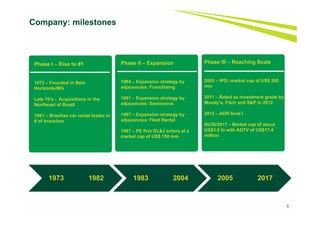

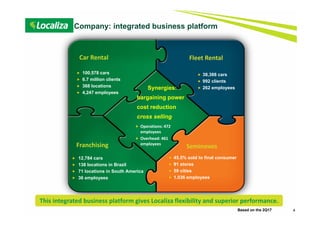

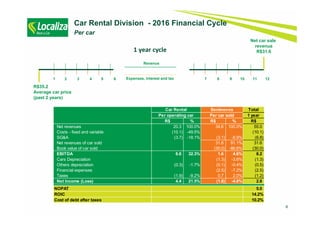

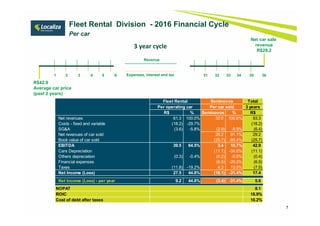

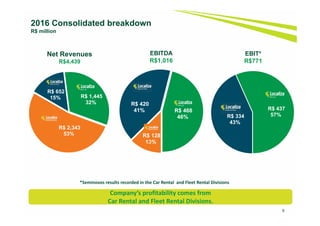

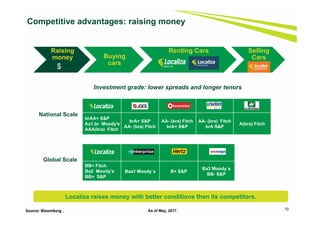

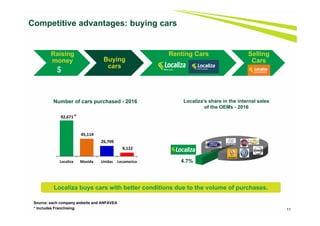

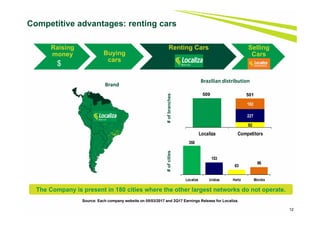

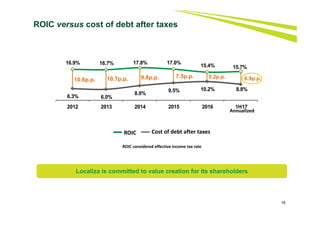

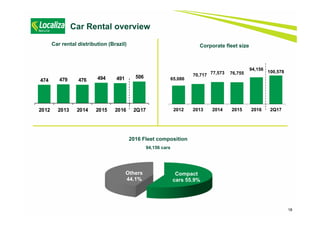

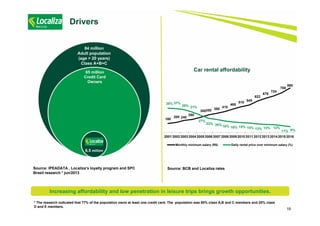

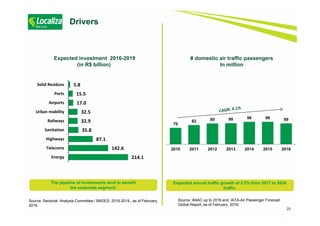

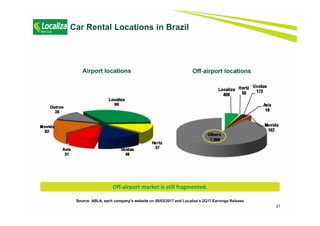

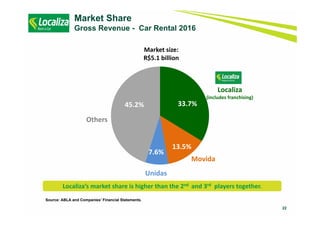

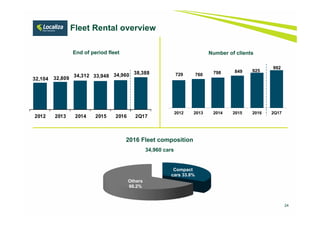

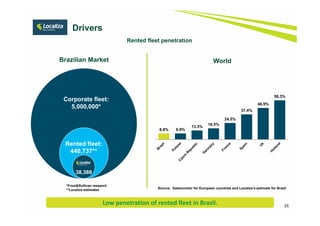

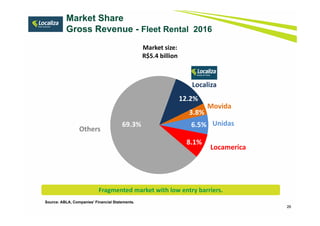

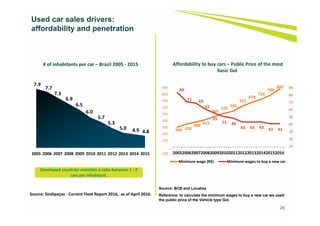

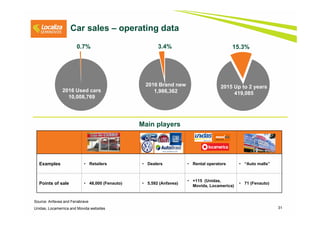

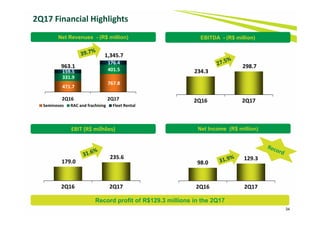

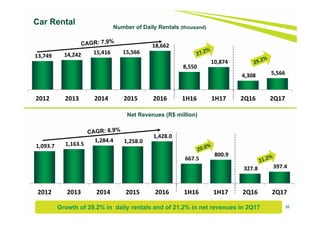

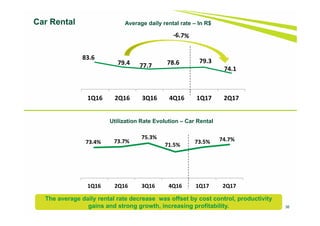

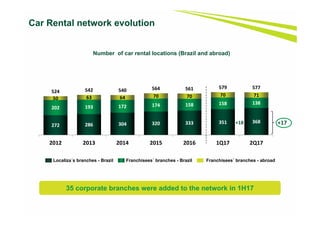

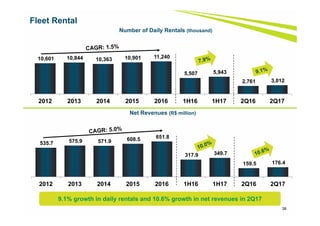

