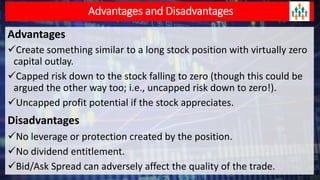

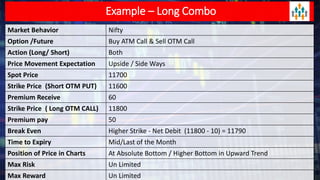

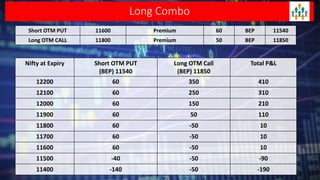

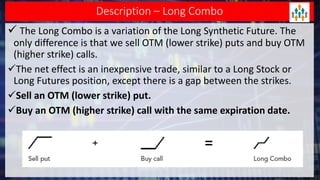

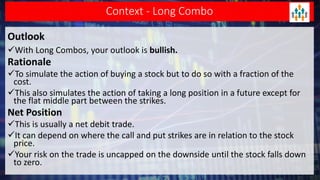

The document discusses the long combo trading strategy, which combines selling out-of-the-money (OTM) puts and buying OTM calls to simulate long stock positions with reduced capital requirements. It highlights the bullish outlook of this strategy, its risk management approach, and the effects of time decay on options. The document also outlines the advantages and disadvantages of the long combo, such as uncapped profit potential and minimal capital outlay but no dividend entitlement.

![Context – Long Combo

Effect of Time Decay

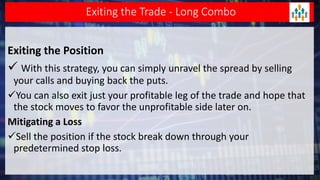

Time decay is harmful to your Long Combo trade, but with this strategy,

you are hedging time decay by buying and selling near the money

options, so the effect is minimal.

What you lose from the Long Call time value, you benefit from the Short

Put position.

Appropriate Time Period to Trade

you will be using this strategy in conjunction with another trade.

It is generally more sensible to use this as a longer -term trade.

Breakeven

• With net debits: [higher strike + net debit]

• With net credits: [lower strike - net credit]](https://image.slidesharecdn.com/lectureno62-longcombo-200710023329/85/Lecture-no-62-long-combo-6-320.jpg)