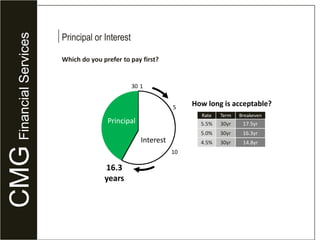

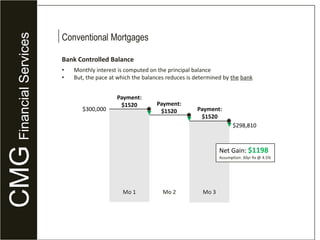

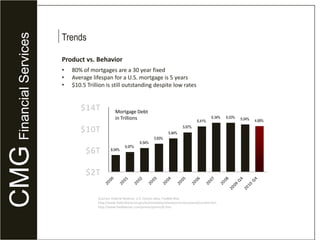

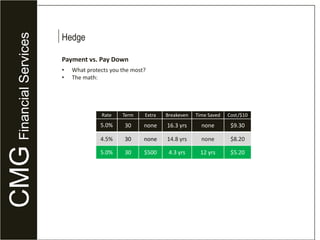

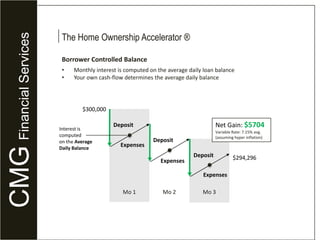

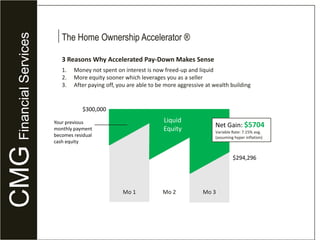

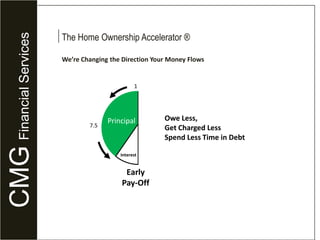

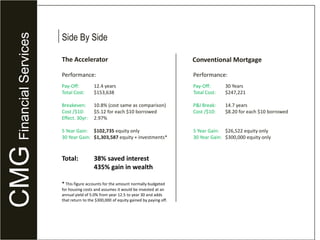

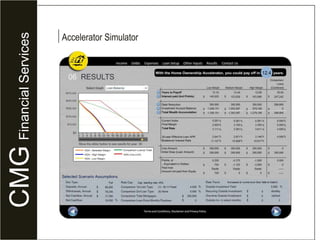

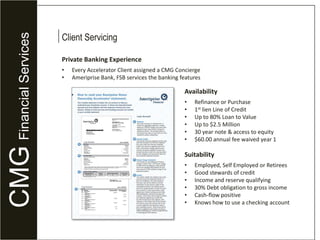

This document provides information about CMG Financial Services, a nationwide private mortgage bank. It discusses CMG's Home Ownership Accelerator product, which is a first lien line of credit that allows borrowers to pay down their mortgage balance faster by linking their mortgage to a checking account where extra payments can be made. The document compares the Accelerator product to a conventional fixed-rate mortgage, showing how the Accelerator can save interest costs and allow the mortgage to be paid off over 30 years. It also provides details on client servicing, availability, and suitability for the Accelerator product.