value of $0.50 each as a scrap. Lower of Part No. Quantity Cost Market Total Cost Total Market Cost or Market 110 600 $95 $100.00 $57,000 $60,000 $57,000 111 1,000 60 52.00 60,000 52,000 52,000 112 500 80 76.00 40,000 38,000 38,000 113 200 170 180.00 34,000 36,000 34,000 120 400 205 208.00 82,000 83,200 82,000 121 1,600 16 0.50 25,600 800 800 122 300 240 235.00 72,000 70,500 70,500 Totals $370,600 $340,500 $334,300 (a) $334,300 (b) $340,500 Question 2 E9-12 (Gross Profit Method) Astaire Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 $160,000 Purchases (gross) 640,000 Freight-in 30,000 Sales 1,000,000 Sales returns 70,000 Purchase discounts 12,000 (a) Inventory, May 1 (at cost) $160,000 Purchases (at cost) 640,000 Purchase discounts (12,000) Freight-in 30,000 Goods available (at cost) 818,000 Sales (at selling price) $1,000,000 Sales returns (at selling price) (70,000) Net sales (at selling price) 930,000 Less: Gross profit (25% of $930,000) 232,500 Sales (at cost) 697,500 Approximate inventory, May 31 (at cost) $120,500 (b) Gross profit as a percent of sales must be computed:

- 2. 25% = 20% of sales 100% + 25% Inventory, May 1 (at cost) $160,000 Purchases (at cost) 640,000 Purchase discounts (12,000) Freight-in 30,000 Goods available (at cost) 818,000 Sales (at selling price) $1,000,000 Sales returns (at selling price) (70,000) Net sales (at selling price) 930,000 Less gross profit (20% of $930,000l) 186,000 Sales (at cost) 744,000 Approximate inventory, May 31 (at cost) $74,000 Question 3 E10-5 (Treatment of Various Costs) Allegro Supply Company, a newly formed corporation, incurred the following expenditures related to Land, to Buildings, and to Machinery and Equipment. Abstract company's fee for title search $ 520 Architect's fees 3,170 Cash paid for land and dilapidated building thereon 92,000 Removal of old building $20,000 Less: Salvage 5,500 14,500 Interest on short-term loans during construction 7,400 Excavation before construction for basement 19,000 Machinery purchased (subject to 2% cash discount, which was not taken) 65,000 Freight on machinery purchased 1,340 Storage charges on machinery, necessitated by noncompletion of building when machinery was 2,180 delivered New building constructed (building construction took 6 months from date of purchase of land and old building) 485,000 Assessment by city for drainage project 1,600 Hauling charges for delivery of machinery from storage to new building 620 Installation of machinery 2,000 Trees, shrubs, and other landscaping after completion of building (permanent in nature) 5,400 Determine the amounts that should be debited to Land, to Buildings, and to Machinery and Equipment. Assume the benefits of capitalizing interest during construction exceed the cost of implementation. Question 3

- 3. Machinery Land Buildings & Equipment Other Abstract fees $520 $ 0 $ 0 $ 0 Architect's fees 0 3,170 0 0 Cash paid for land and old 92,000 0 0 0 building Removal of old building 14,500 0 0 0 ($20,000 - $5,500) Interest on loans during 0 7,400 0 0 construction Excavation before 0 19,000 0 0 construction Misc. exp. Machinery purchased 0 0 63,700 1,300 (Disc. lost) Freight on machinery 0 0 1,340 0 Storage charges caused by Misc. exp. 0 0 0 2,180 noncompletion of bldg (loss) New building 0 485,000 0 0 Assessment by city 1,600 0 0 0 Hauling charges - Misc. exp. 0 0 0 620 machinery (loss) Installation - machinery 0 0 2,000 0 Landscaping 5,400 0 0 0 $114,020 $514,570 $67,040 $4,100 Question 4 E10-12 (Entries for Asset Acquisition, Including Self-Construction) Below are transactions related to Impala Company. (a) The City of Pebble Beach gives the company 5 acres of land as a plant site. The market value of this land is determined to be $81,000. (b) 14,000 shares of common stock with a par value of $50 per share are issued in exchange for land and buildings. The property has been appraised at a fair market value of $810,000, of which $180,000 has been allocated to land and $630,000 to buildings. The stock of Impala Company is not listed on any exchange, but a block of 100 shares was sold by a stockholder 12 months ago at $65 per share, and a block of 200 shares was sold by another stockholder 18 months ago at $58 per share. (c) No entry has been made to remove from the accounts for Materials, Direct Labor, and Overhead the amounts properly chargeable to plant asset accounts for machinery constructed during the year. The following information is given relative to costs of the machinery constructed. Materials used $12,500 Factory supplies used 900 Direct labor incurred 16,000 Additional overhead (over regular) caused by construction of machinery, excluding factory supplies used 2,700 Fixed overhead rate applied to regular manufacturing operations 60% of direct labor cost Cost of similar machinery if it had been purchased from outside 44,000 suppliers

- 4. Description/Account Debit Credit (a) Land 81,000 Contribution revenue 81,000 (b) Buildings 630,000 Land 180,000 Common stock ($50 × $14,000) 700,000 Paid-in capital in excess of par* 110,000 (c) Machinery 41,700 Direct labor 16,000 Factory overhead **13,200 Materials 12,500 • Since the market value of the stock is not determinable, the market value of the property is used as the basis for recording the asset and issuance of the stock. ** Fixed overhead applied (60% × $16,000) $9,600 Additional overhead 2,700 Factory supplies used 900 $13,200