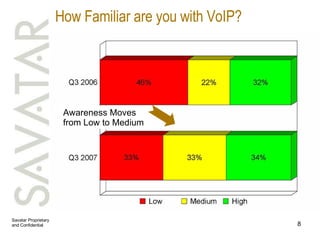

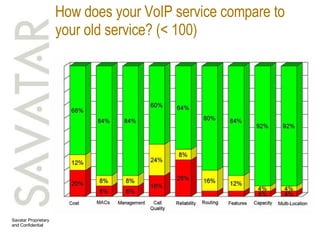

The document summarizes research from a study on the SMB VoIP market. Key findings include: SMBs are unsure where to learn about and purchase VoIP solutions; no single provider dominates; measured SMB VoIP adoption has declined; interest in fixed-mobile convergence is higher than expected; and total cost of ownership models show hosted VoIP can cost around $45 per employee per month for a 75-employee company. The research included surveys, interviews and competitive analysis of VoIP providers.

![For more information: Mick Ahearn, VP Business Development [email_address] +1-617-670-4315](https://image.slidesharecdn.com/macario-john-1206225073837769-5/85/Macario-John-33-320.jpg)