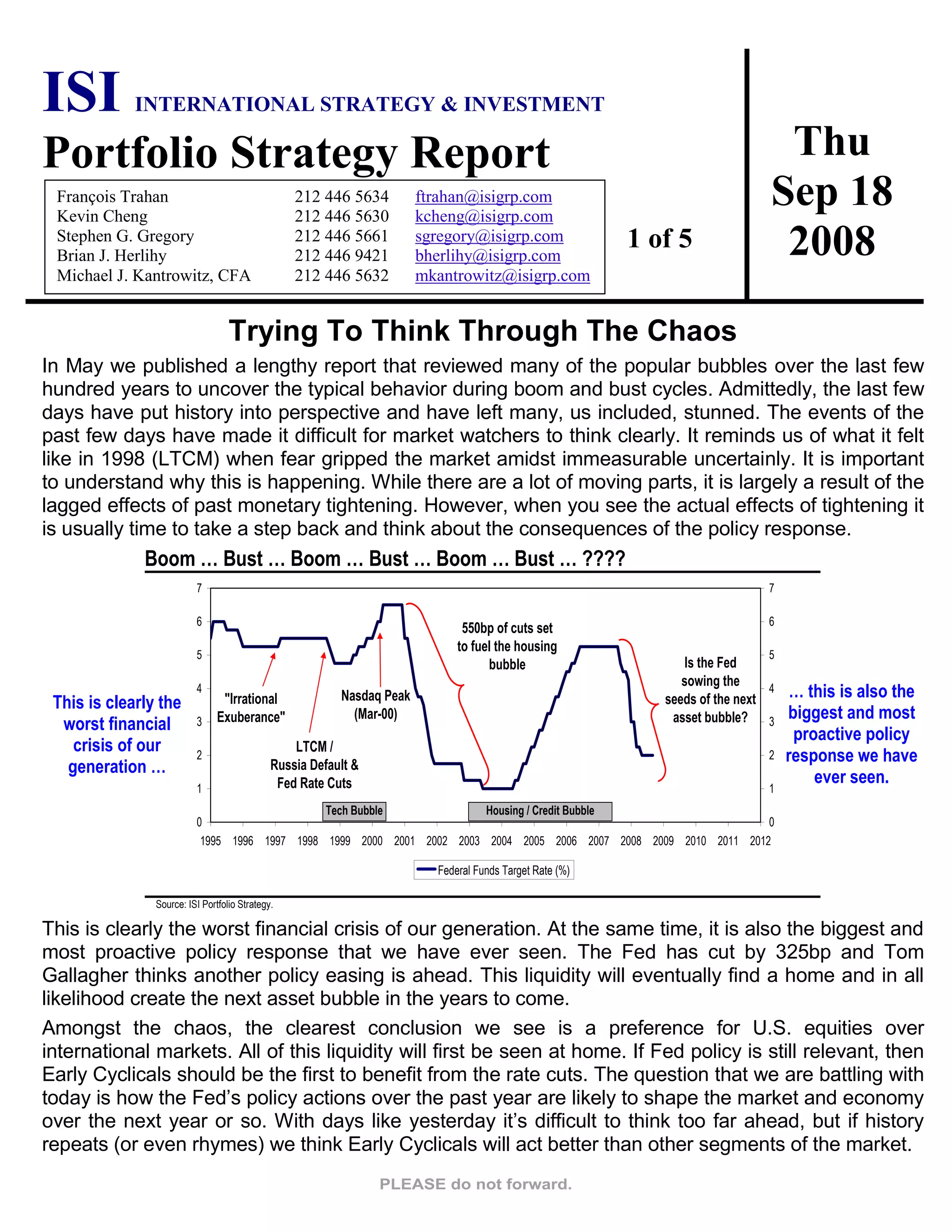

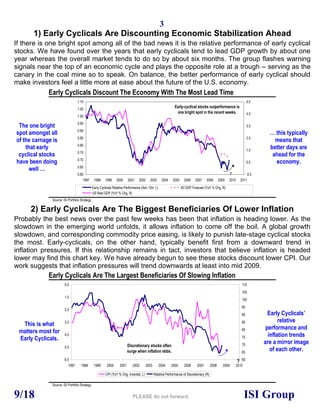

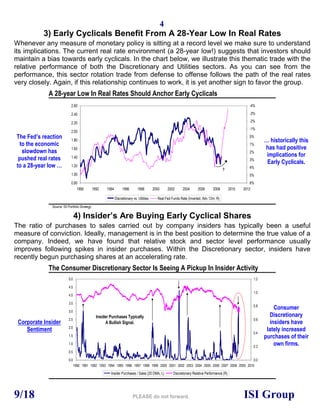

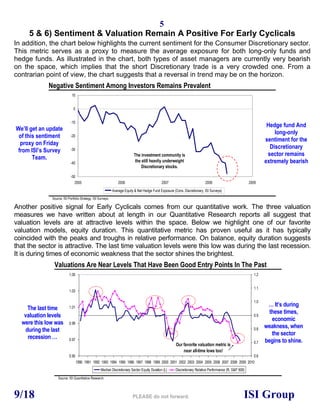

This document provides an analysis of the current financial crisis and its causes. It summarizes that the crisis is largely due to the lagged effects of past monetary tightening by the Federal Reserve. While this is the worst crisis of the generation, the response by the Fed, including 325 basis points of rate cuts, is also the most aggressive seen. This liquidity will eventually fuel the next asset bubble. The analysis concludes that U.S. equities will outperform international markets due to the Fed actions, and early cyclical stocks should benefit first from interest rate cuts.