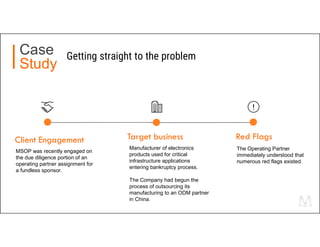

This document provides guidance on enhancing due diligence outcomes for private equity funds and family offices by utilizing experienced operating partners. It emphasizes the value of operational diligence in evaluating potential investments and highlights a case study where an operating partner identified critical issues in a business undergoing bankruptcy. Ultimately, it showcases how effective due diligence can unlock value and improve investor decision-making.