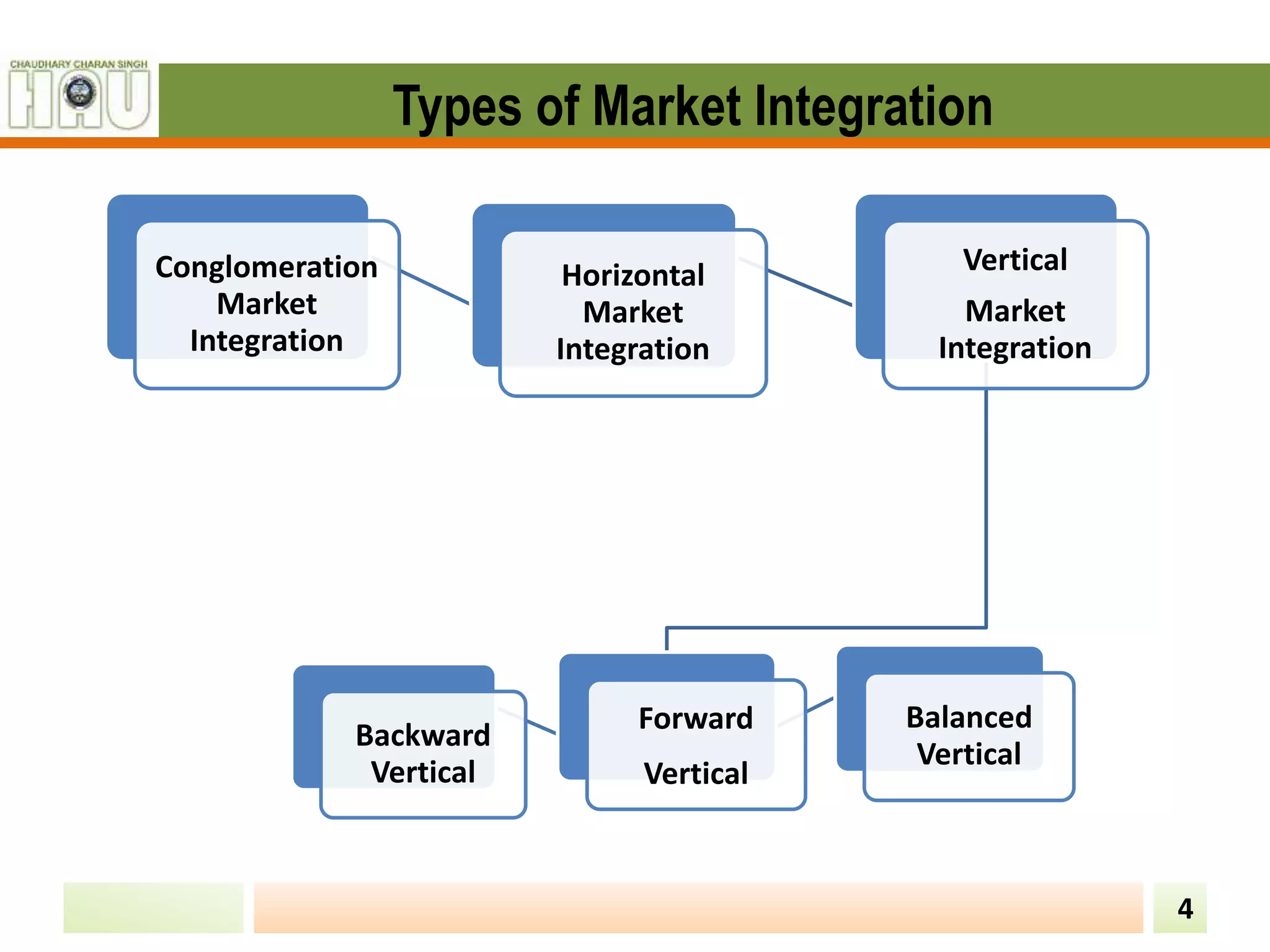

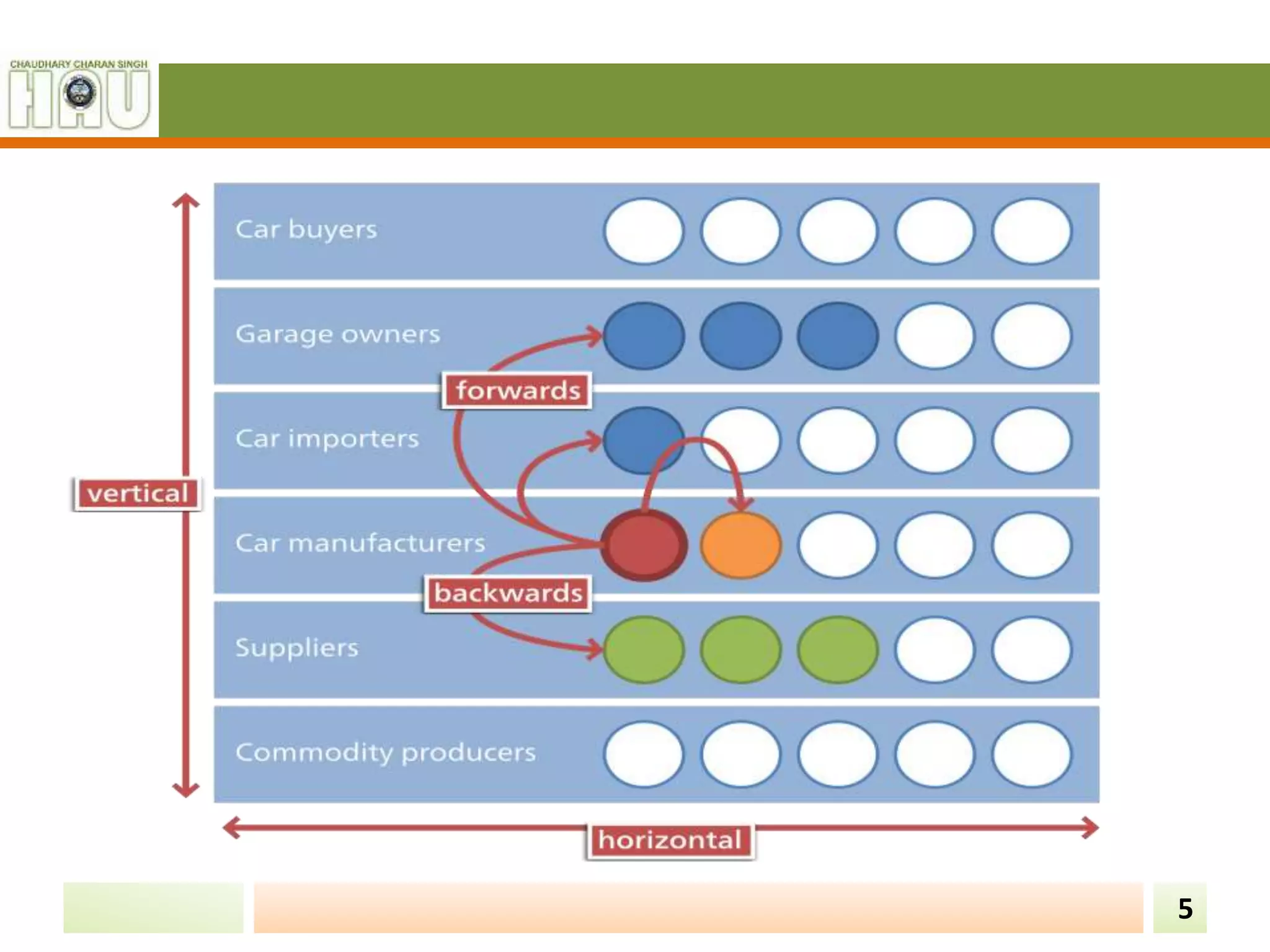

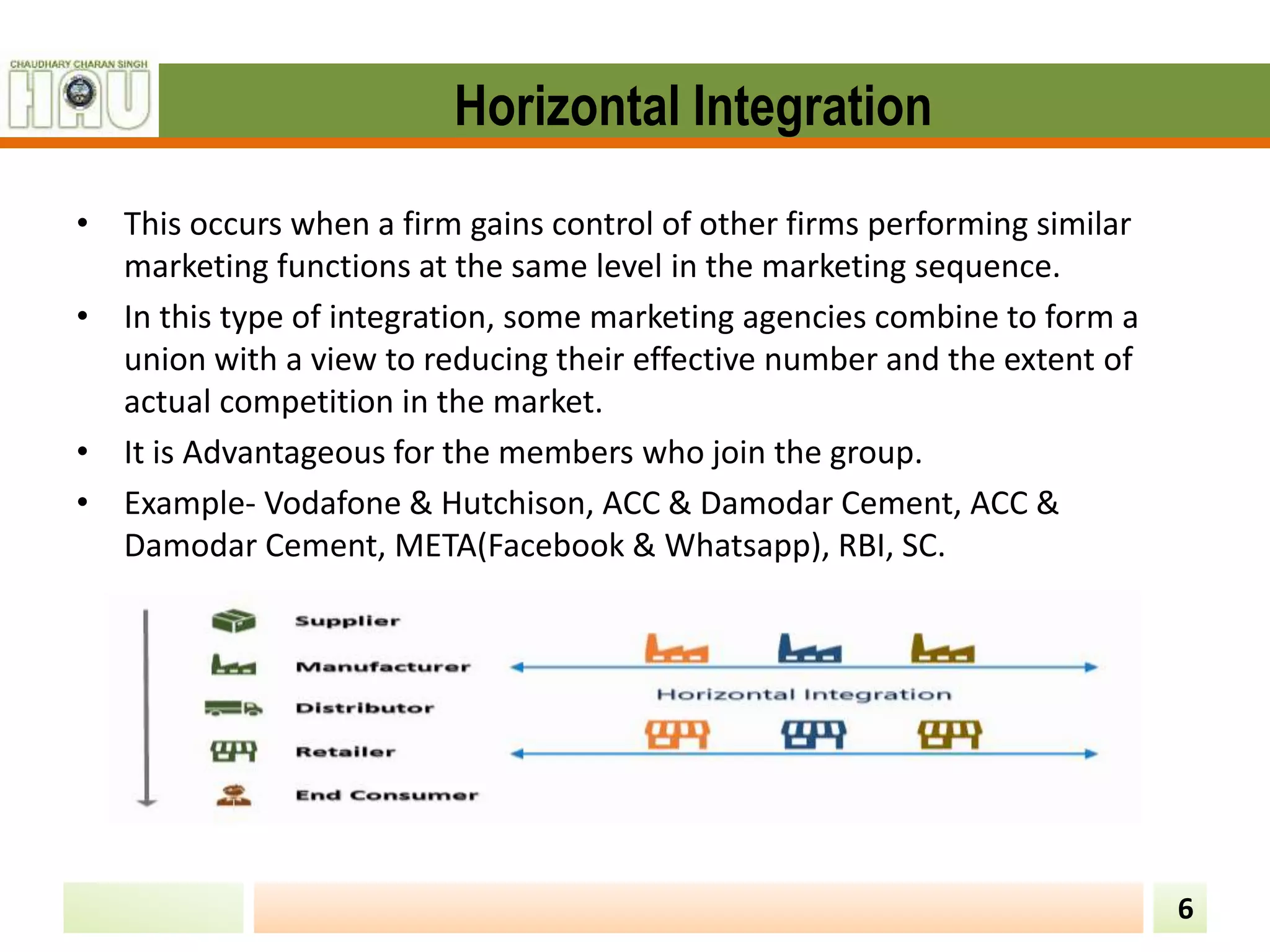

