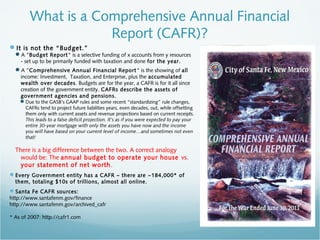

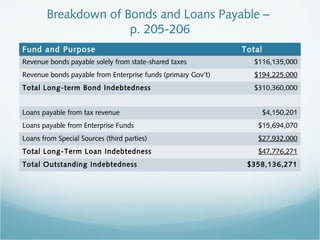

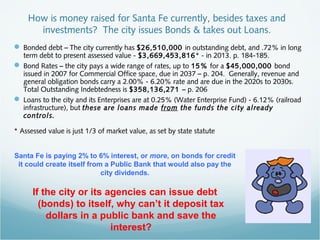

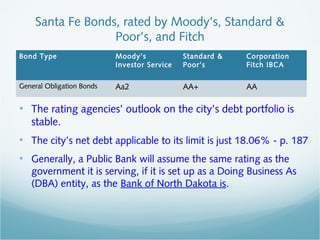

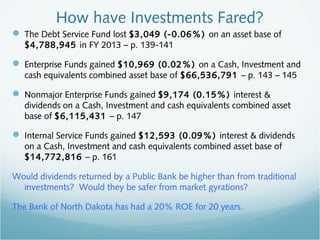

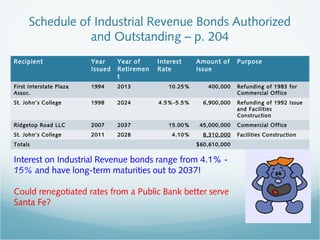

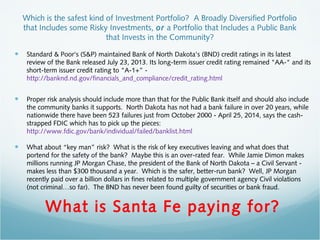

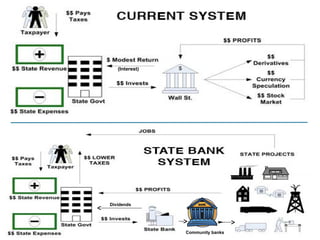

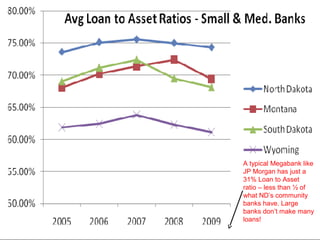

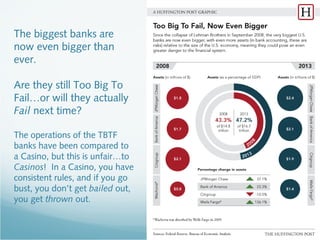

The document discusses the concept of a public bank for Santa Fe, New Mexico, contrasting it with traditional financial practices and emphasizing the potential benefits such as local job creation and consistent returns. It explains the nature of Comprehensive Annual Financial Reports (CAFRs) and highlights Santa Fe's current debt and investment strategies, arguing that investments in a public bank could be more prudent. The document advocates for reallocating some CAFR funds into a public banking system to improve fiscal stability and community support.