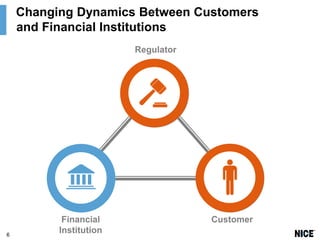

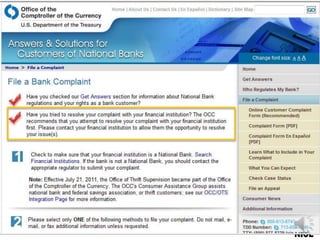

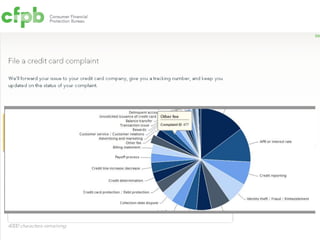

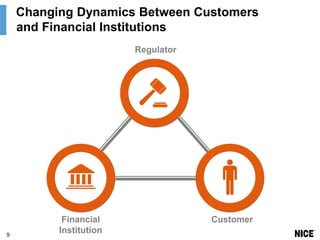

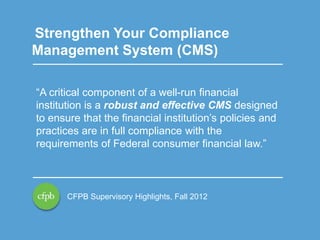

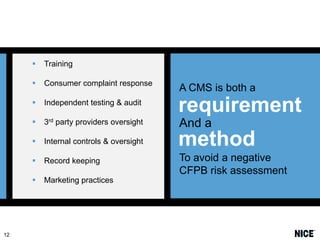

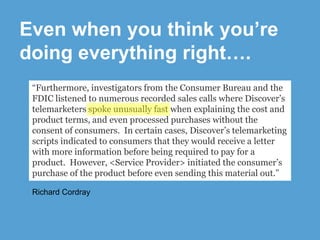

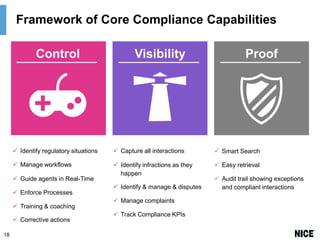

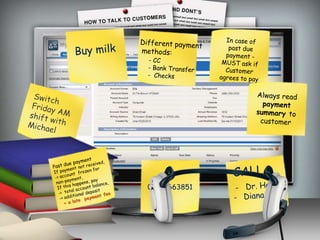

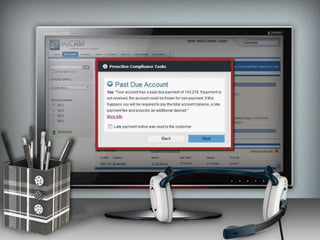

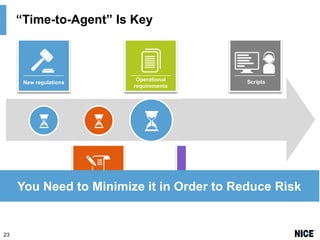

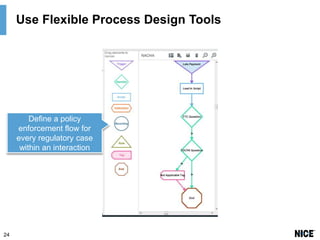

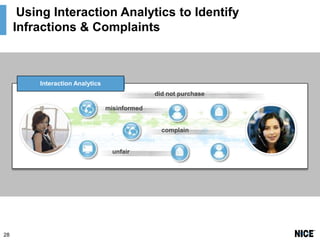

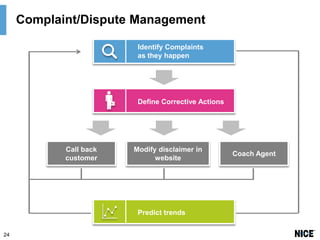

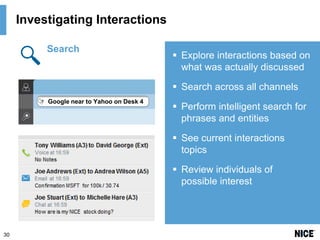

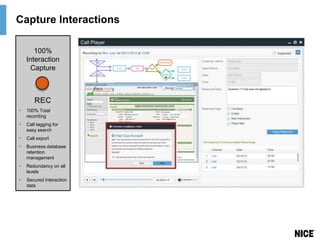

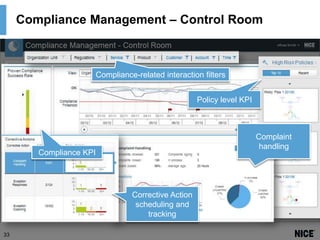

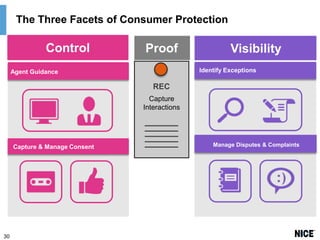

This document discusses consumer compliance in the age of the Consumer Financial Protection Bureau (CFPB). It notes that the dynamics between customers, financial institutions, and regulators have changed, with increased compliance requirements. Financial institutions need to strengthen their compliance management systems (CMS) to avoid negative CFPB risk assessments. Contact centers are particularly exposed areas that require visibility, control, and proof of compliance. The document outlines a framework for core compliance capabilities and how technologies can provide agent guidance, capture interactions for disputes, and ensure compliance through recording and analytics.