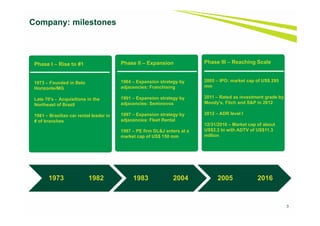

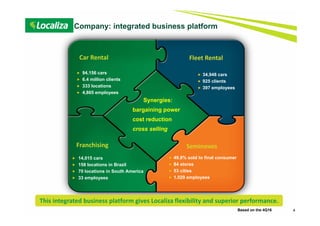

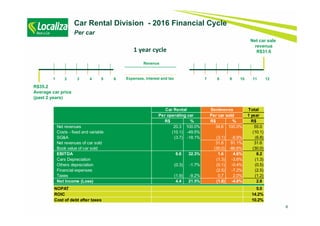

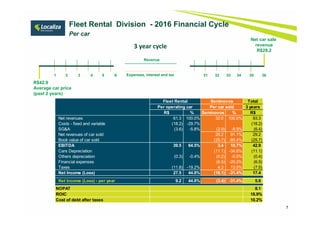

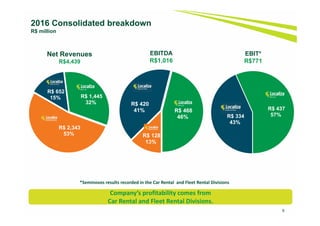

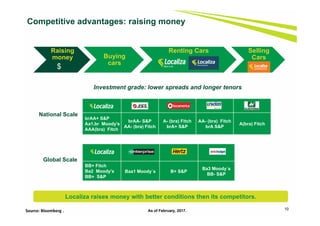

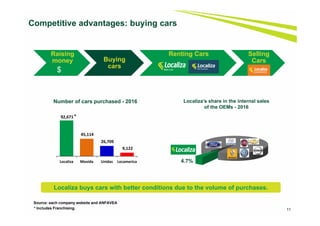

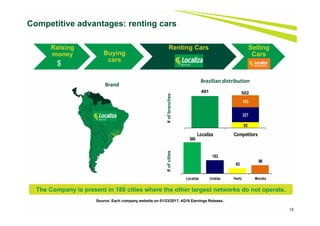

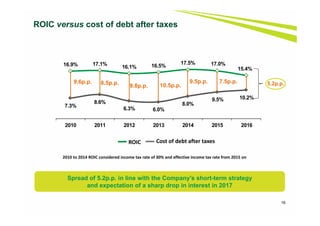

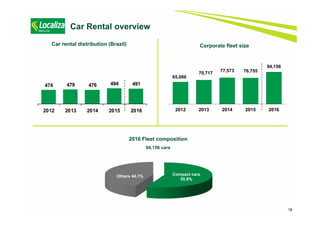

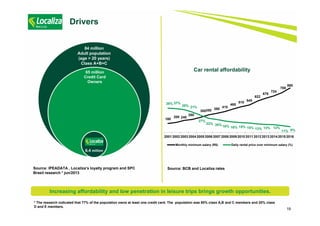

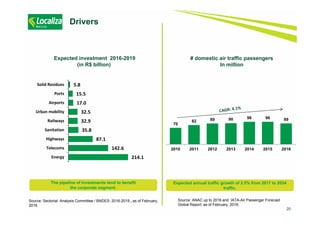

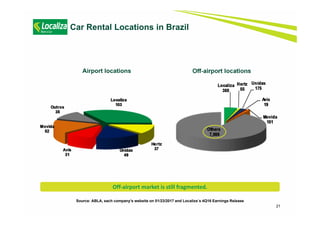

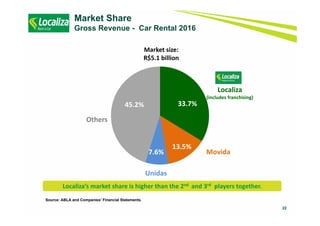

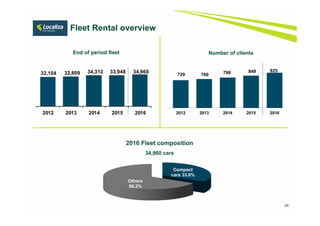

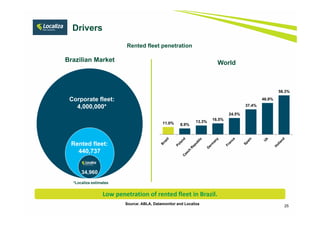

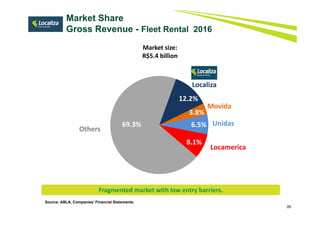

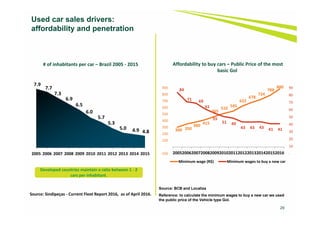

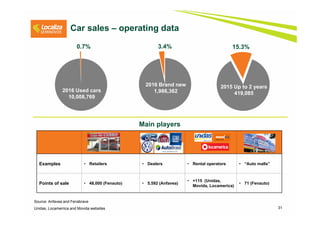

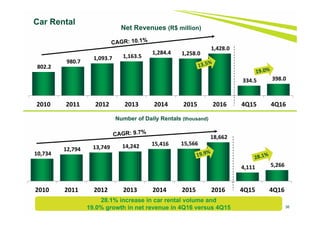

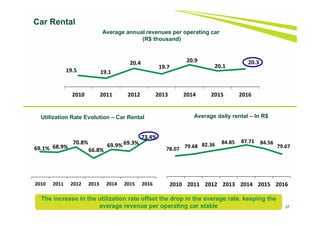

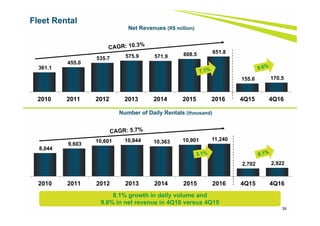

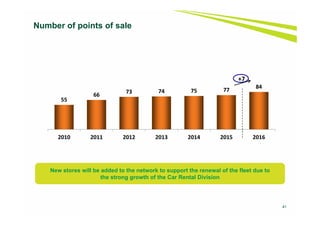

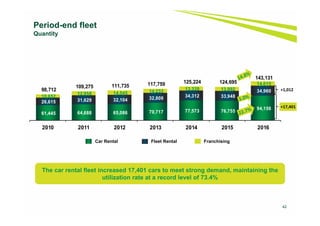

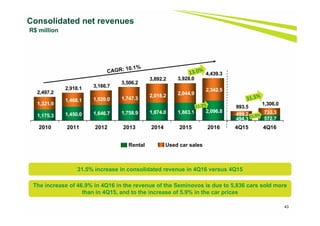

