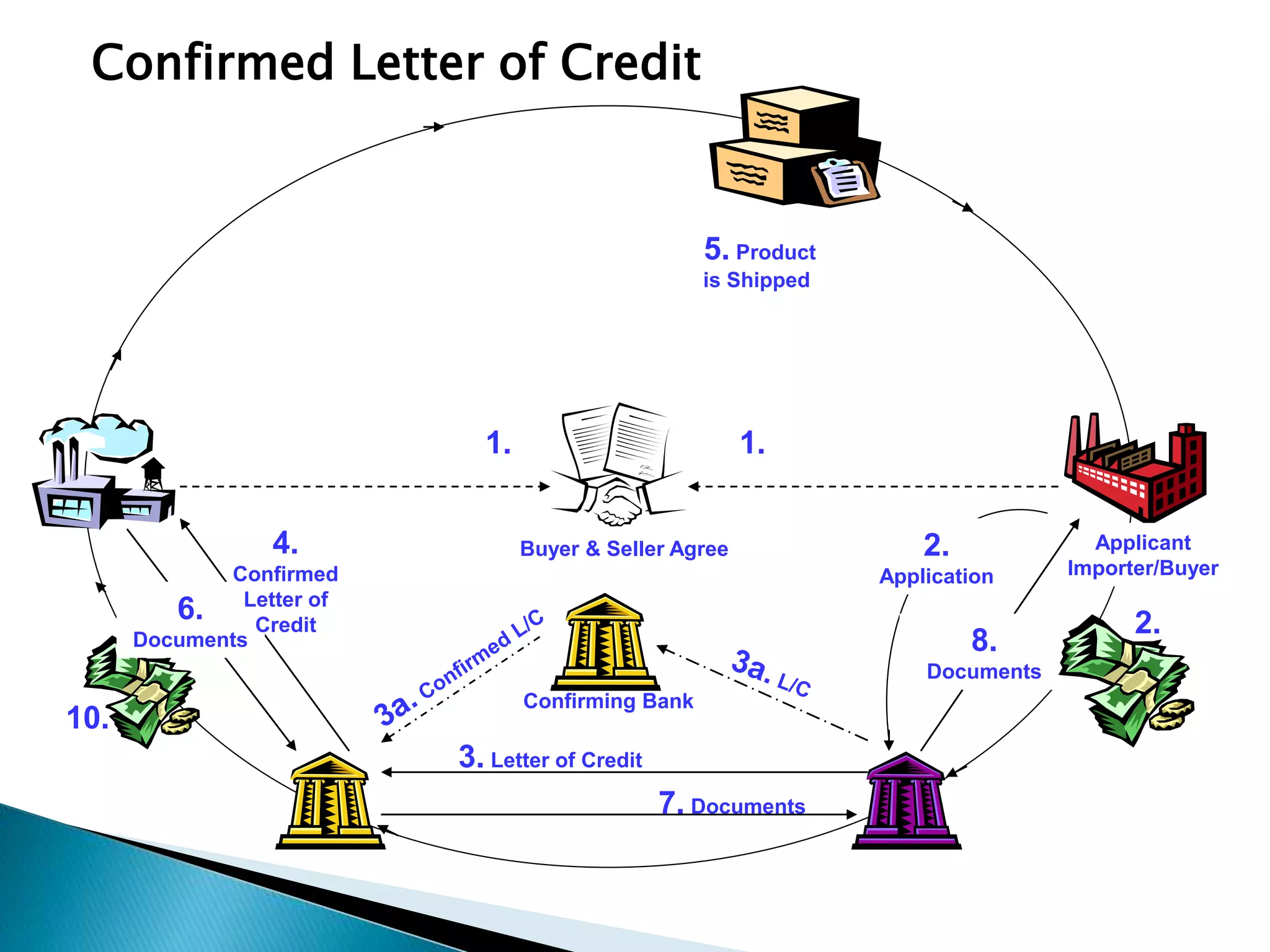

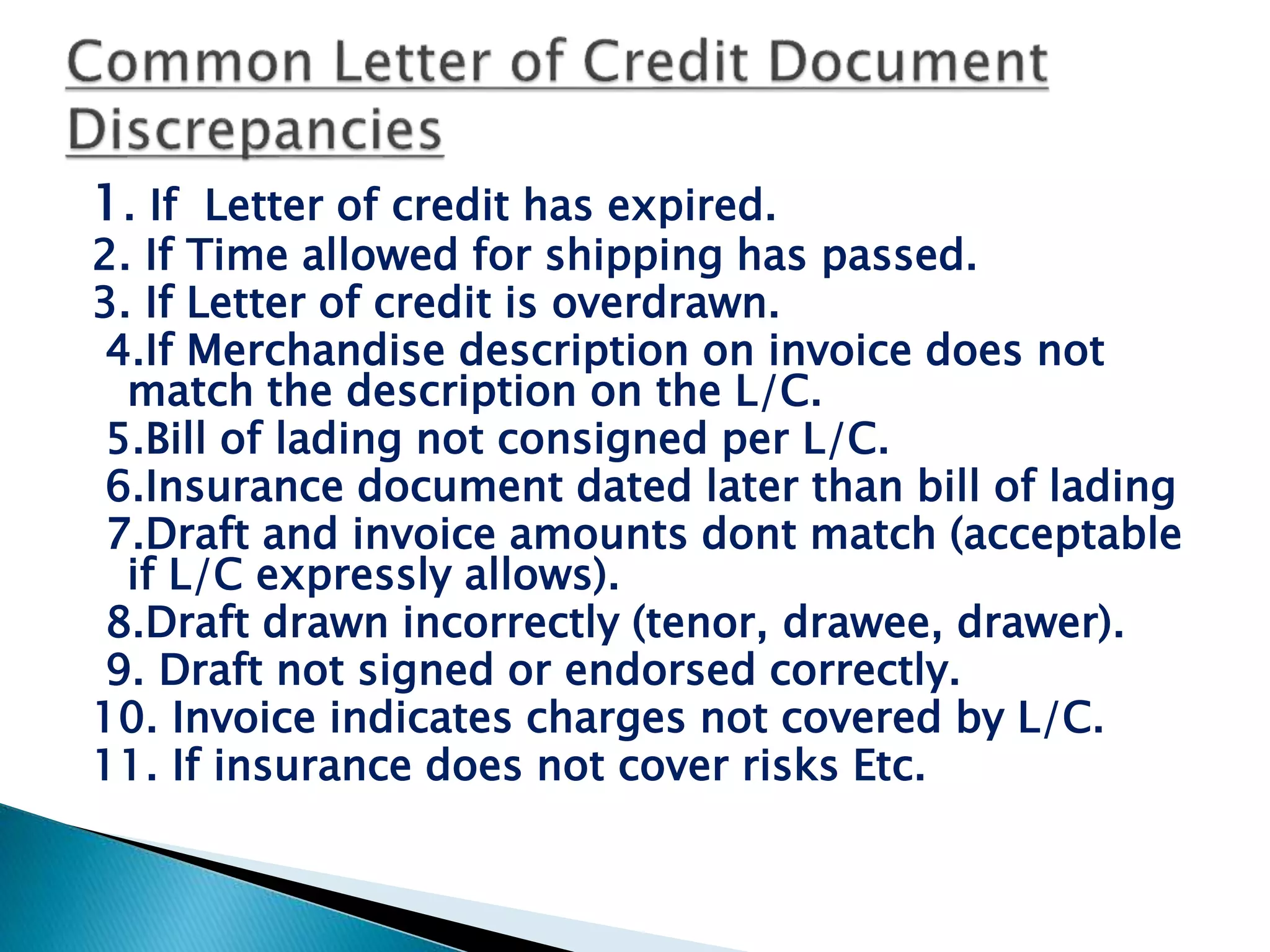

A letter of credit (LC) is a bank-issued document that ensures payment to a seller once specific conditions are met and required documents are submitted. It serves as a vital payment mechanism in international trade, helping to mitigate risks for both buyers and sellers, depending on whether they are acting as importers or exporters. The document outlines various types of LCs, their applications in transactions, and the advantages and disadvantages for both parties involved.