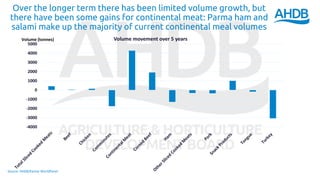

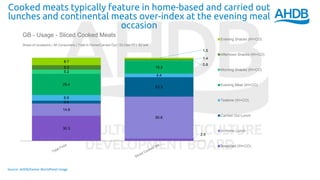

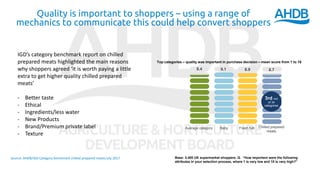

This document analyzes market trends in the sliced cooked meat category in the UK. It finds that ham accounts for the largest volume share but continental meats like Parma ham and salami are growing. Quality is an important factor for consumers when purchasing sliced cooked meats. The document recommends promoting quality attributes and providing easy browsing and selection in store to drive further category growth.