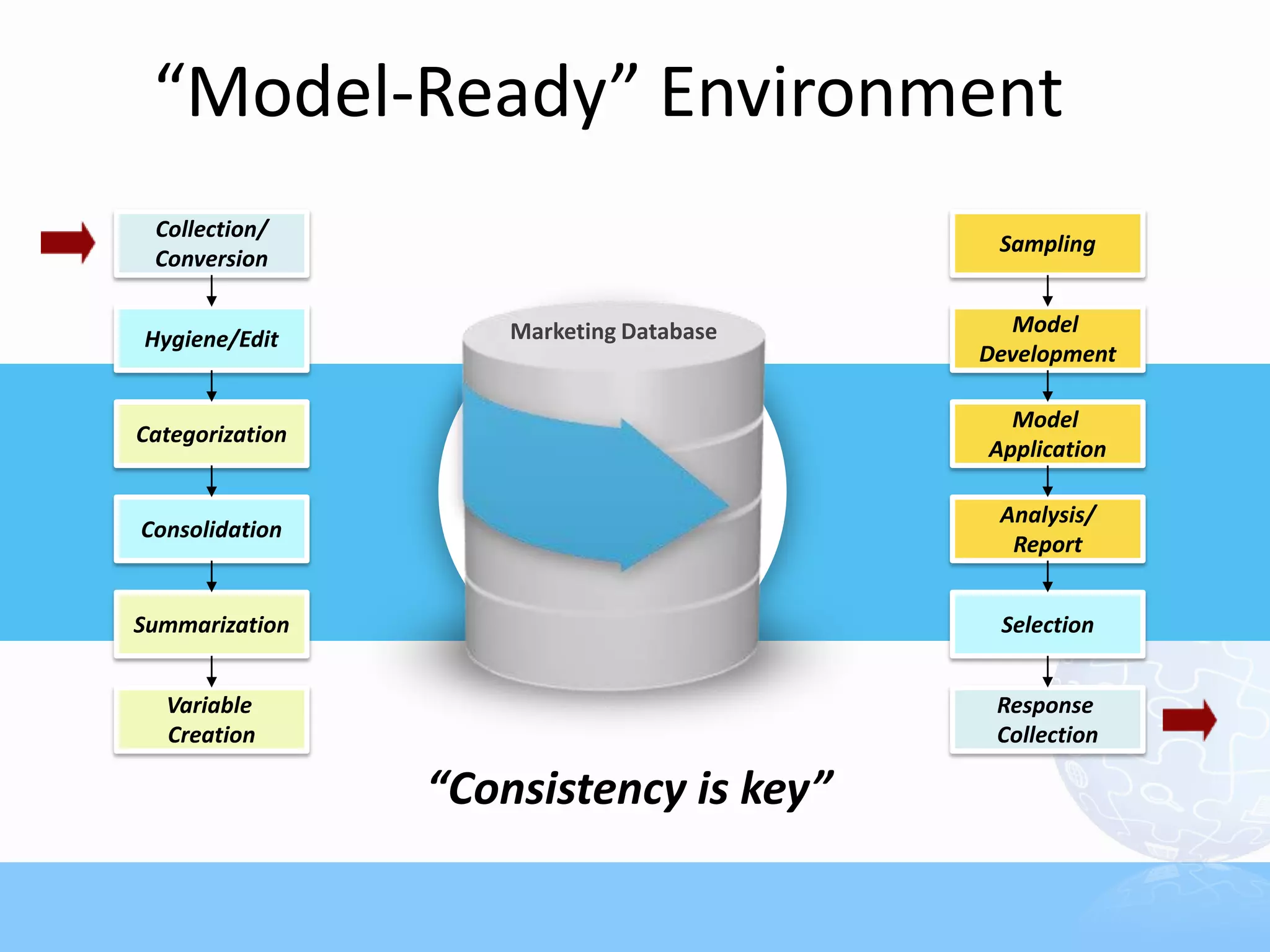

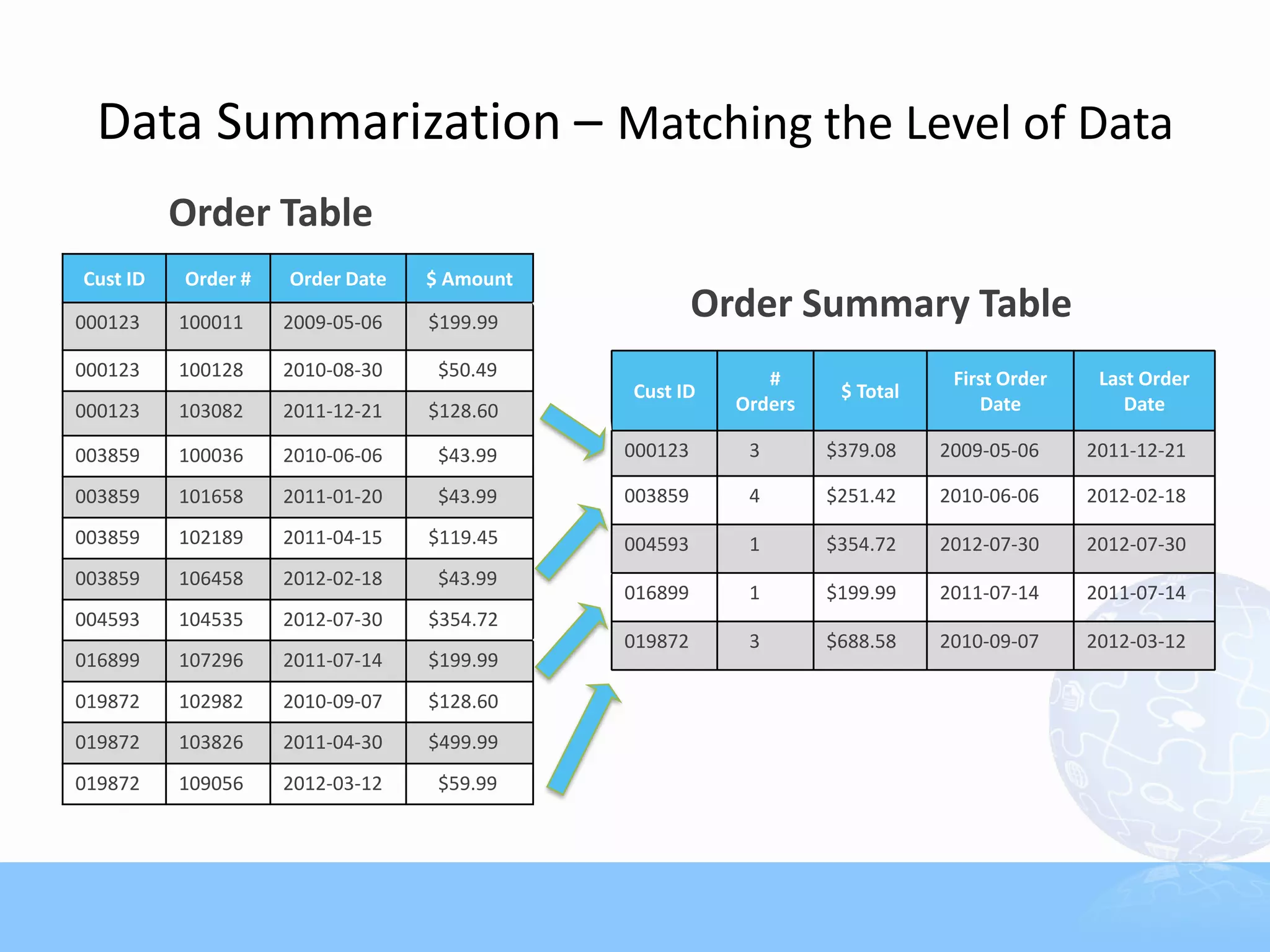

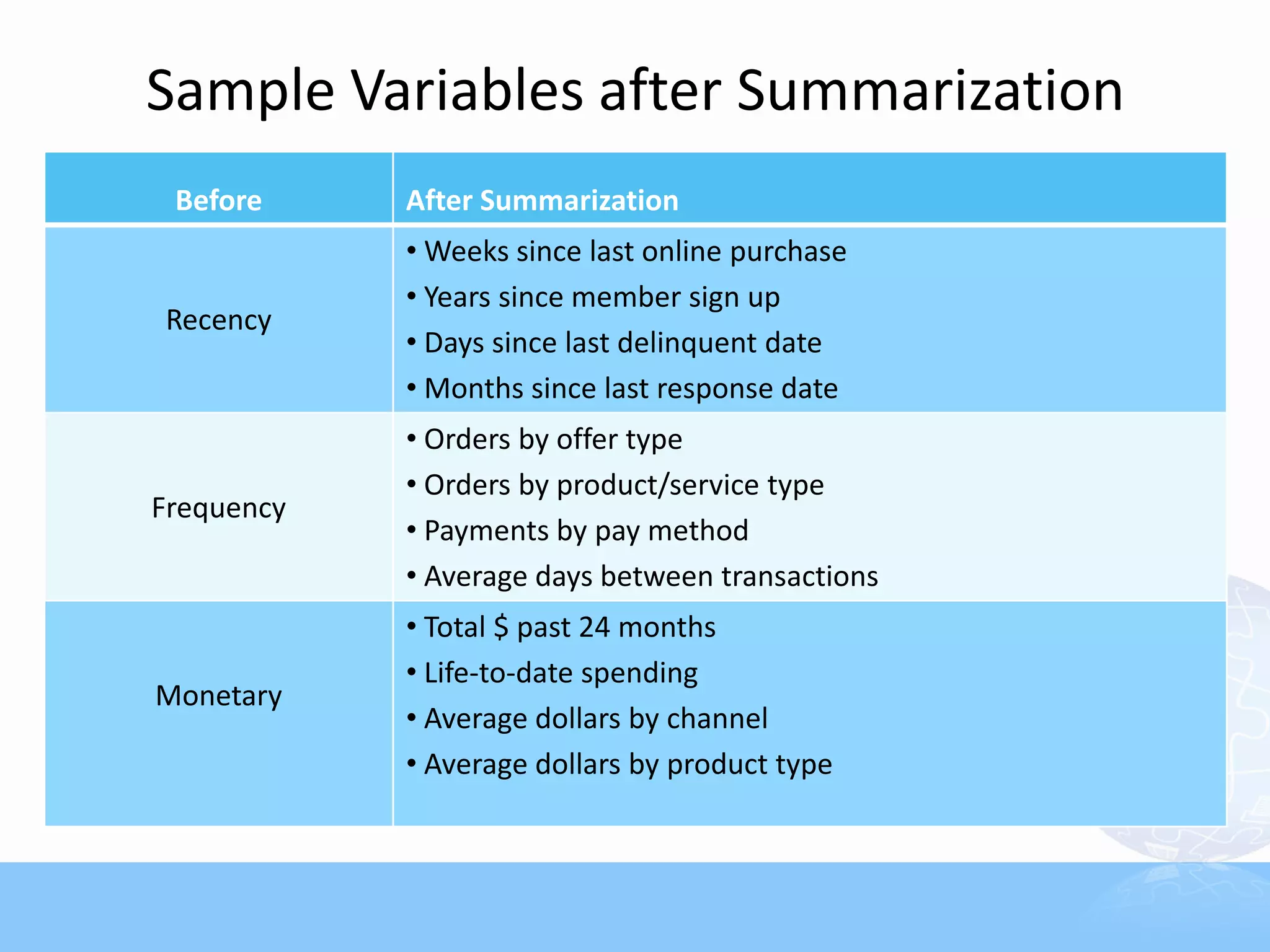