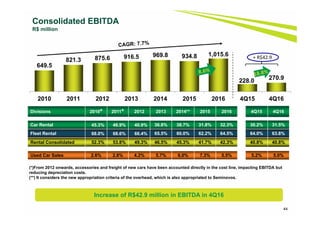

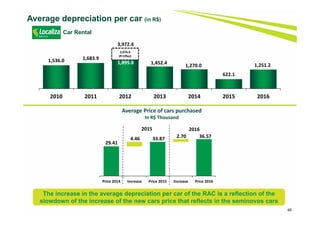

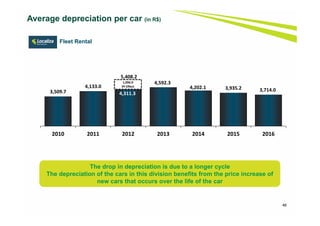

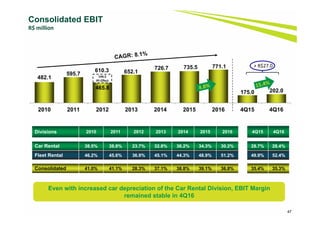

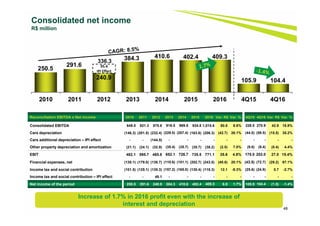

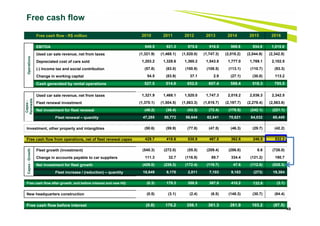

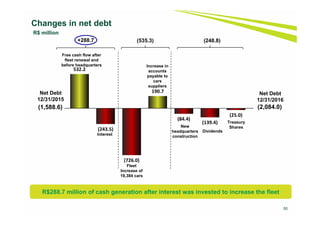

This presentation provides an overview of Localiza, a car rental company based in Brazil. It discusses Localiza's history and growth, integrated business platform consisting of car rental, fleet rental, franchising, and used car sales divisions. It highlights the company's competitive advantages including scale in purchasing cars, large network of locations, innovation, and expertise in managing assets and used car sales. Financial information is presented on the car rental and fleet rental divisions showing their profitability and returns above Localiza's cost of debt. The Brazilian car rental and fleet rental market is also summarized, noting the fragmented nature of off-airport locations and low penetration of fleet rentals as drivers of future growth opportunities.