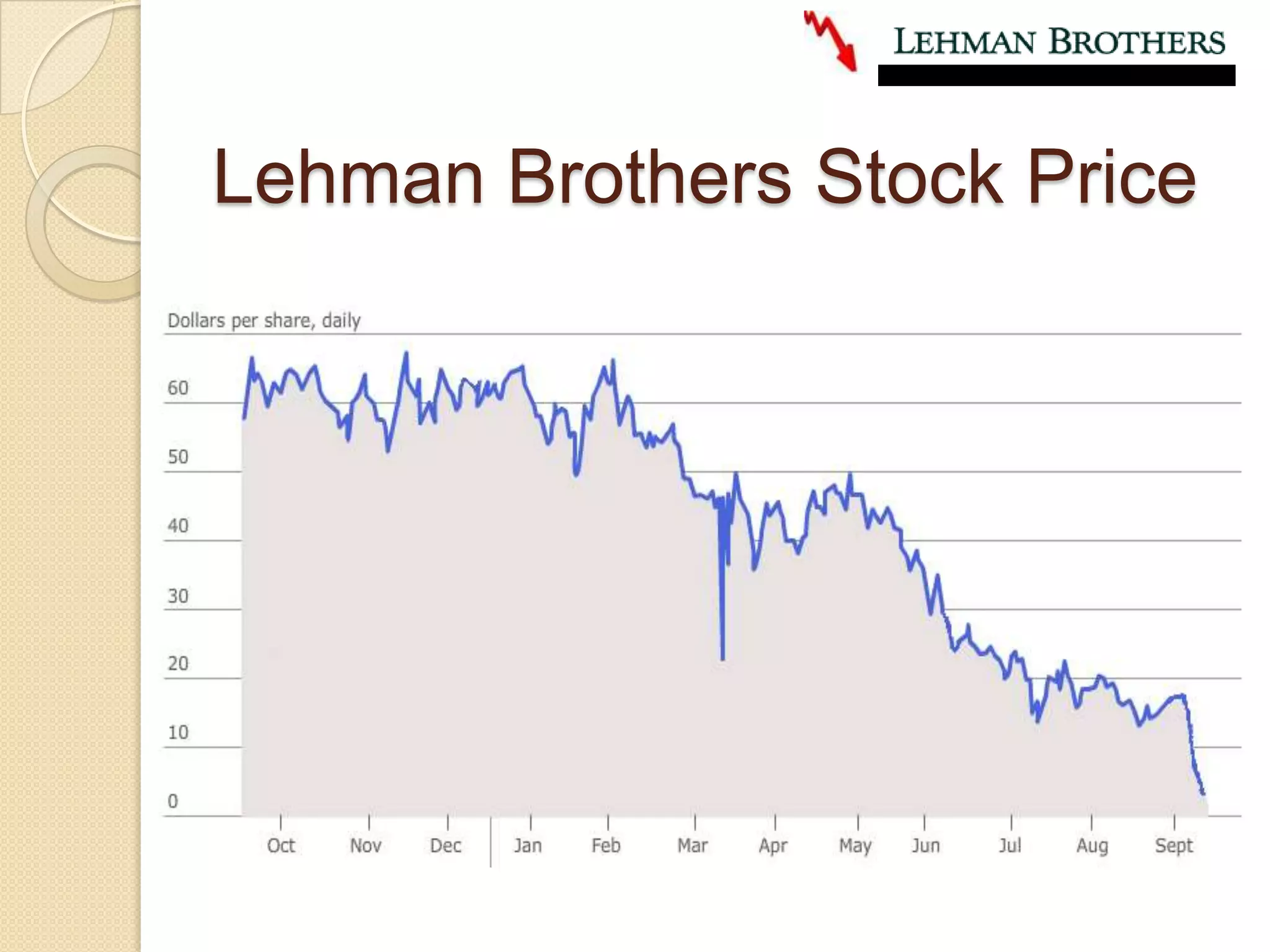

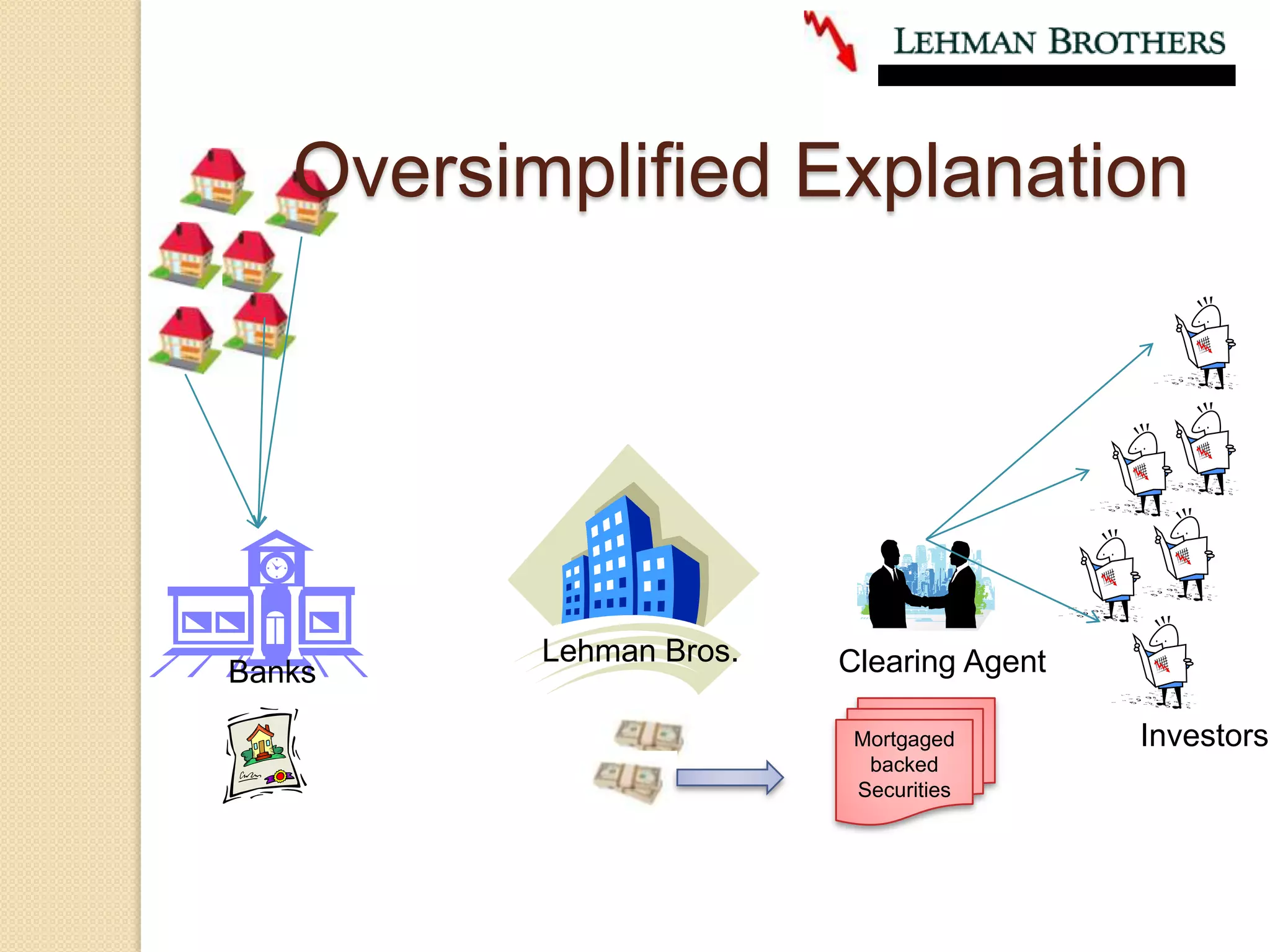

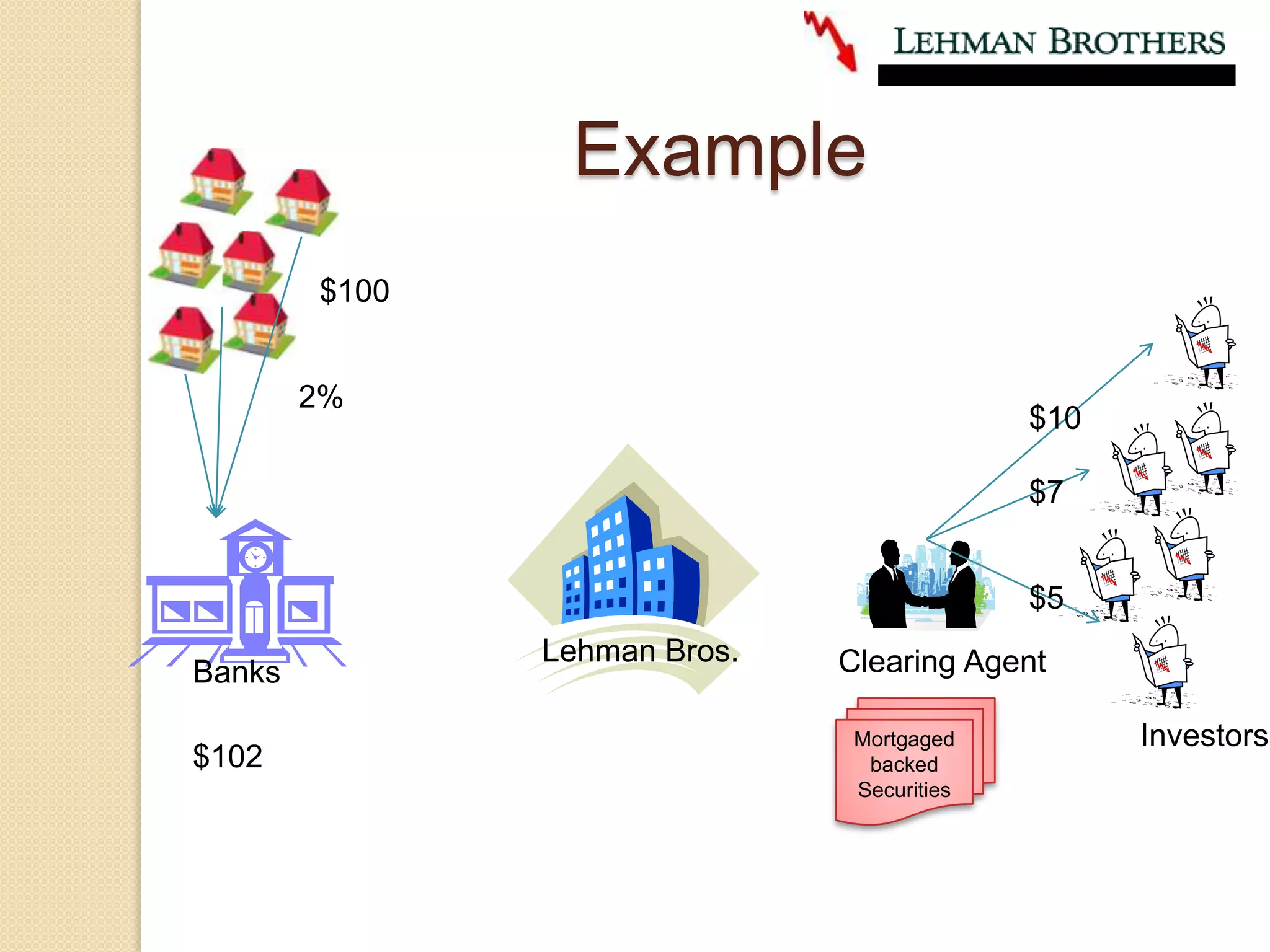

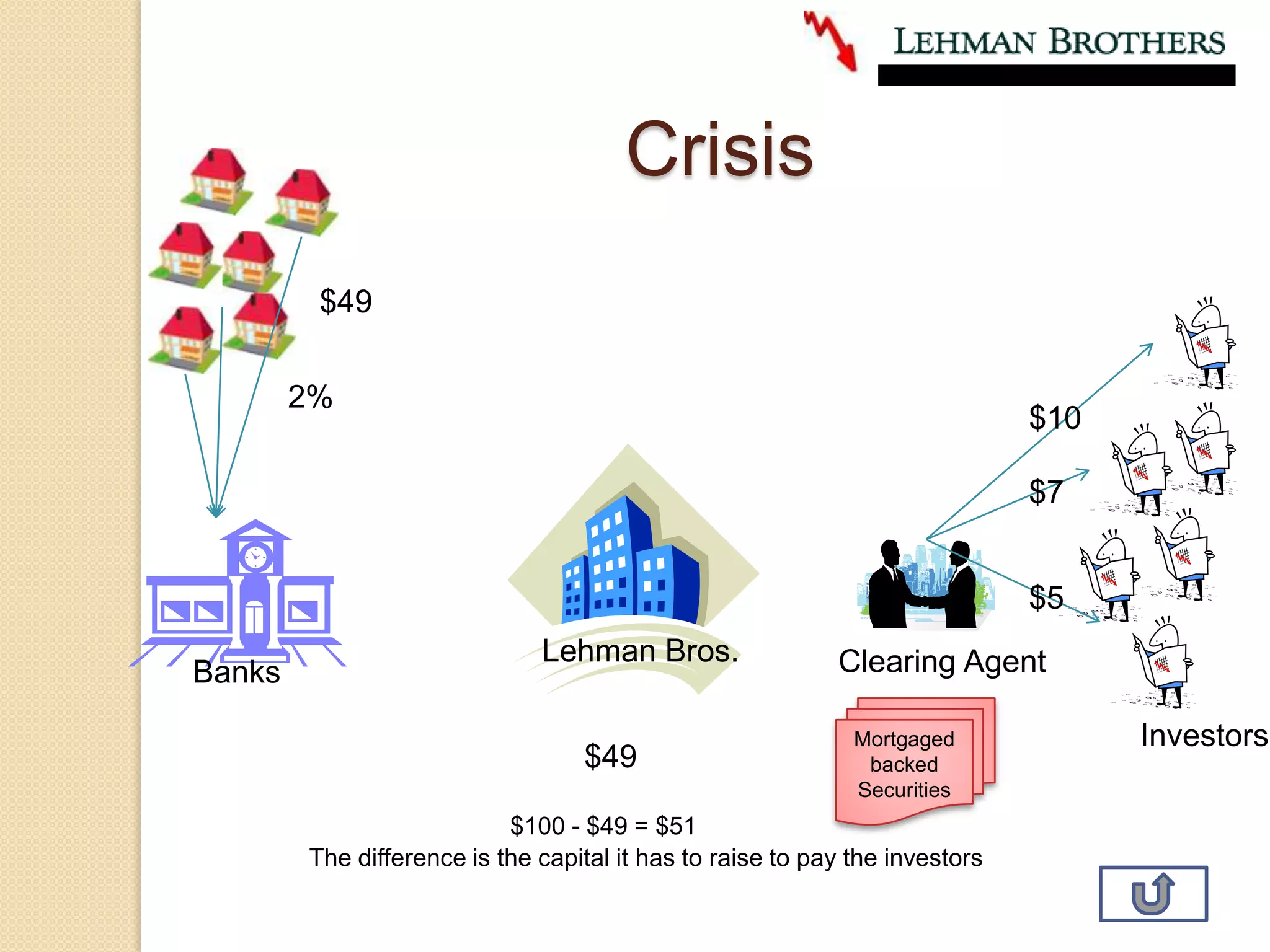

The collapse of Lehman Brothers was precipitated by the subprime mortgage crisis. Subprime lending involved making loans to borrowers who did not qualify for market interest rates. By 2008, 25% of subprime loans were delinquent or in foreclosure. Government policies in the 1970s and 1990s loosened lending standards and encouraged risky lending. Financial innovation like securitization and CDOs made the risks associated with subprime mortgages difficult to assess. In September 2008, JP Morgan demanded billions in collateral from Lehman, which Lehman could not pay, leading to its bankruptcy.