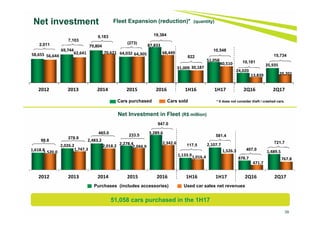

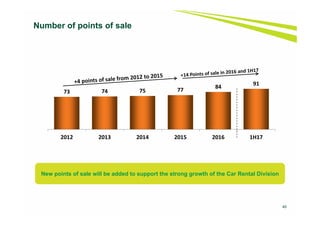

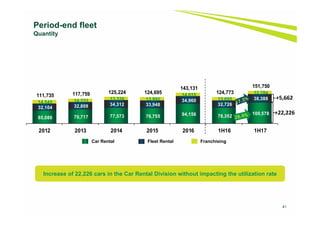

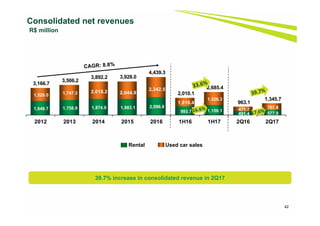

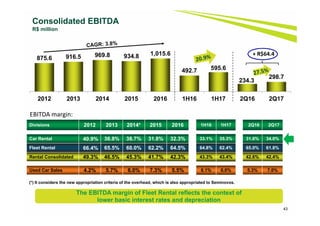

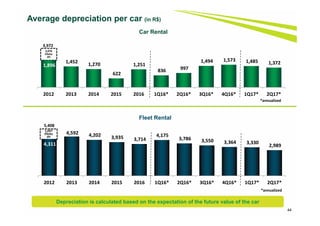

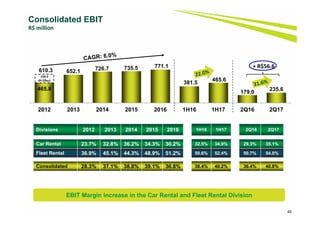

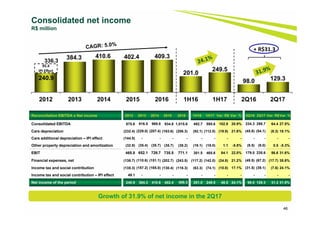

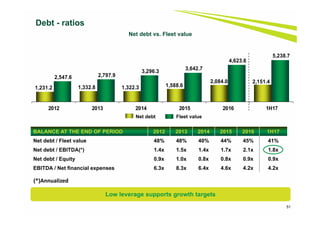

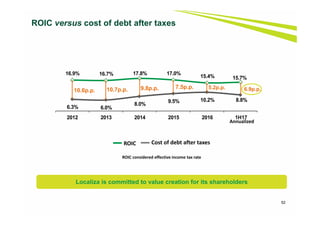

This presentation provides an overview of Localiza, a Brazilian car rental company. It discusses the company's history and milestones, integrated business platform consisting of car rental, fleet rental, franchising, and used car sales divisions, competitive advantages in raising money, buying cars, renting cars, innovation, and selling used cars. Financial information is presented on the car rental and fleet rental divisions. The presentation also reviews market drivers, locations, and Localiza's leading market share positions in both the car rental and fleet rental markets in Brazil.