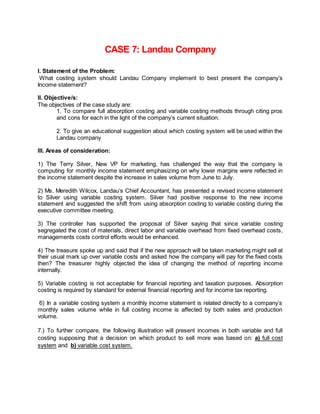

The document discusses which costing system, variable or absorption, Landau Company should use to present its income statement. It analyzes pros and cons of each system, considering the company's situation where production decreased temporarily. It recommends keeping the full absorption costing system as it best characterizes production levels over time and is required for tax and financial reporting, while acknowledging variable costing may enhance short-term cost control efforts.