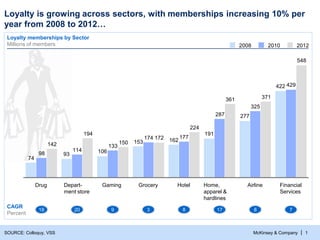

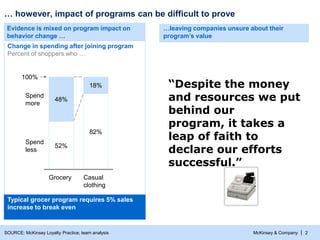

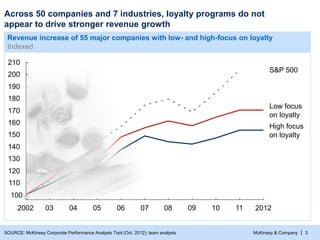

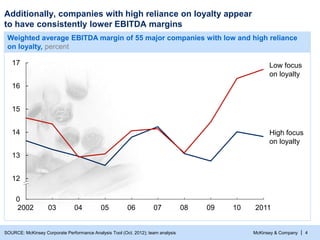

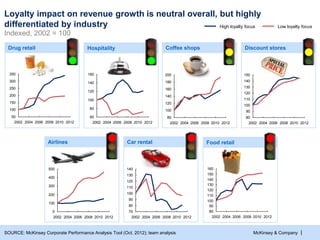

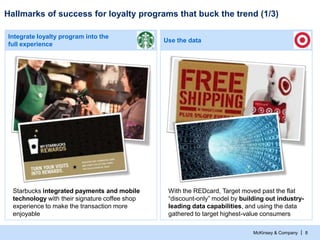

The document discusses the growth and challenges of loyalty programs across various sectors, indicating a 10% annual increase in memberships from 2008 to 2012. It highlights the difficulty in proving the impact of these programs on spending, revealing that many companies experience minimal revenue growth despite significant investments. Successful loyalty programs often integrate user experience, address customer pain points, and focus on high-value consumers while learning from data analytics.