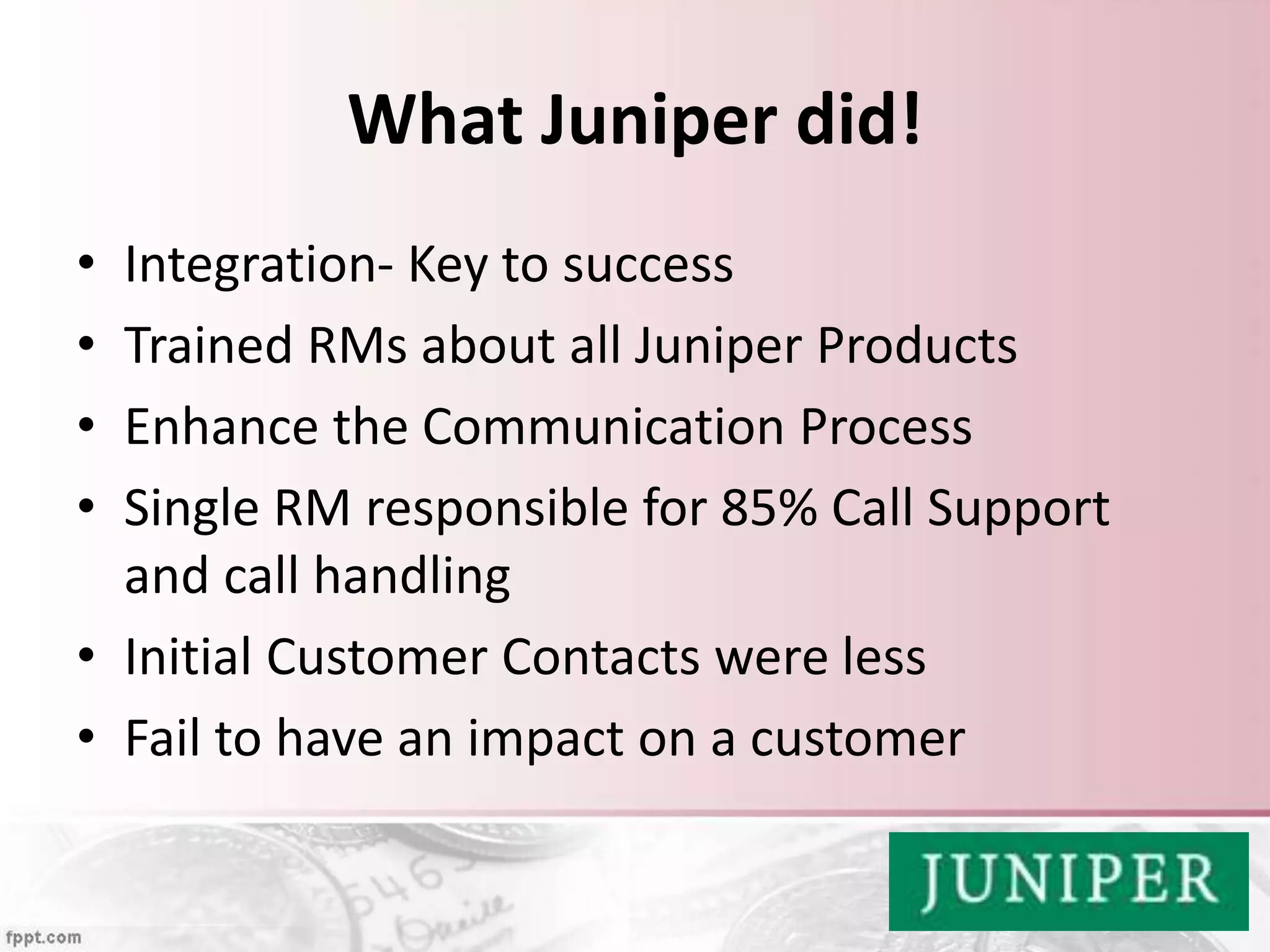

Juniper Bank, launched in October 2000 in Wilmington, Delaware, was acquired by Barclays in 2004 and offers various credit cards with varying APRs and no significant annual fees. The bank focuses on simplifying consumer banking and customer service, employing trained relationship managers to enhance communication and support. Despite challenges in delivering a personal touch and making data-driven decisions, Juniper has received positive feedback, achieving the top spot in Gomez Advisors.