JLL Detroit Multifamily Insight - Summer 2018

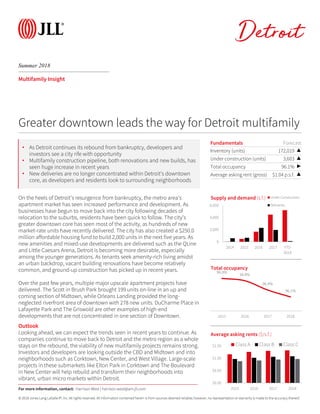

- 1. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2018 Detroit Multifamily Insight On the heels of Detroit’s resurgence from bankruptcy, the metro area’s apartment market has seen increased performance and development. As businesses have begun to move back into the city following decades of relocation to the suburbs, residents have been quick to follow. The city’s greater downtown core has seen most of the activity, as hundreds of new market-rate units have recently delivered. The city has also created a $250.0 million affordable housing fund to build 2,000 units in the next five years. As new amenities and mixed-use developments are delivered such as the QLine and Little Caesars Arena, Detroit is becoming more desirable, especially among the younger generations. As tenants seek amenity-rich living amidst an urban backdrop, vacant building renovations have become relatively common, and ground-up construction has picked up in recent years. Over the past few years, multiple major upscale apartment projects have delivered. The Scott in Brush Park brought 199 units on-line in an up and coming section of Midtown, while Orleans Landing provided the long- neglected riverfront area of downtown with 278 new units. DuCharme Place in Lafayette Park and The Griswold are other examples of high-end developments that are not concentrated in one section of Downtown. Outlook Looking ahead, we can expect the trends seen in recent years to continue. As companies continue to move back to Detroit and the metro region as a whole stays on the rebound, the viability of new multifamily projects remains strong. Investors and developers are looking outside the CBD and Midtown and into neighborhoods such as Corktown, New Center, and West Village. Large-scale projects in these submarkets like Elton Park in Corktown and The Boulevard in New Center will help rebuild and transform their neighborhoods into vibrant, urban micro markets within Detroit. Fundamentals Forecast Inventory (units) 172,019 ▲ Under construction (units) 3,603 ▲ Total occupancy 96.1% ▶ Average asking rent (gross) $1.04 p.s.f. ▲ Greater downtown leads the way for Detroit multifamily 96.9% 96.8% 96.4% 96.1% 2015 2016 2017 2018 Total occupancy $0.00 $0.50 $1.00 $1.50 2015 2016 2017 2018 Average asking rents ($/s.f.) Class A Class B Class C For more information, contact: Harrison West | harrison.west@am.jll.com • As Detroit continues its rebound from bankruptcy, developers and investors see a city rife with opportunity • Multifamily construction pipeline, both renovations and new builds, has seen huge increase in recent years • New deliveries are no longer concentrated within Detroit’s downtown core, as developers and residents look to surrounding neighborhoods 0 2,000 4,000 6,000 2014 2015 2016 2017 YTD 2018 Supply and demand (s.f.) Under Construction Deliveries

