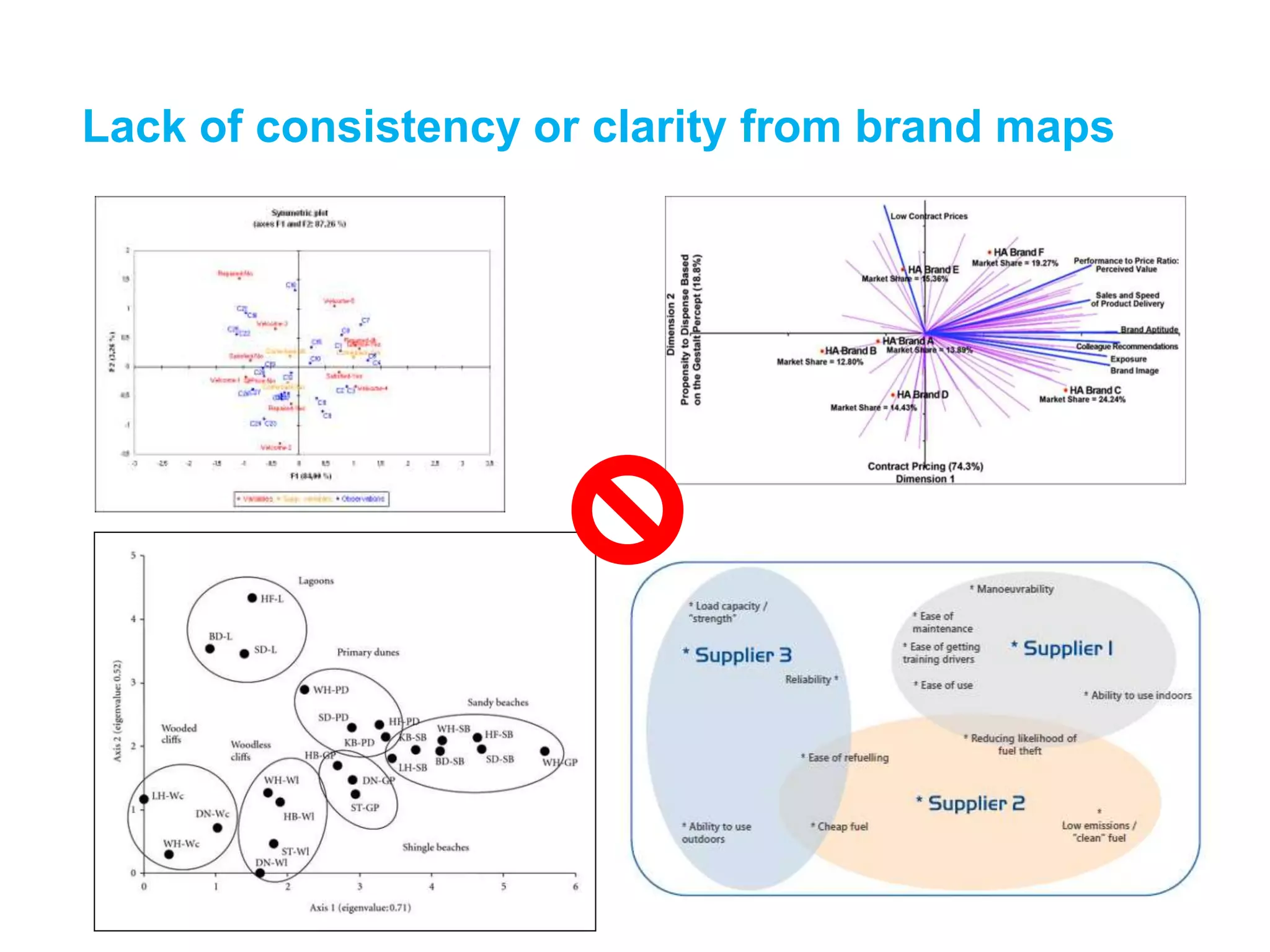

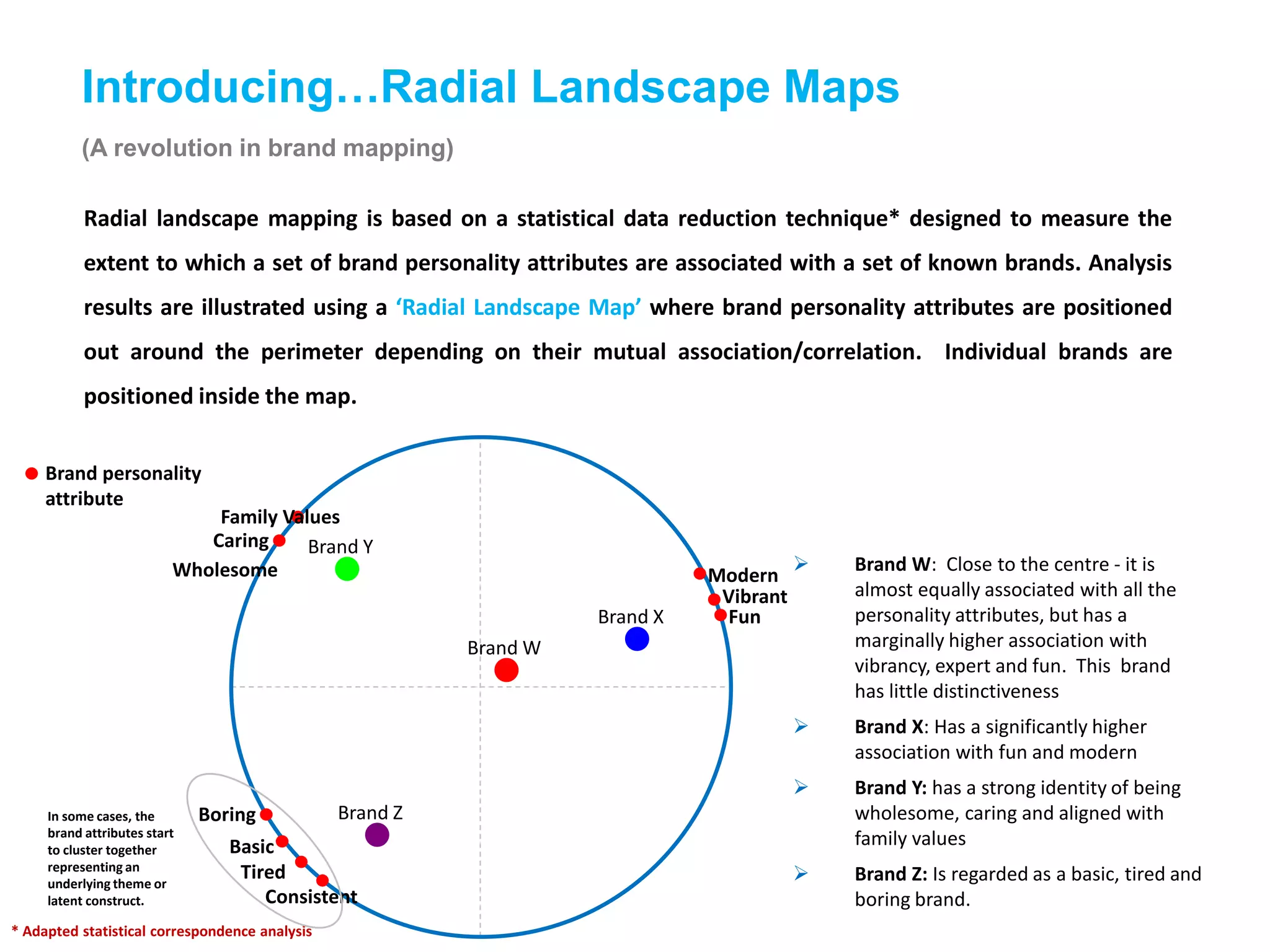

Radial landscape mapping is a revolutionary market research tool that enhances traditional brand perceptual mapping by addressing limitations such as clutter and complexity. This innovative approach uses statistical data reduction to visualize brand attributes and consumer perceptions effectively, facilitating easier interpretation by non-technical audiences. Case studies demonstrate its applications in various sectors, revealing insights into brand positioning and consumer engagement across multiple industries.