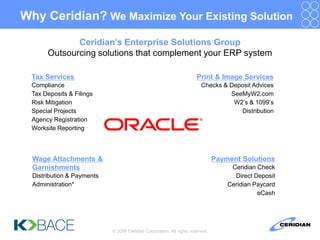

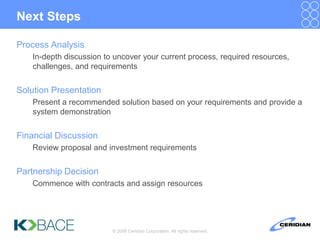

This document summarizes an enterprise solutions presentation by Ceridian. It introduces Ceridian as a trusted partner with over 70 years of experience in payroll and tax services. The presentation outlines the benefits of outsourcing tax services to Ceridian, including reducing financial risk, administrative burden, and freeing up client resources. It also describes Ceridian's tax service solutions, implementation process, data access and reporting tools, customer support, and next steps to establish a partnership.