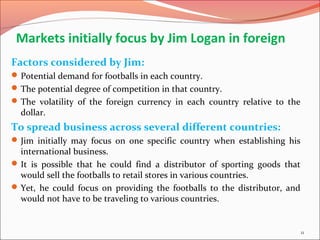

This presentation summarizes two case studies related to international business expansion. The first case discusses the advantages and disadvantages of a US roller blade company called Blades, Inc. expanding into Thailand. While it could lower costs, it would also face currency risk and difficulty monitoring foreign managers. The second case examines a small US sporting goods company considering becoming a multinational corporation. It discusses factors for initially focusing foreign markets and establishing business abroad through low-cost methods like licensing or joint ventures.