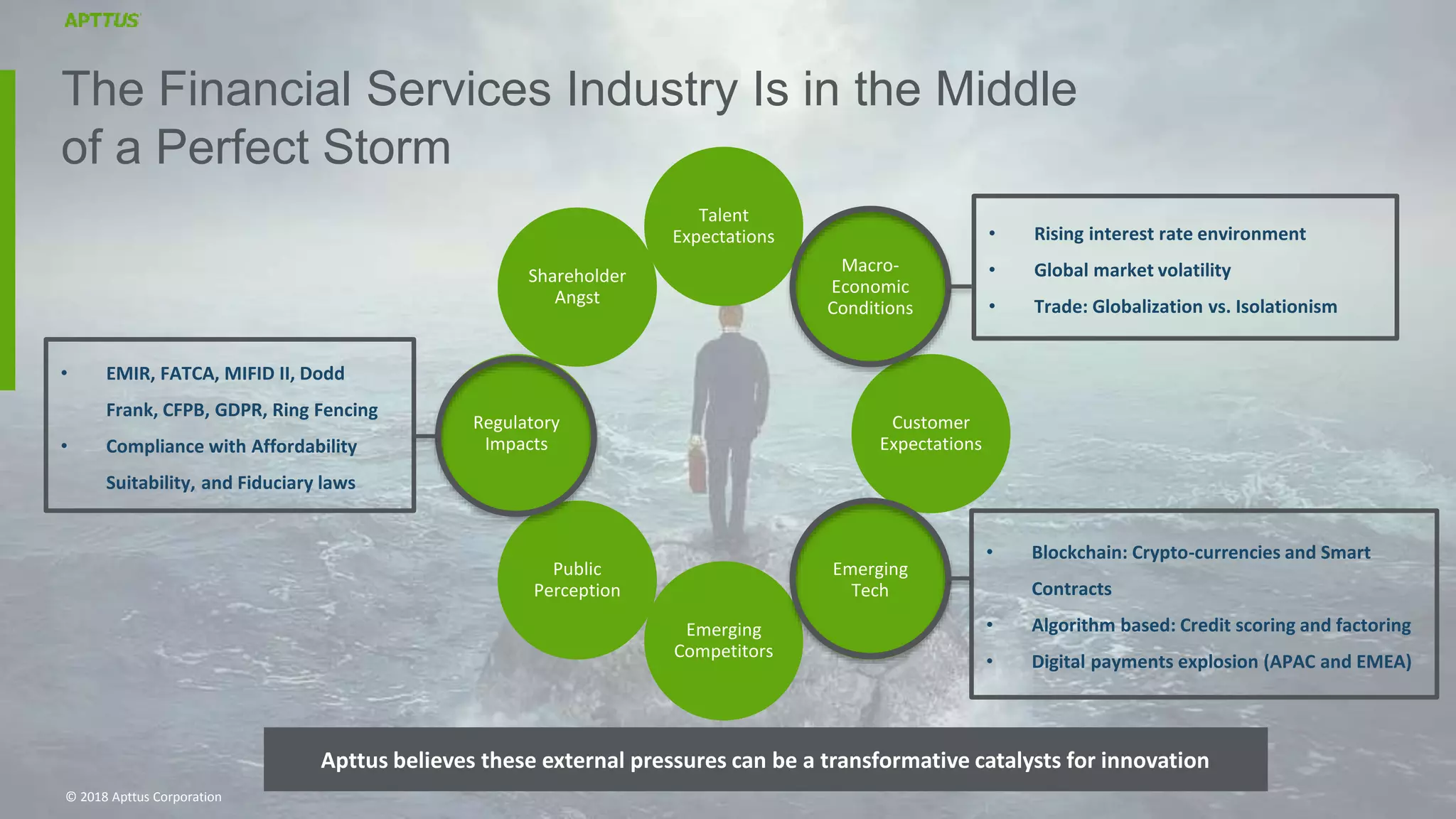

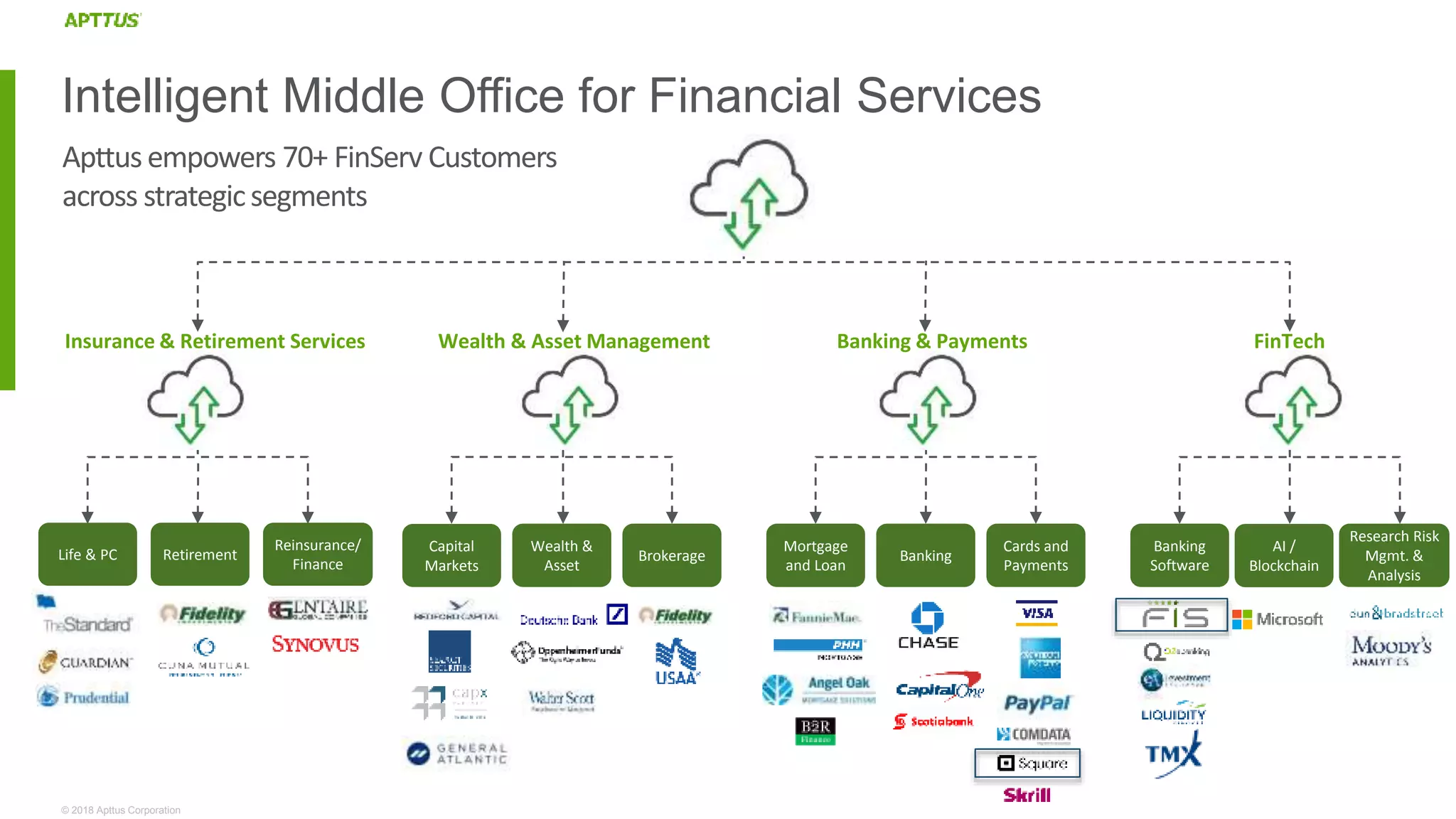

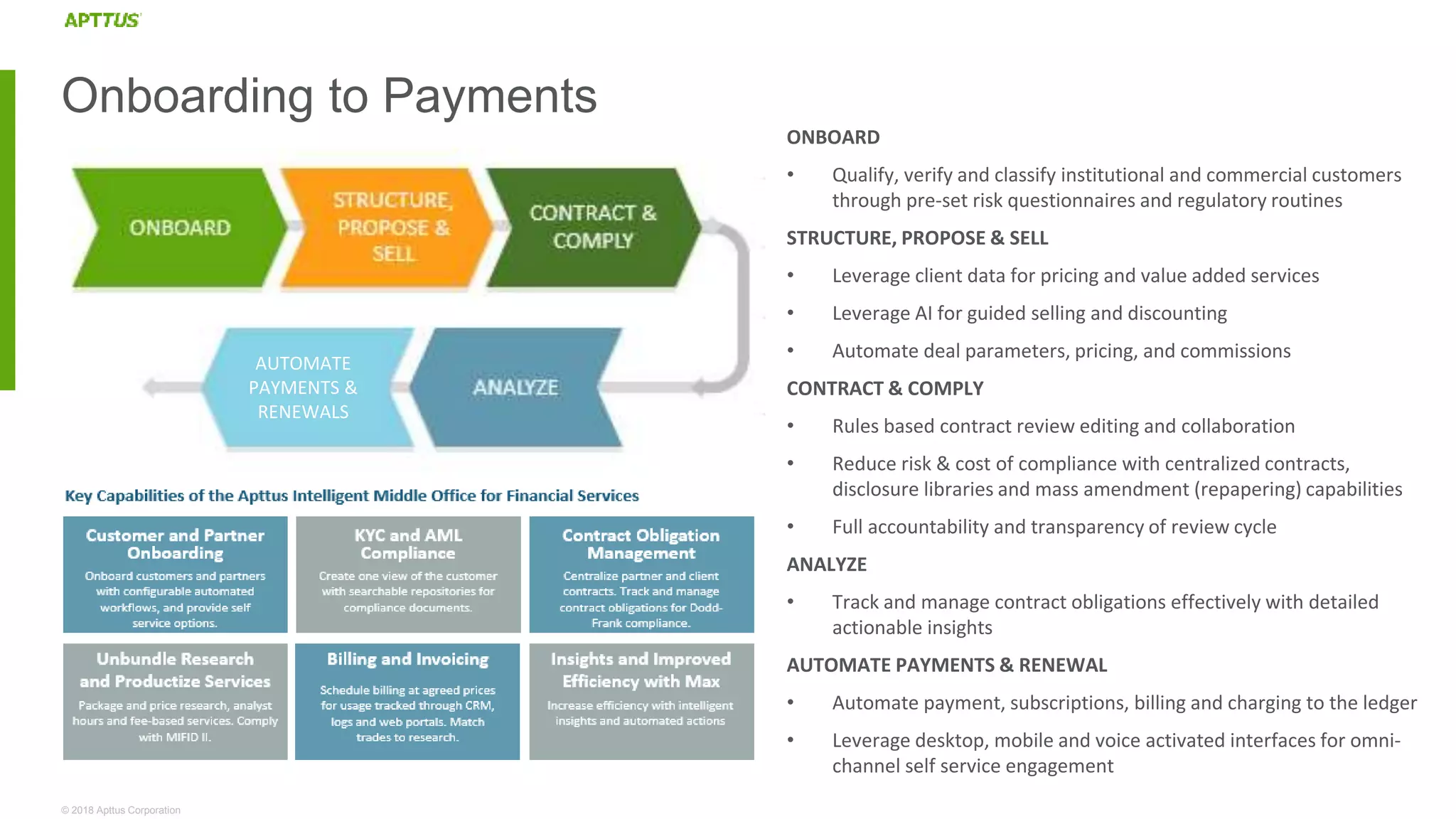

