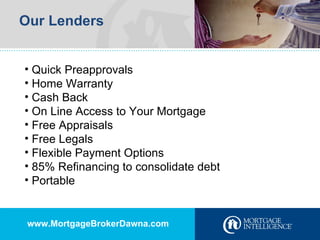

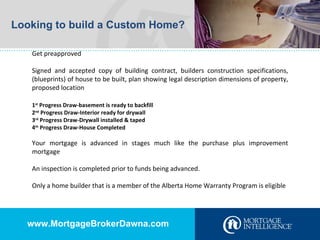

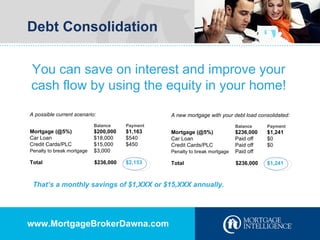

The document provides information on current mortgage rates and special offers from MortgageBrokerDawna.com, including a 5 year fixed rate of 3.89% and 5 year variable rate of 2.30%. It outlines financing options for purchasing homes, renovations, debt consolidation, and states that self-employed individuals who have been turned down by banks may qualify for a stated income mortgage. Contact information is provided to get customized mortgage options and rates.