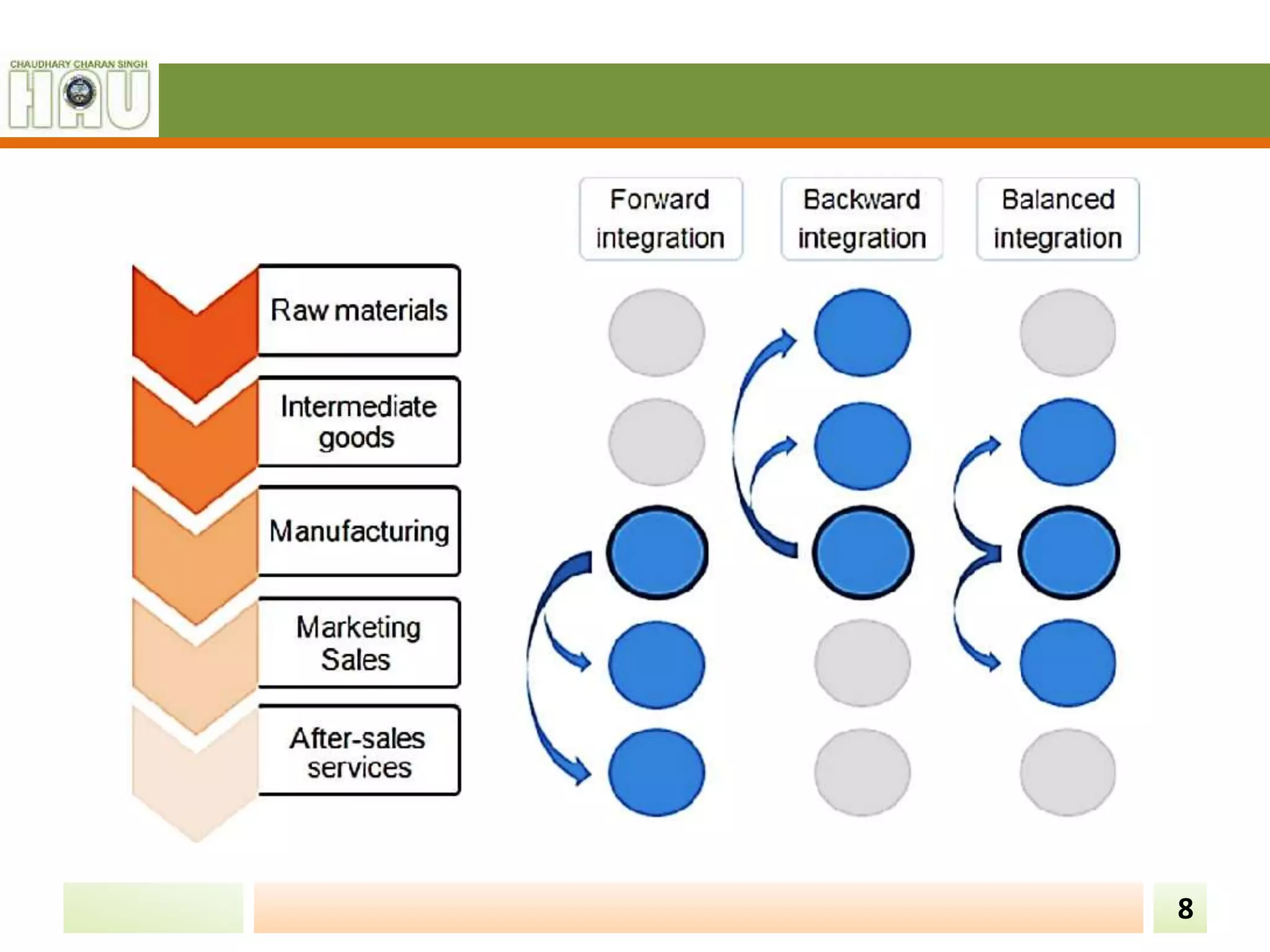

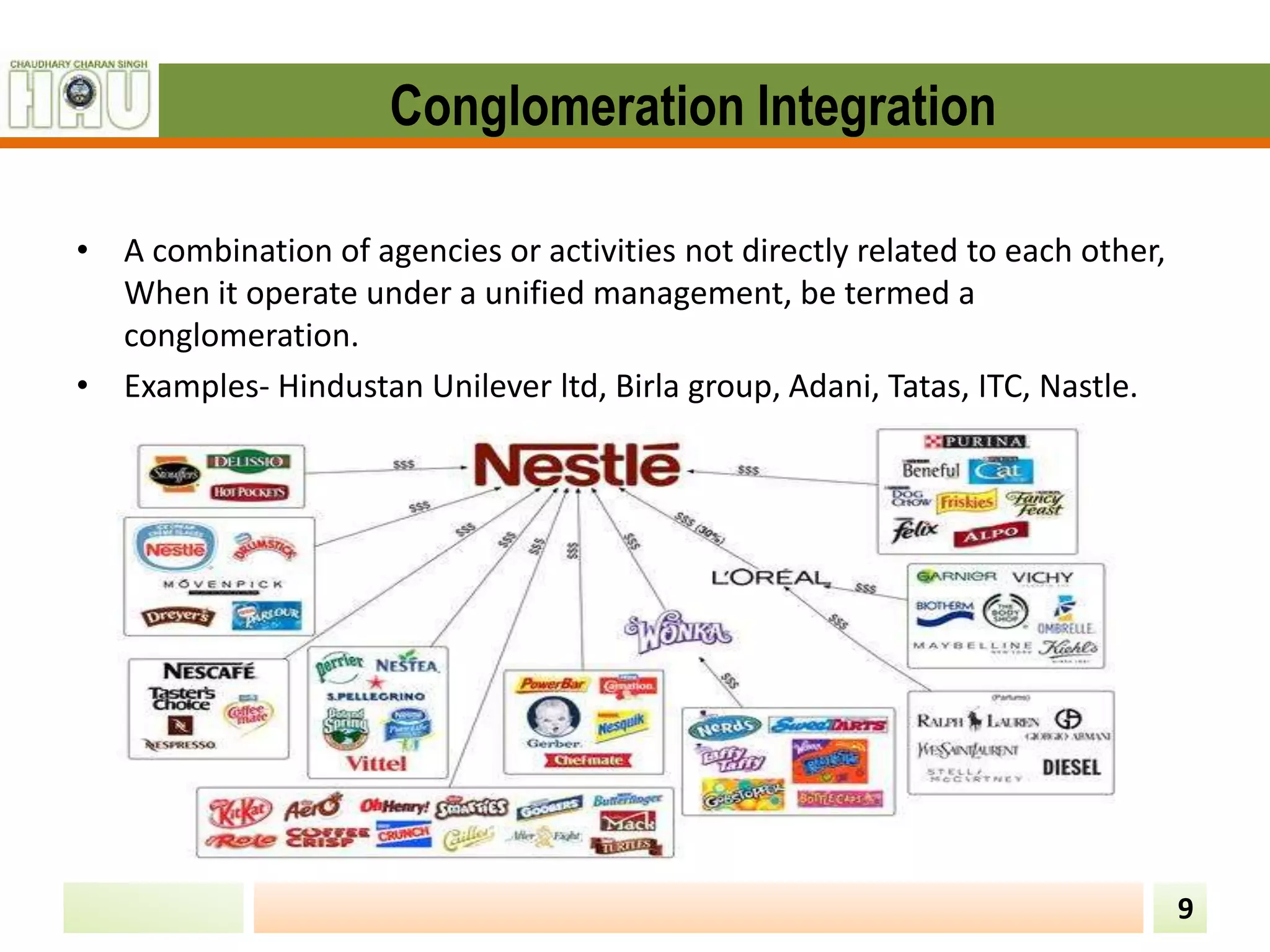

The document defines market integration as the consolidation of marketing functions under single management, with features such as rapid information flow and price adjustments. It discusses three types of market integration: horizontal, vertical, and conglomeration, providing examples for each type. Additionally, it outlines the effects of integration on operational efficiency, market share, and price stabilization.