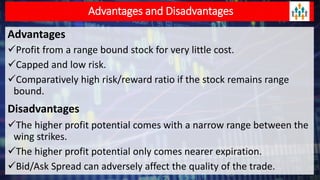

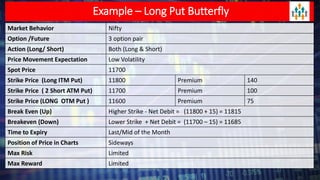

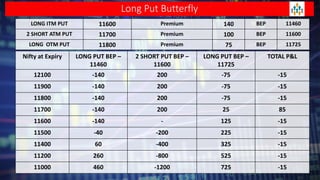

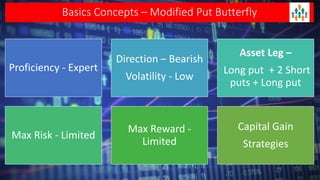

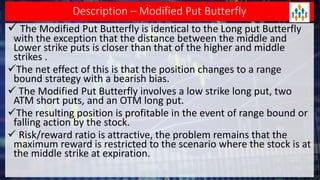

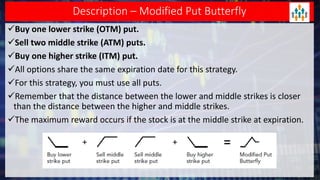

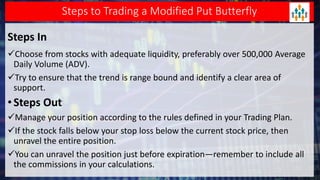

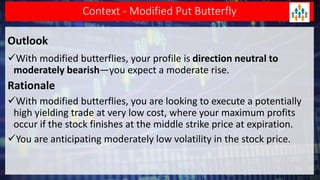

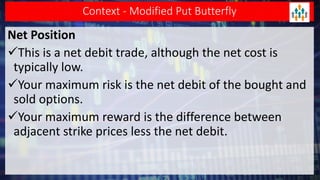

The document outlines the modified put butterfly trading strategy, which consists of a long put at a low strike, two short puts at a middle strike, and a long put at a higher strike. This strategy is designed for a range-bound market with a bearish bias, allowing for limited risk and profit potential, particularly if the stock closes at the middle strike at expiration. It emphasizes selecting stocks with adequate liquidity, managing the position based on predefined rules, and factoring in the effects of time decay on profitability.

![Context - Modified Put Butterfly

Effect of Time Decay

Time decay is helpful to this position when it is profitable and

harmful when the position is unprofitable.

When you enter the trade, typically the stock price will be in the

profitable area of the risk profile, so from that perspective, time

decay harms the position.

Time Period to Trade

Month or Less

Breakeven [Lower strike + max risk]](https://image.slidesharecdn.com/lectureno46-modifiedputbutterfly-200703114942/85/Lecture-no-46-modified-put-butterfly-8-320.jpg)