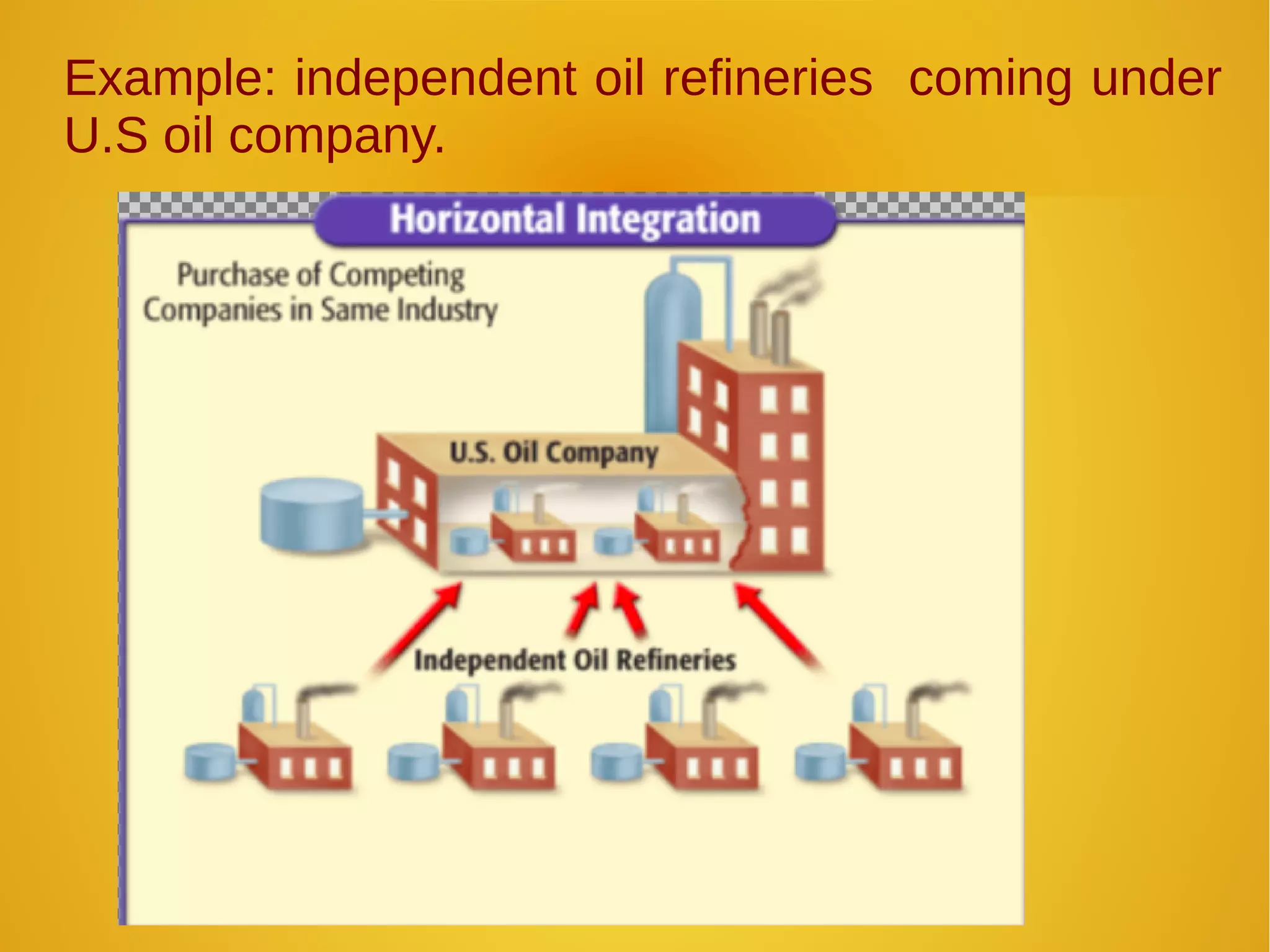

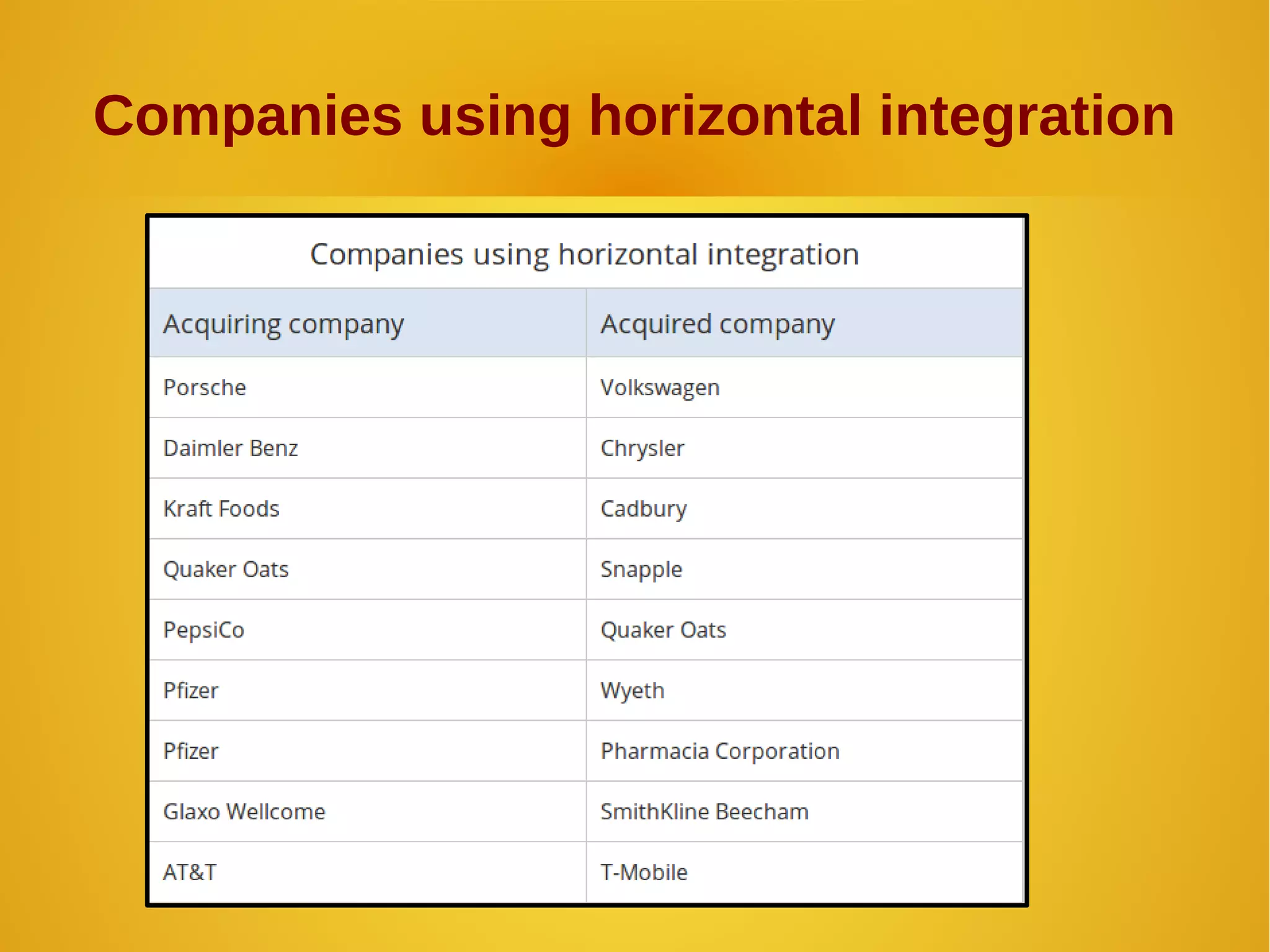

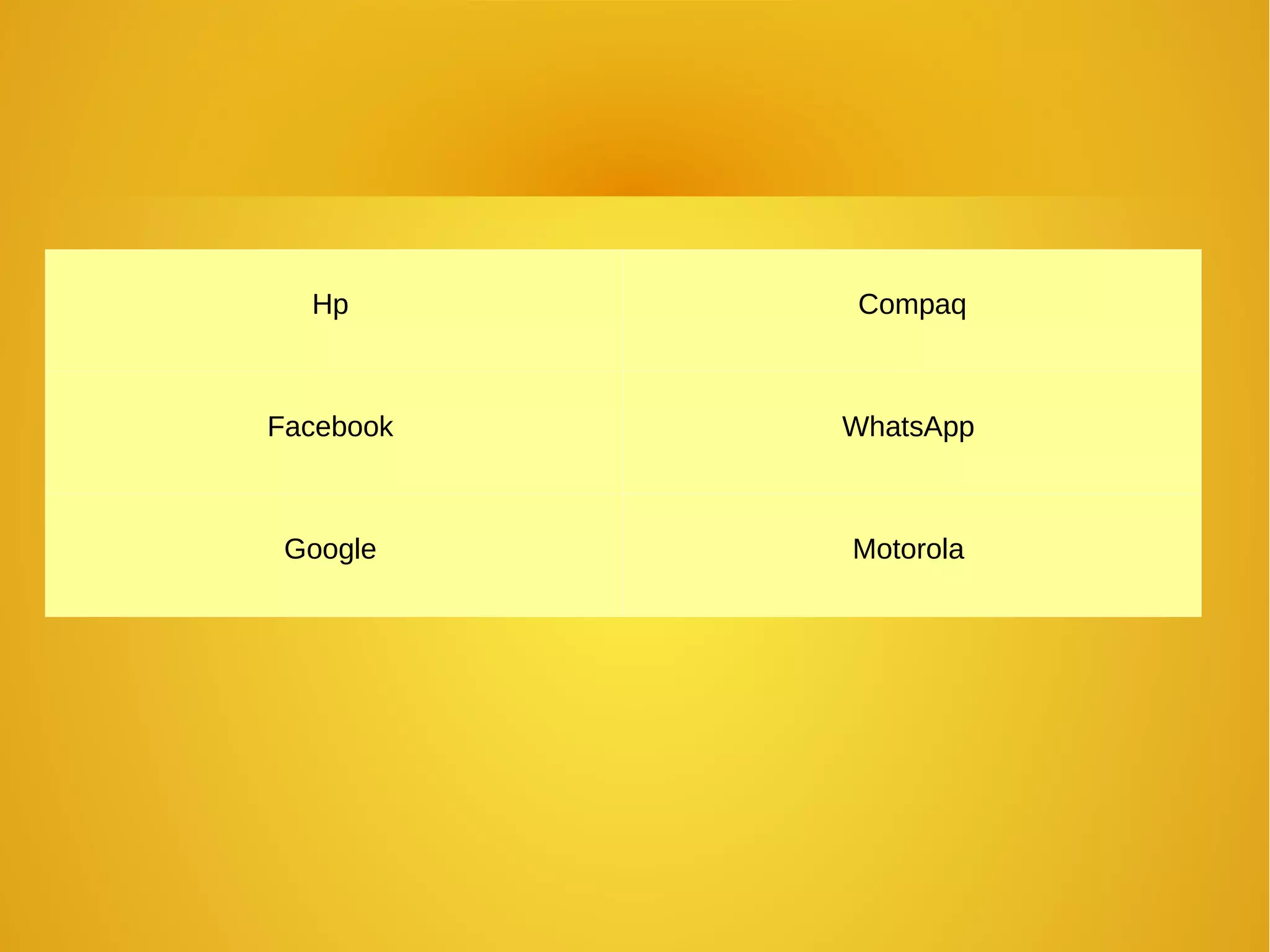

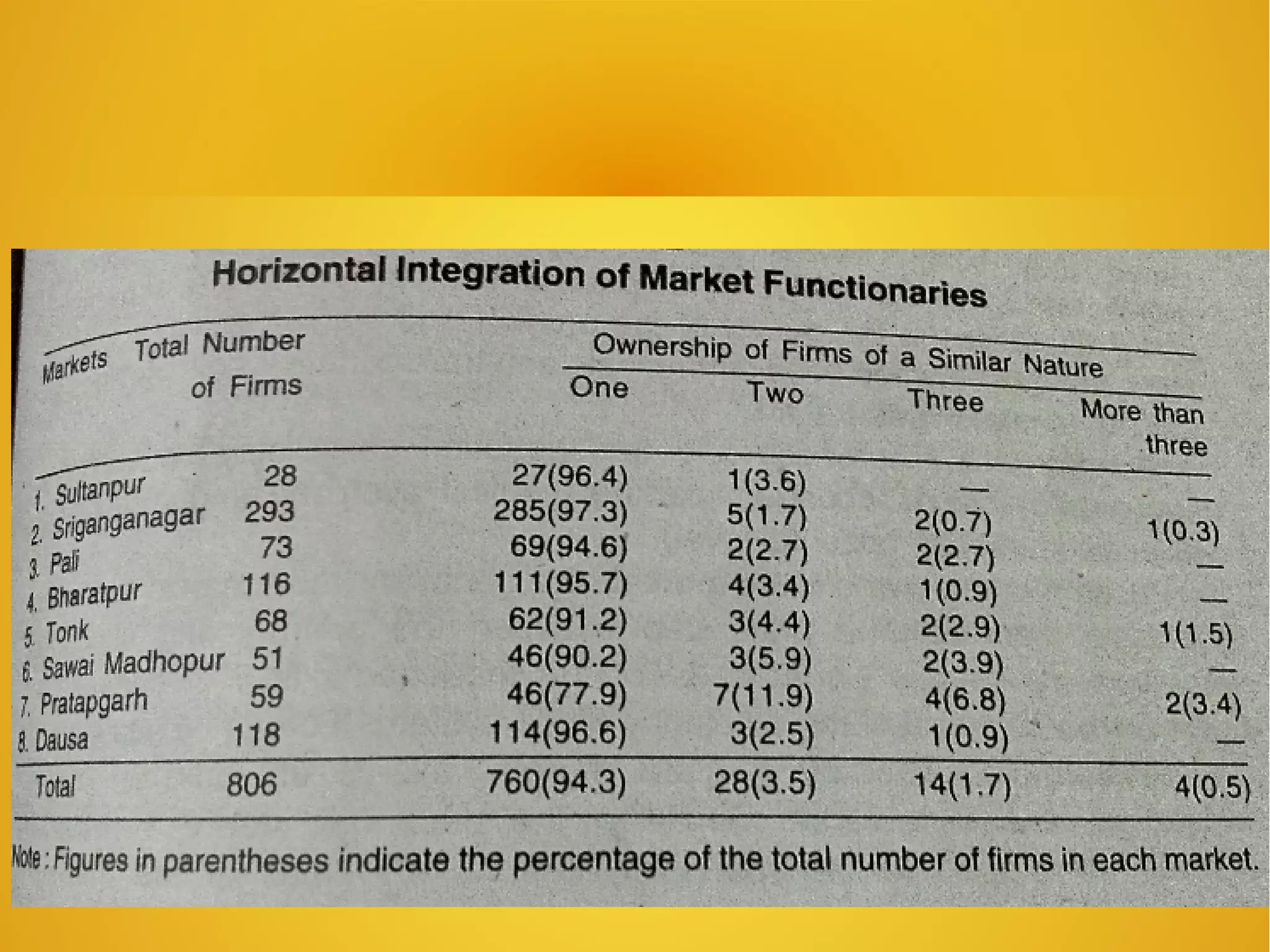

