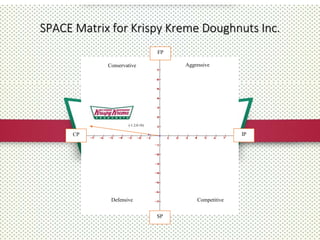

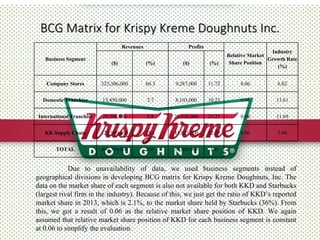

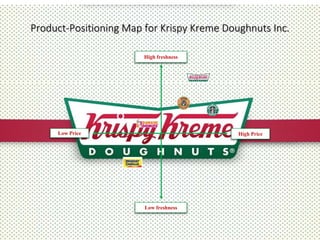

The document presents a strategic analysis of Krispy Kreme Doughnuts Inc. using a SPACE matrix and BCG matrix to evaluate its internal and external positions. It discusses financial performance metrics, competitive positioning, and growth potential, indicating the company faces both challenges and opportunities in the market. The analysis utilizes specific data points to derive insights into market share and the overall competitive landscape against peers like Starbucks.