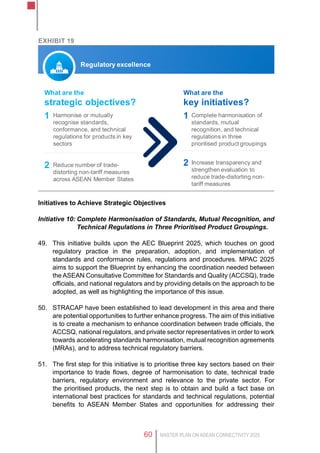

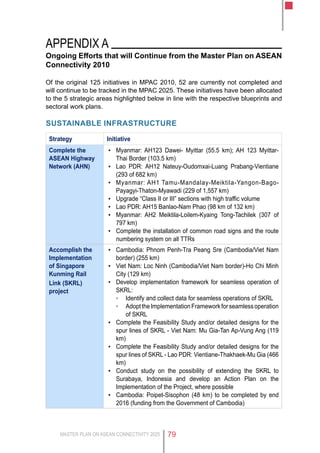

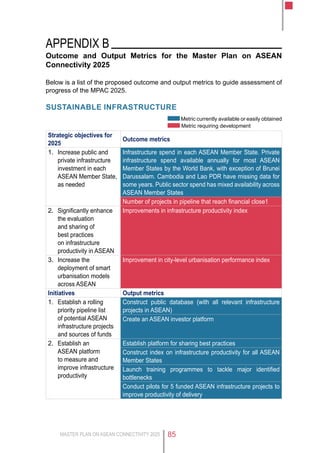

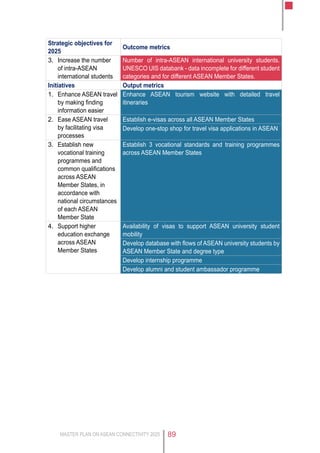

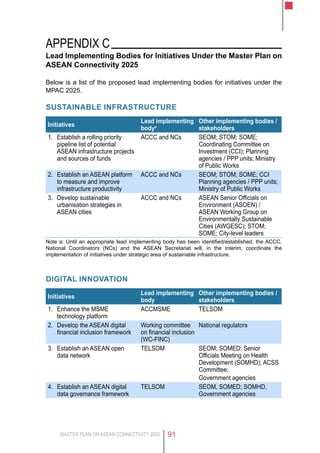

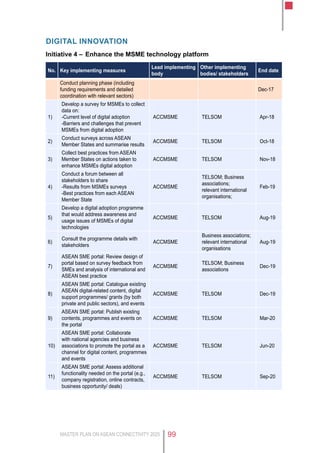

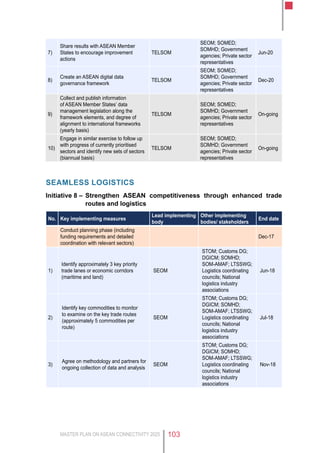

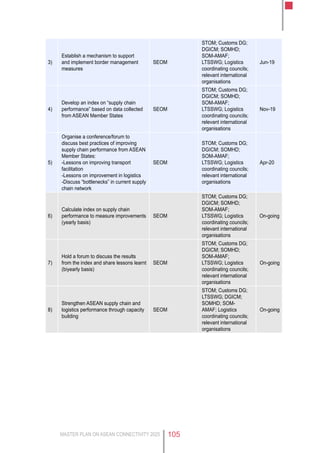

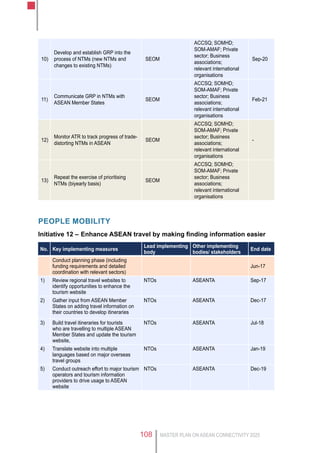

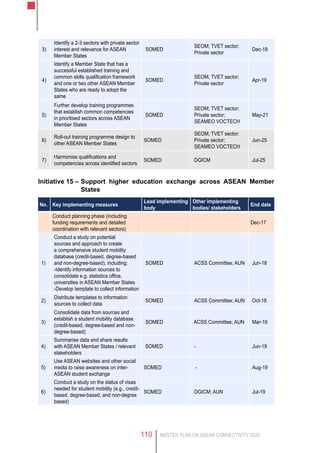

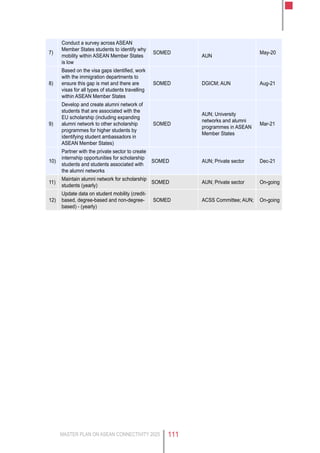

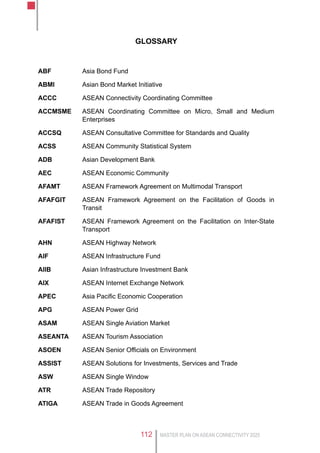

The document presents the Master Plan on ASEAN Connectivity 2025, which aims to achieve a seamlessly and comprehensively connected ASEAN community by 2025. It outlines initiatives to enhance sustainable infrastructure, digital innovation, seamless logistics, regulatory excellence, and people mobility across Southeast Asia. The plan seeks to promote regional competitiveness, inclusiveness, and a stronger sense of community through improved physical, institutional, and social connections between ASEAN countries.