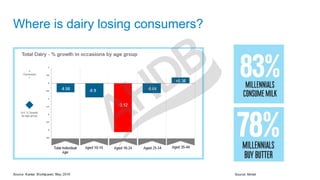

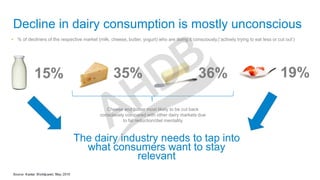

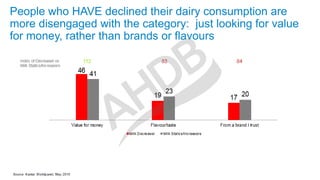

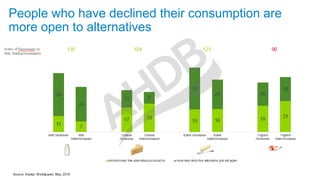

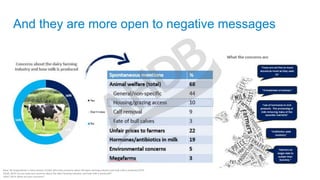

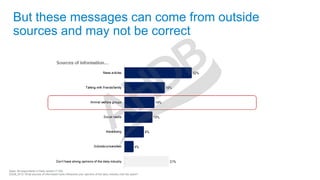

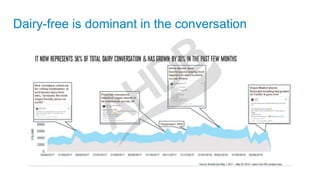

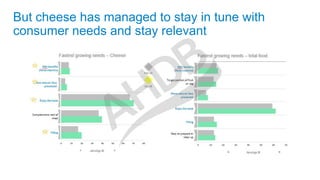

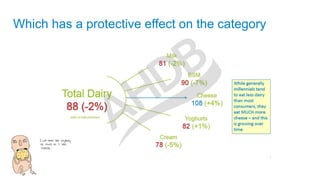

The document discusses the decline in dairy consumption and identifies key factors contributing to this trend, including consumer disengagement and the rise of dairy alternatives. It highlights that consumers, particularly Gen Z, are questioning dairy products while seeking value and innovation. The dairy industry is urged to innovate and engage with younger consumers to remain relevant amidst growing competition from alternative products.