The daily derivatives outlook report provides the following key information:

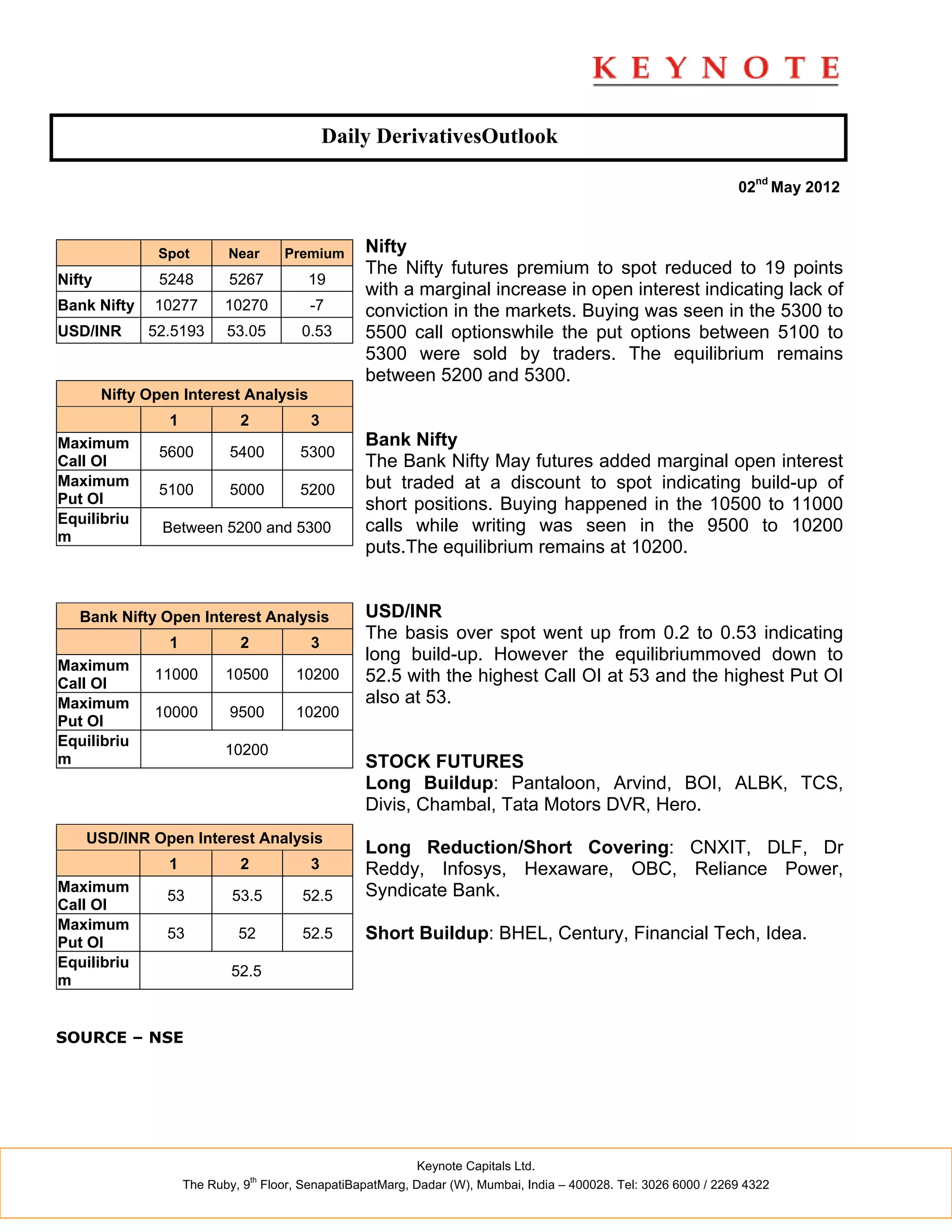

1. The Nifty futures premium to spot reduced, indicating a lack of conviction in the markets. Call options between 5300-5500 saw buying while puts between 5100-5300 saw writing.

2. For Bank Nifty, marginal open interest was added but it traded at a discount to spot, indicating short positions being built up. Calls between 10500-11000 saw buying and puts between 9500-10200 saw writing.

3. For USD/INR, the basis over spot increased but the equilibrium moved down, with the highest call and put open interest both at 53.