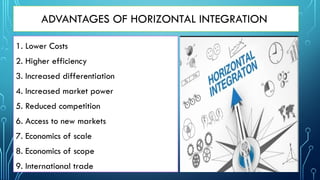

Market integration refers to the interconnectedness of prices across different locations or related goods, driven by reduced transportation costs and trade barriers. It improves global trade efficiency and market competition, while offering benefits such as higher profits, new market access, and varied product availability; however, it can also lead to potential downsides like reduced quality and flexibility. There are three primary types of market integration: horizontal, vertical, and conglomeration, each with specific advantages and disadvantages.