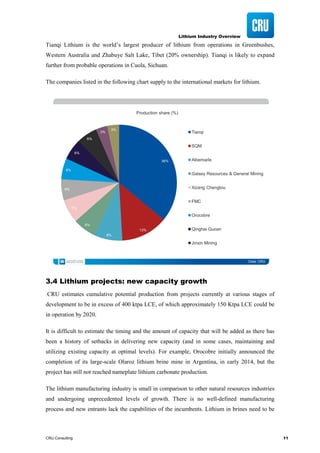

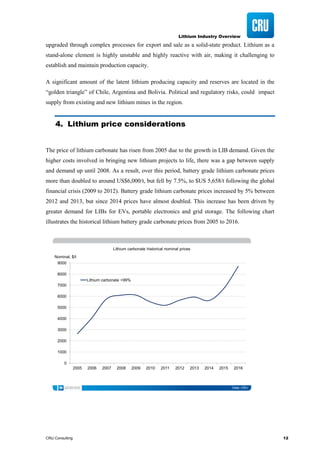

The document provides an overview of the lithium industry, highlighting the dominant players, demand growth for lithium, and supply considerations. It notes that lithium demand is expected to grow significantly, particularly for lithium-ion batteries used in electric vehicles and renewable energy storage, with a CAGR of 14.5% from 2015 to 2020. Additionally, the supply is concentrated among a few major producers and political factors may affect production in key regions.