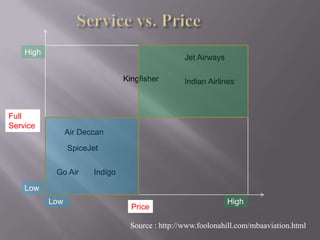

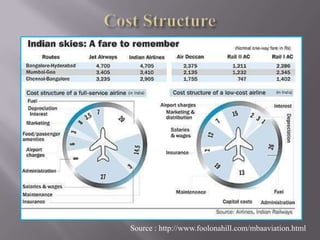

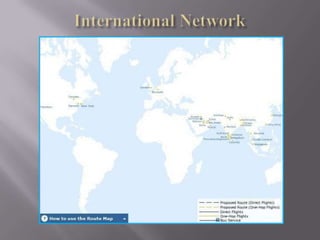

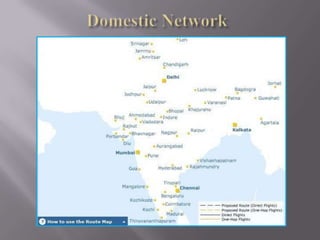

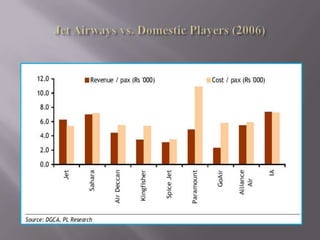

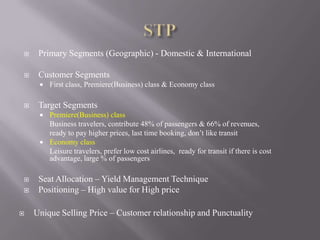

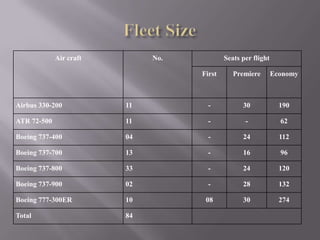

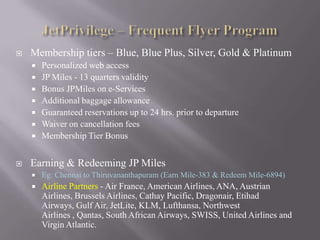

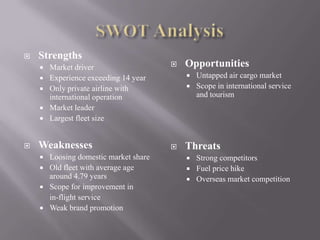

Jet Airways is India's largest domestic airline and second largest international carrier. It operates over 450 daily flights to 76 destinations worldwide. Jet Airways aims to provide a high quality service experience to passengers through initiatives like its JetPrivilege frequent flyer program and multiple service classes. The airline faces competition in the domestic market from carriers like Kingfisher, Indian Airlines, GoAir and SpiceJet.