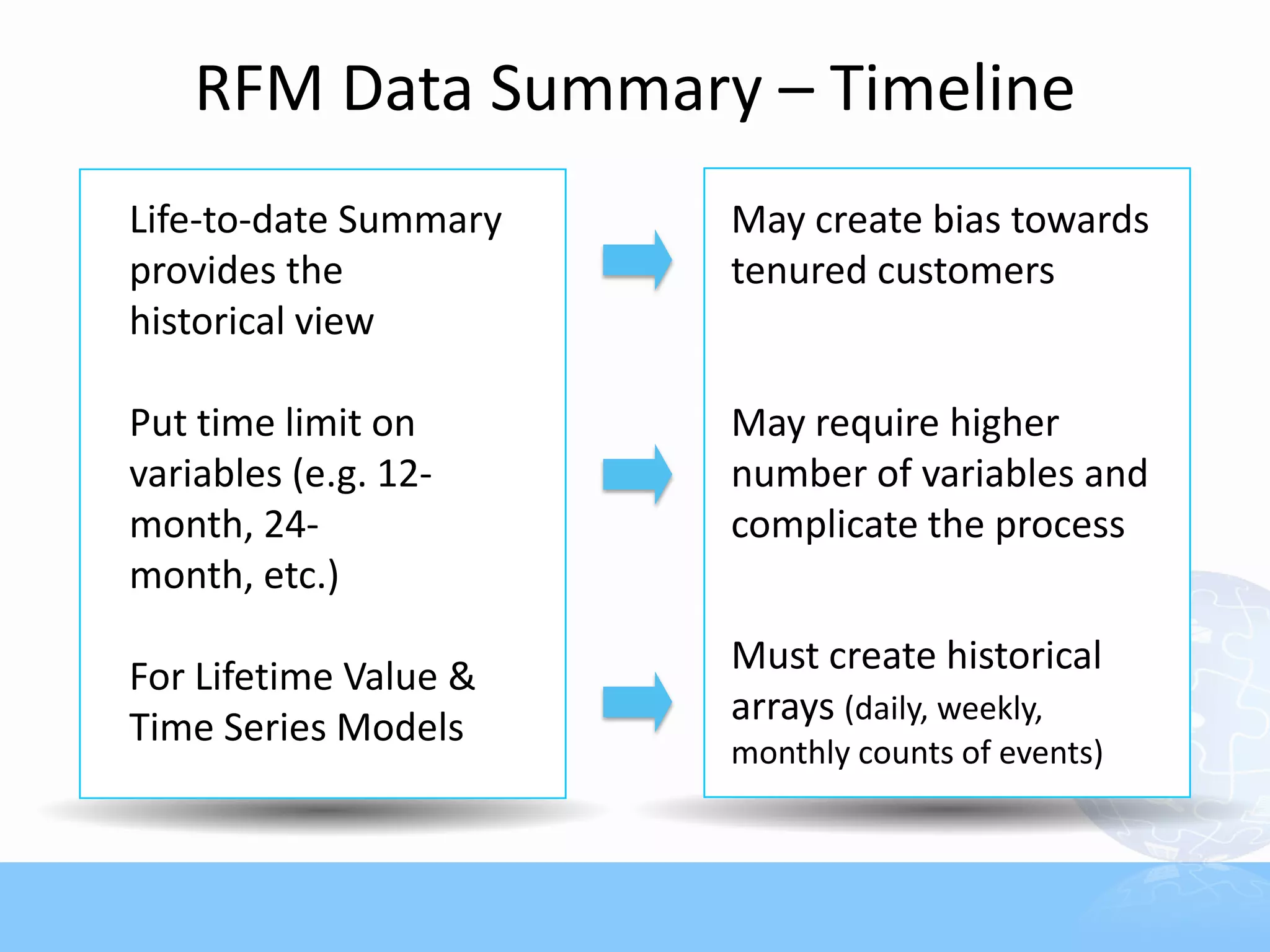

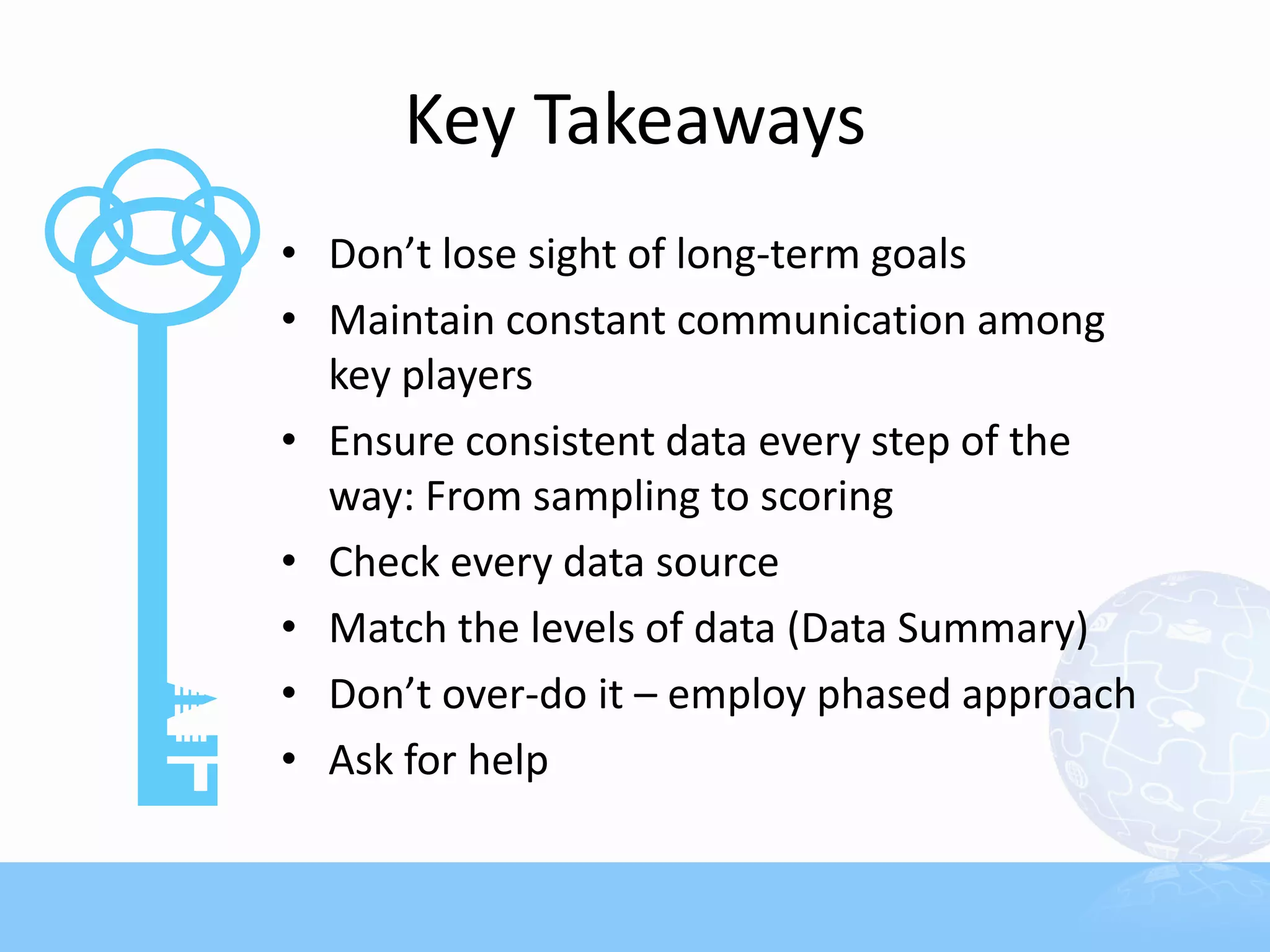

The document provides guidance on designing marketing databases to support advanced analytics and predictive modeling. It discusses the importance of collecting the right data ingredients, summarizing and categorizing variables, and ensuring consistency. Different types of analytics and variables are described, along with challenges in implementing models and what a "model-ready" database environment entails.