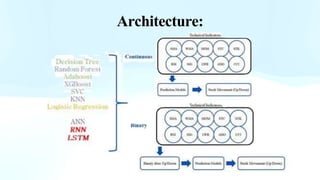

This document presents a comparative analysis of using machine learning and deep learning algorithms to predict stock market trends via continuous and binary data. It discusses using historical data from four stock market groups over 10 years as inputs to nine machine learning and two deep learning models. The results indicate that recurrent neural networks and long short-term memory networks outperformed other models for both continuous and binary data, with better accuracy when the inputs were converted to binary before being fed to the models.