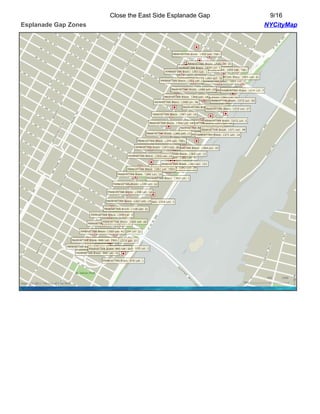

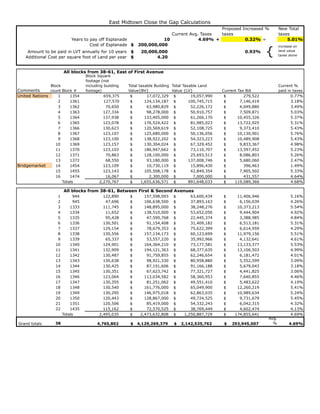

The East Side Esplanade Gap Closure proposal aims to raise $200 million over 10 years to construct an esplanade from 38th to 61st street, funded by a land value tax that incentivizes development on underused land. This tax structure is designed to improve property values in the area, drawing on successful precedents like the High Line project that boosted surrounding investments. The proposal seeks a minor increase in tax rates, ensuring that those who benefit from the improvements contribute to their funding.