1. Speed Boat is used to quickly generate ideas where participants write ideas on post-its and discuss the top ideas.

2. Dot Voting is used to prioritize ideas where participants vote on their favorite ideas by placing stickers on ideas.

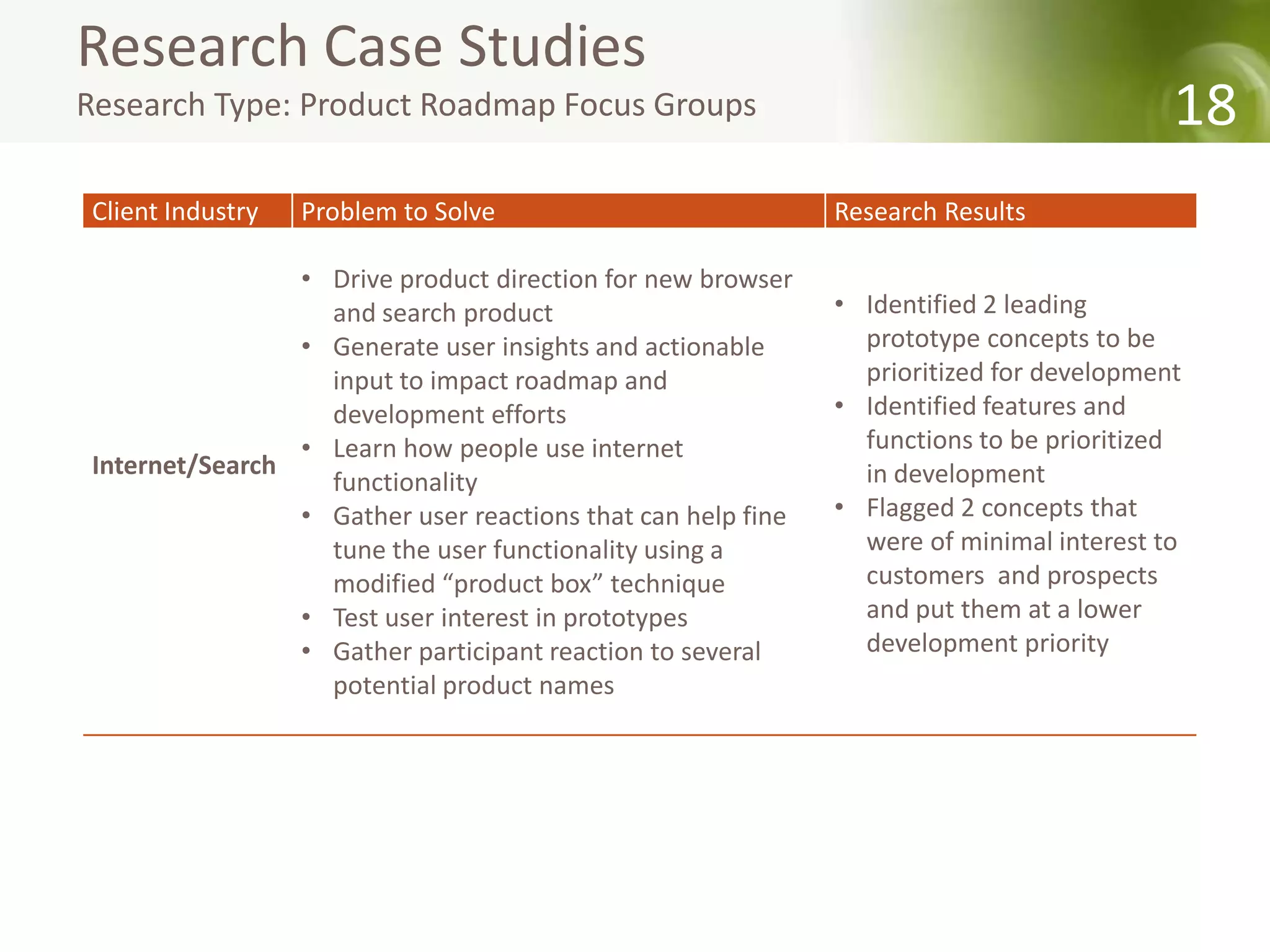

3. Product Box allows participants to imagine new product features and functions by placing them in a box.