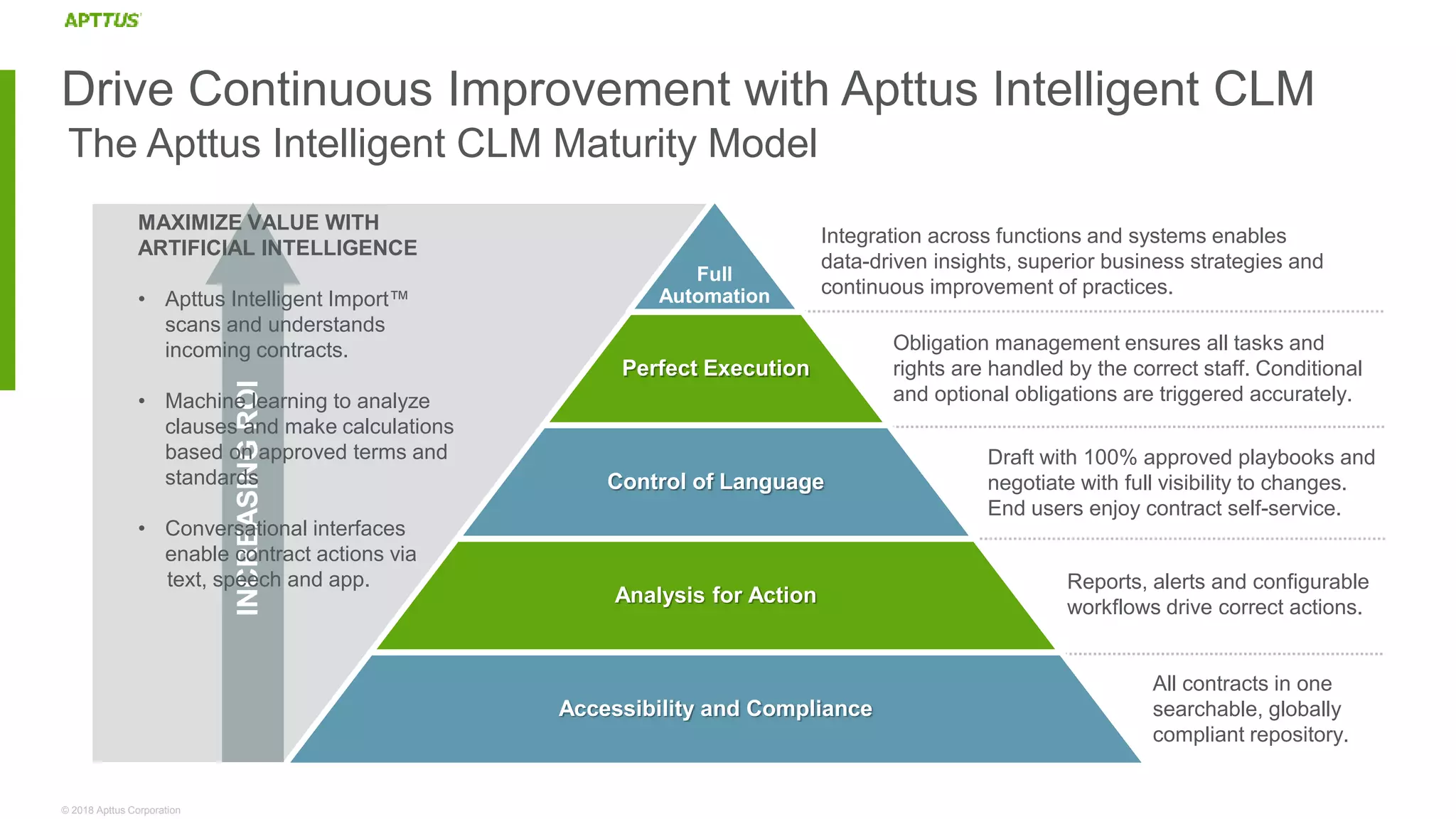

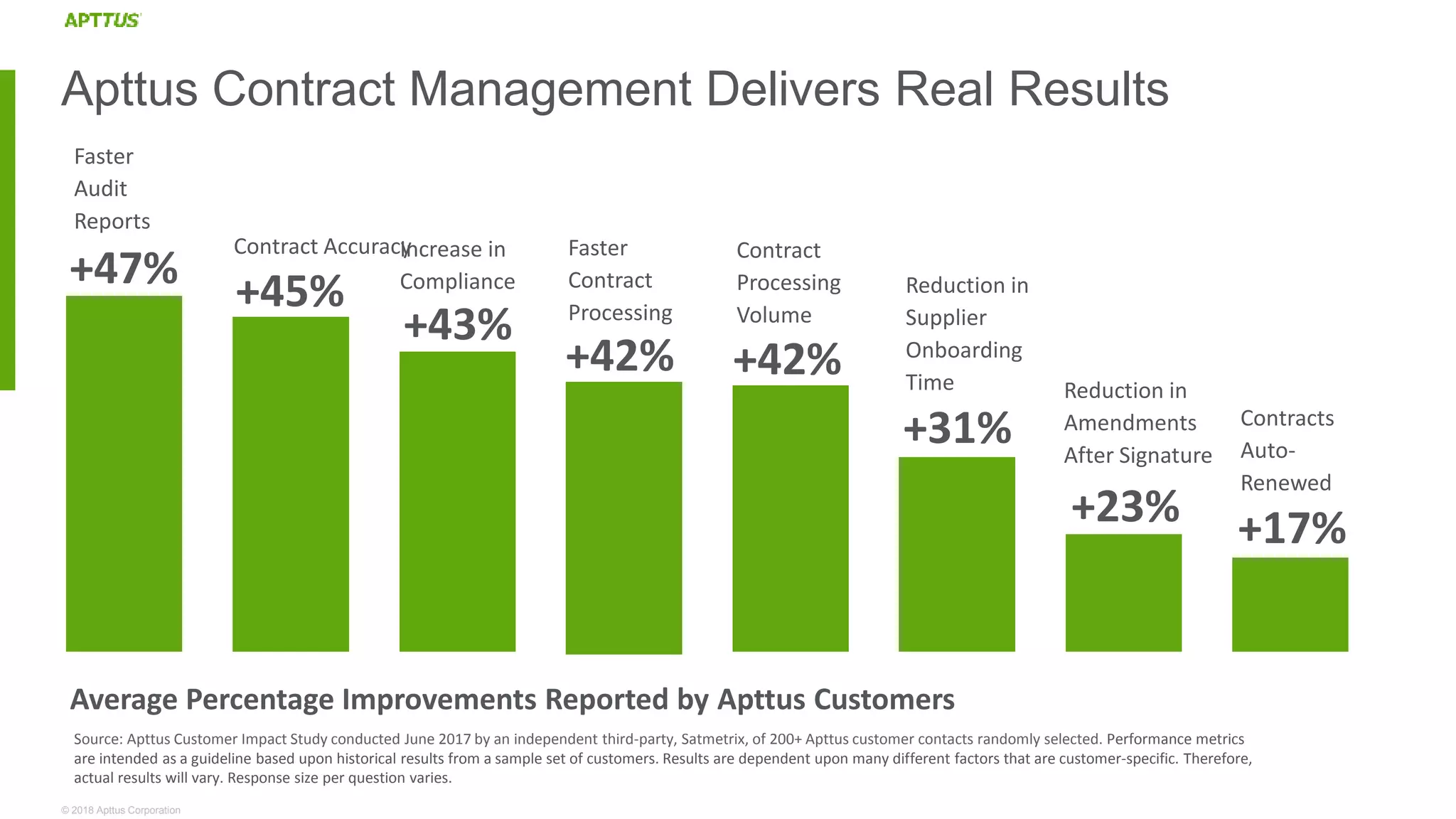