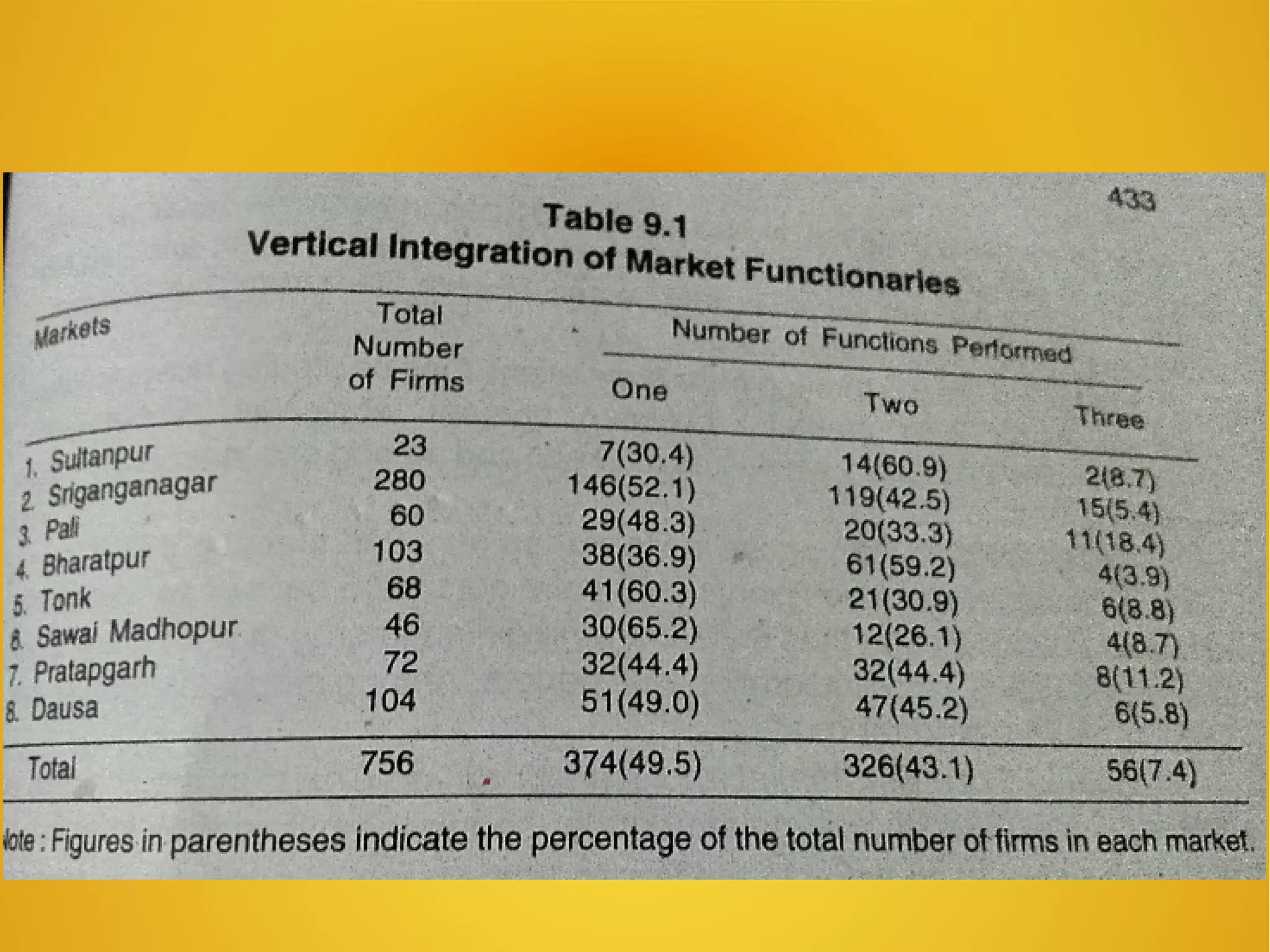

This document discusses market integration in agriculture. It defines market integration as the expansion of firms through consolidating additional marketing functions under single management. There are three main types of market integration: horizontal, vertical, and conglomeration. Horizontal integration occurs when firms in the same market level combine, like independent oil refineries. Vertical integration links functions along the supply chain. Conglomeration combines unrelated activities under one firm. Market integration can be measured by assessing integration among firms and spatially separated markets using methods like price correlation and spatial price differentials.