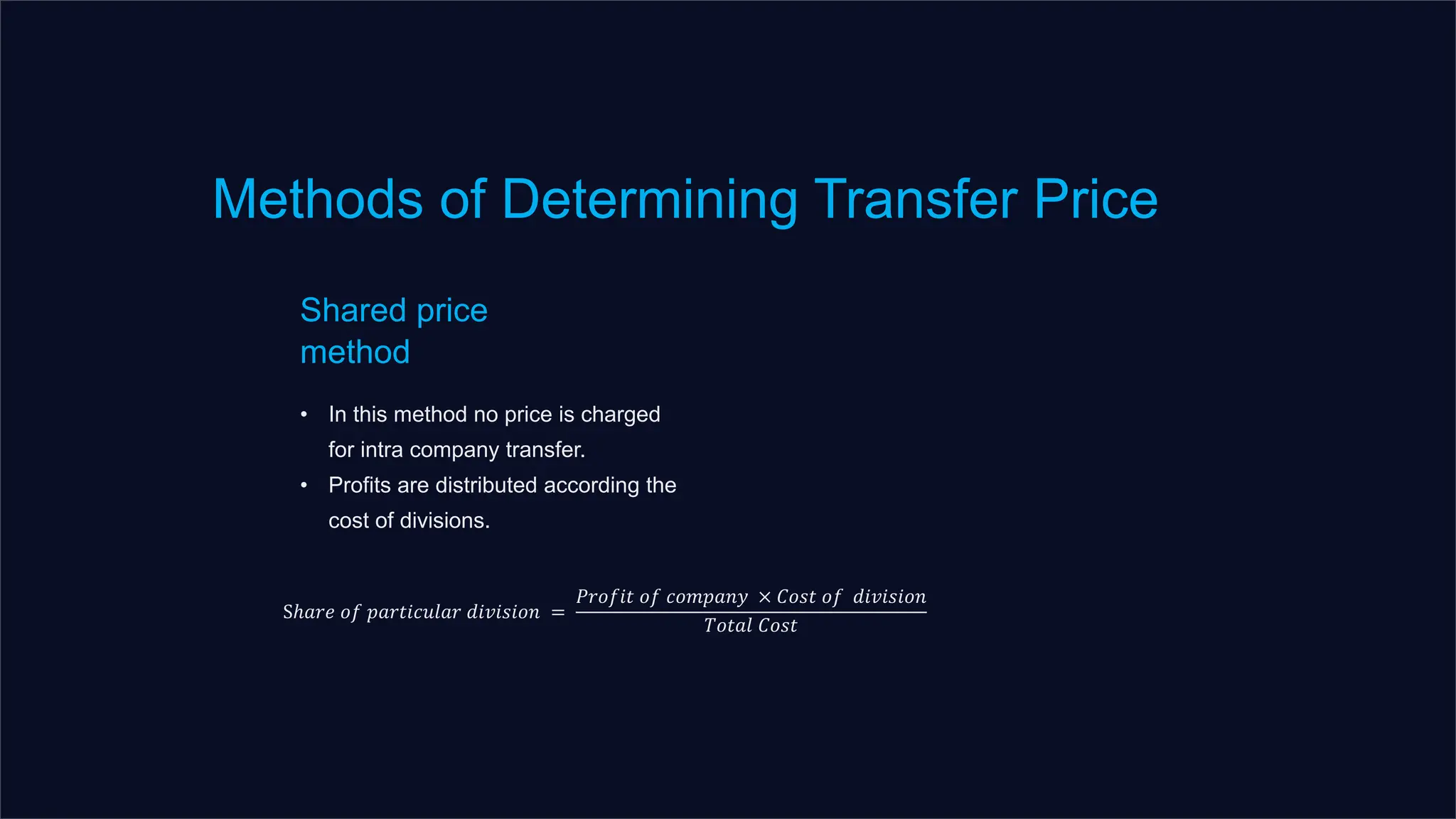

The document discusses transfer pricing, which is the price at which goods or services are exchanged between divisions within the same organization, and explores its methods, impacts, and financial implications. It highlights the importance of alignment with company goals, divisional autonomy, and how transfer prices can affect profits and decision-making. Additionally, it covers various methods of setting transfer prices, including cost-based, market-based, and profit-based methods, while also touching on international transfer pricing and its significance for tax liabilities among multinational corporations.