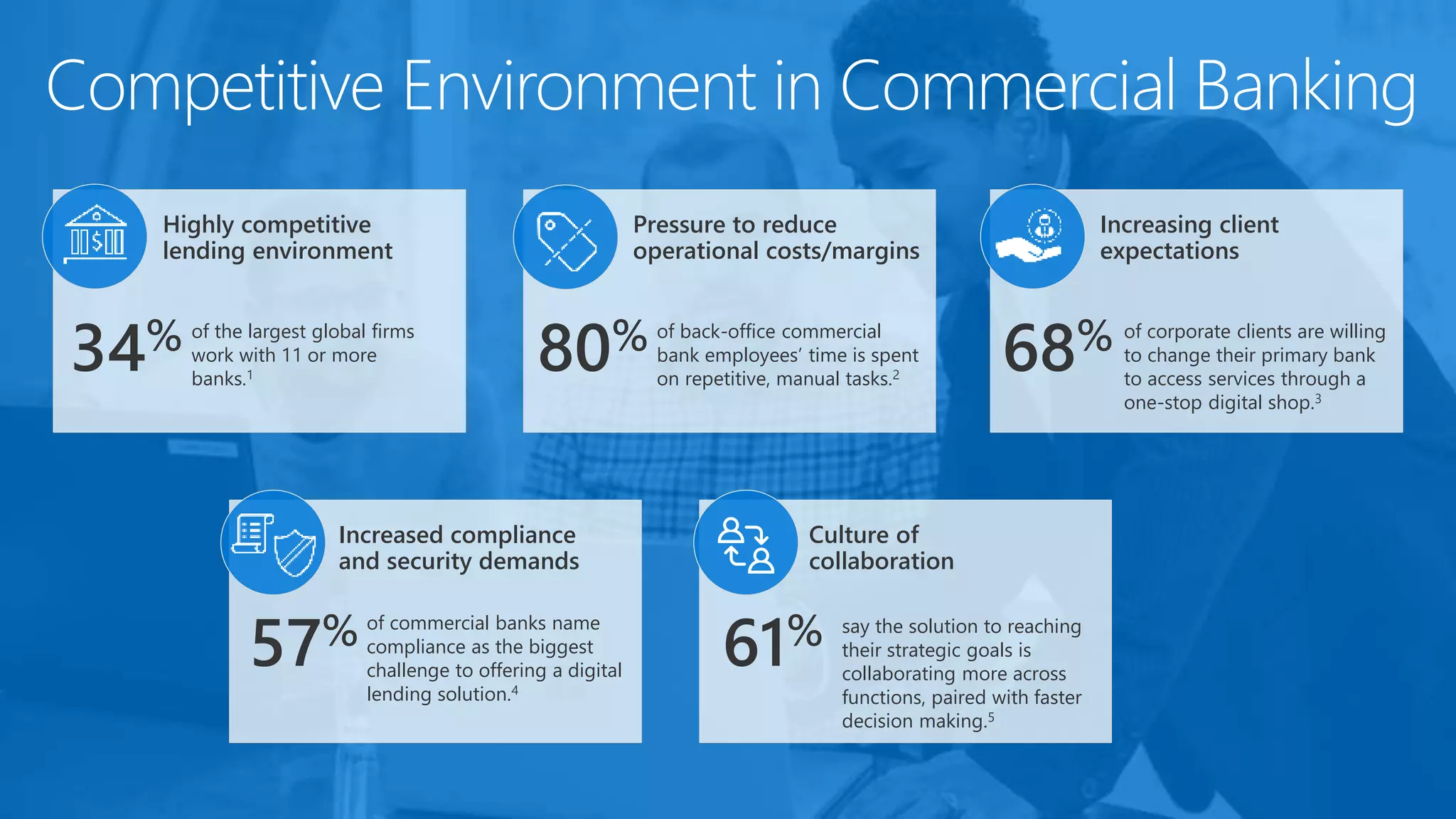

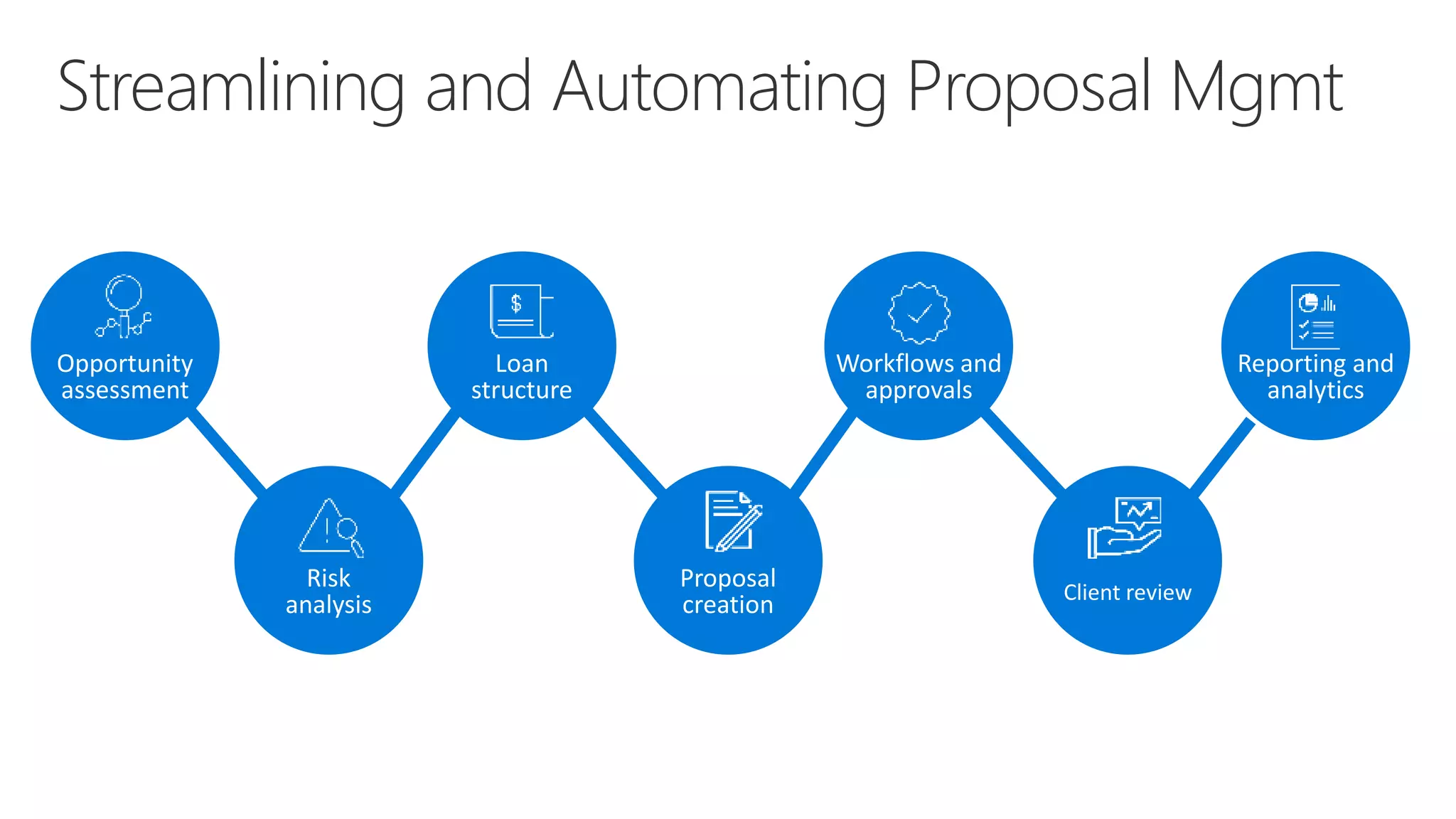

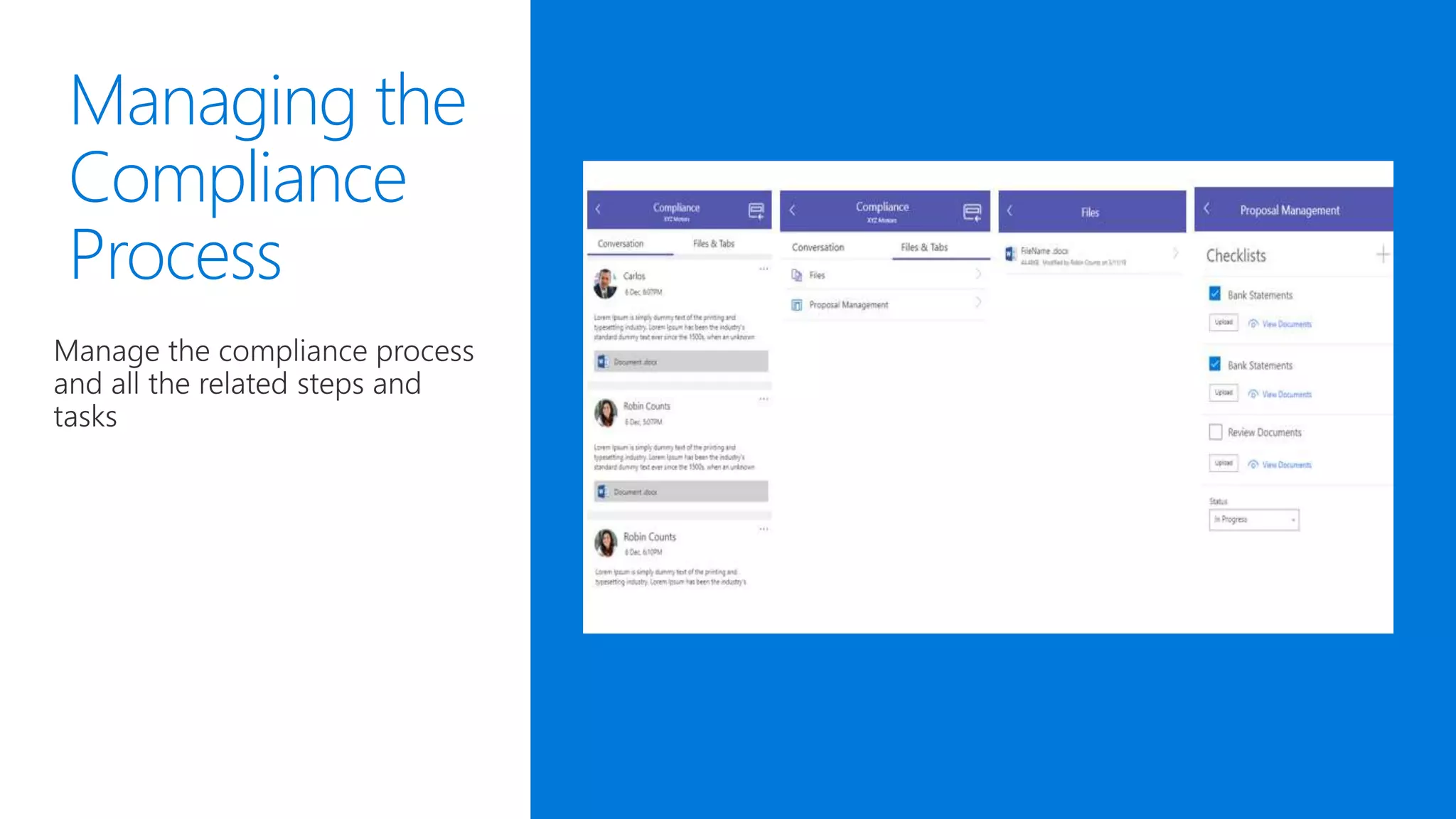

The document discusses the challenges and opportunities facing the financial services industry amidst evolving macroeconomic conditions, regulatory impacts, and emerging technologies like blockchain and AI. It highlights how Apttus empowers over 70 financial services customers through intelligent contract lifecycle management to enhance operational efficiency and compliance. The collaboration between Apttus and Microsoft aims to streamline proposal and contract management in a highly competitive lending environment.