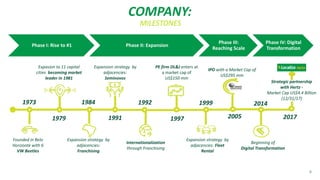

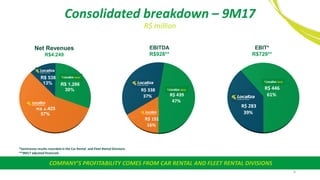

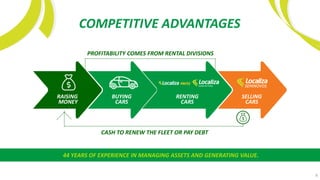

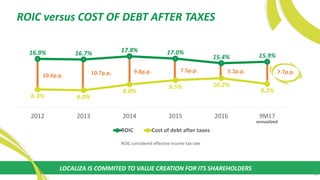

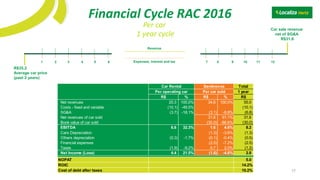

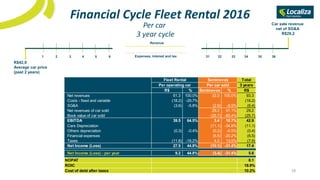

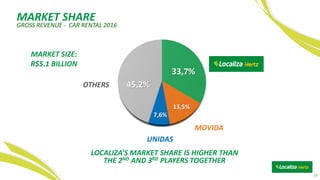

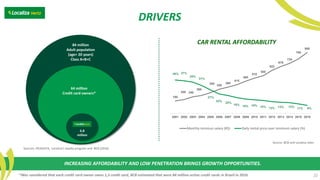

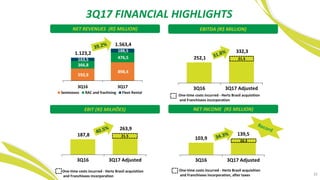

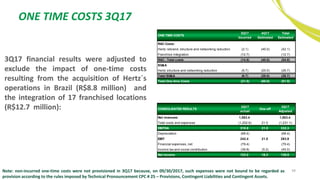

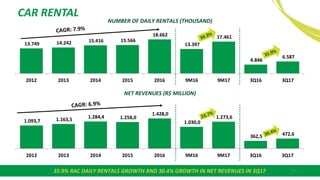

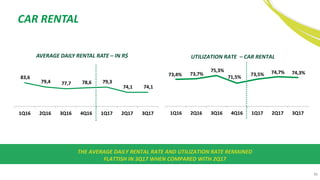

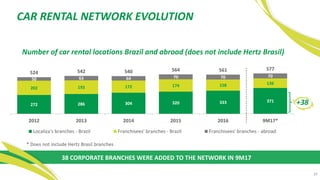

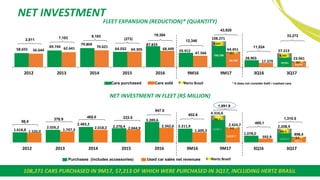

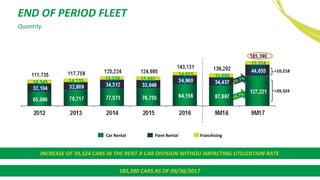

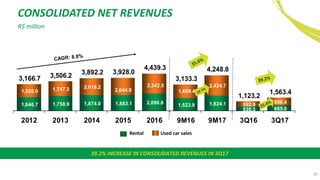

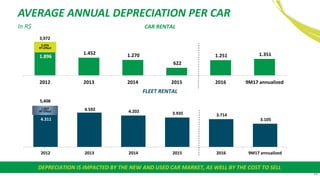

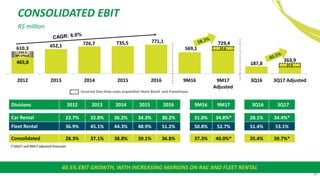

The document provides an overview of Localiza, a car rental company based in Brazil. It discusses Localiza's business divisions including car rental, fleet rental, and used car sales. It highlights Localiza's competitive advantages such as its integrated business platform, leadership in loyalty and quality, efficient used car sales, and innovation in technology. Financial details are presented showing that profitability comes mainly from the car rental and fleet rental divisions.