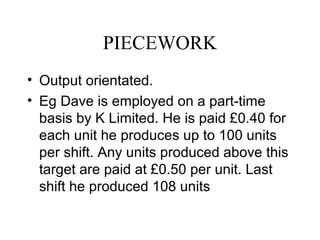

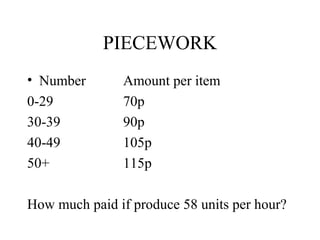

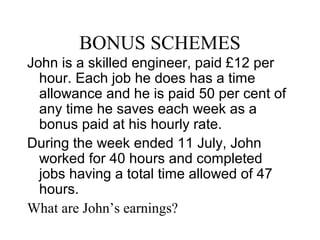

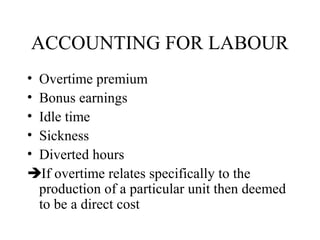

This document discusses various methods for rewarding and accounting for employee labor costs, including: time-based pay with overtime premiums; piecework pay based on units produced; bonus schemes for completing work faster than allotted timeframes; and group incentive schemes. It provides examples of calculating earnings under each method and addresses minimum wage, recording work hours, and treating overtime as a direct versus indirect cost. The overall aims are to understand different pay incentives and accounting for labor expenses.