- 2. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2018 Detroit Multifamily Statistics For more information, contact: Harrison West | harrison.west@am.jll.com Class Inventory (Units) Total Occupancy (%) YoY Occupancy Change (%) Average Monthly Rent PSF ($) YoY Rent Growth (%) Under Construction (Units) Urban Greater Downtown A 4,910 97.95% 2.14% $1.76 3.99% 1,281 Suburban Downriver A 713 99.30% -0.70% $1.28 7.18% 138 East Side A 2,361 96.61% -1.85% $1.12 0.21% 1,102 North Oakland County A 2,011 95.56% -0.86% $1.19 0.77% 465 Southeast Oakland County A 739 97.49% 0.54% $1.56 3.65% 181 Western Oakland County A 3,358 95.62% -0.61% $1.16 1.44% 68 Western Wayne County A 665 91.08% 0.90% $1.40 7.09% 0 Metro Detroit Totals 14,757 96.19% 0.00% $1.32 2.62% 3,235 Class Inventory (Units) Total Occupancy (%) YoY Occupancy Change (%) Average Monthly Rent PSF ($) YoY Rent Growth (%) Under Construction (Units) Urban Greater Downtown B 2,327 95.30% -1.92% $1.42 1.96% 0 East Detroit B 694 95.13% -1.30% $1.26 8.35% 0 West Detroit B 200 97.00% 3.50% $0.97 -2.56% 0 Suburban Downriver B 6,858 96.13% 0.08% $1.02 3.07% 0 East Side B 12,800 95.73% -0.49% $0.99 3.11% 0 North Oakland County B 7,907 96.10% -0.26% $1.05 4.70% 0 Southeast Oakland County B 7,516 96.10% -1.28% $1.07 0.66% 0 Western Oakland County B 11,916 96.21% -1.28% $1.11 1.88% 0 Western Wayne County B 5,183 95.43% -1.20% $1.17 -0.23% 0 Metro Detroit Totals 55,401 95.72% -1.00% $1.08 2.33% 0 Class Inventory (Units) Total Occupancy (%) YoY Occupancy Change (%) Average Monthly Rent PSF ($) YoY Rent Growth (%) Under Construction (Units) Urban Greater Downtown C 5,092 93.84% -0.35% $1.30 6.13% 0 East Detroit C 1,619 95.08% 1.31% $1.07 9.56% 0 West Detroit C 5,469 94.62% 2.35% $0.86 4.82% 0 Suburban Downriver C 16,231 96.26% -0.67% $0.92 3.90% 0 East Side C 21,333 96.08% -0.76% $0.93 2.88% 0 North Oakland County C 11,300 97.26% -0.74% $0.95 3.38% 368 Southeast Oakland County C 17,611 96.60% -0.49% $0.99 2.24% 0 Western Oakland County C 8,875 96.31% -2.20% $1.00 3.19% 0 Western Wayne County C 14,331 96.61% -0.95% $1.00 4.62% 0 Metro Detroit Totals 101,861 96.27% -0.67% $0.97 3.59% 368

- 3. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2018 Detroit Capital Markets For more information, contact: Harrison West | harrison.west@am.jll.com Investment Trends Debt capital sources continue to have enthusiasm for multifamily deals - and everyone is involved, from local credit unions and banks to CMBS and hard money lenders. There has been a more disciplined approach to underwriting to make multifamily deals work, however, Agencies will continue to place capital aggressively. While we expect origination volume to continue growing, its pace will likely slow. With attractive deals in the market and favorable fundamentals, we anticipate continuing capital inflows to the sector. The new tax law has provided encouragement to real estate buyers and should boost multifamily activity moving forward. 87% 7%Private Institutional Private Equity REIT/Public Type of Buyer 7.8% 7.1% 7.3% 6.7% 6.7% 2014 2015 2016 2017 2018 Cap Rate Trends $0.00 $50,000.00 $100,000.00 2014 2015 2016 2017 2018 Sales Pricing Avg. Price PSF 55,431 30% 27% With college degrees Of residents are renters Median household income Metro Detroit at a glance 17.2M U.S. vehicles sold in 2017 4.3% Unemployment rate 3.7% Downtown population growth since 2010

- 4. © 2018 Jones Lang LaSalle IP, Inc. All rights reserved. All information contained herein is from sources deemed reliable; however, no representation or warranty is made to the accuracy thereof. Summer 2018 Detroit Recent Market Sales For more information, contact: Harrison West | harrison.west@am.jll.com Property Name Address Sale Date Units Sale Price Price Per Unit Fairlane Town Center 100 Lincoln Dr., Dearborn December 2017 200 $38,700,000 $193,500 Chimney Hill Apartments 6834 Chimney Hill Dr., West Bloomfield January 2017 328 $52,100,000 $158,841 Park Place of Northville 43001 Northville Place Dr., Northville August 2017 736 $115,500,000 $156,929 Riverfront Towers 100 Riverfront Dr., Detroit June 2016 555 $79,500,000 $143,243 Village Green of Troy East 2330 John R Rd., Troy August 2016 205 $28,200,000 $137,561 Northville Woods Apartments 18800 Innsbrook Dr., Northville January 2018 274 $35,150,000 $128,285 Emerald Apartments 298 E 13 Mile Rd., Madison Heights January 2017 29 $3,650,000 $125,862 Cinnamon Pointe Apartments 201 Cassia Ct., Canton October 2017 194 $24,000,000 $123,711 The Heights 1545 E 13 Mile Rd., Madison Heights June 2016 225 $26,100,000 $116,000 Canton Club East 41265 Crossbow Cir., Canton August 2016 148 $16,240,000 $109,730