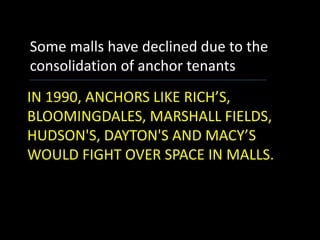

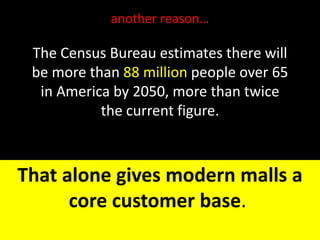

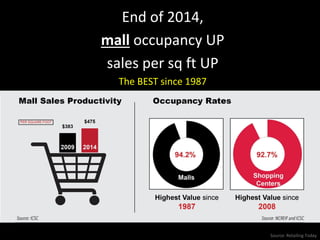

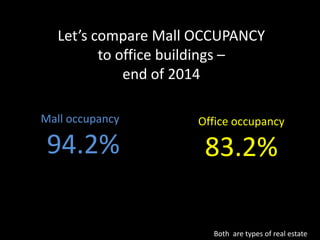

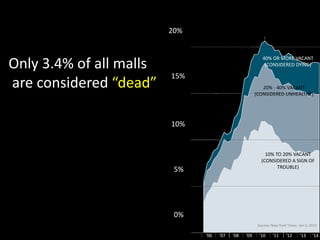

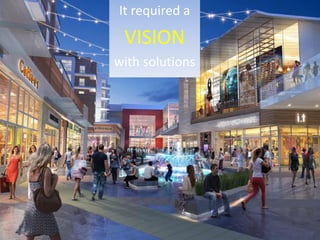

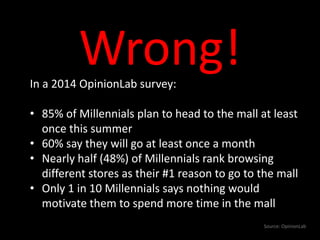

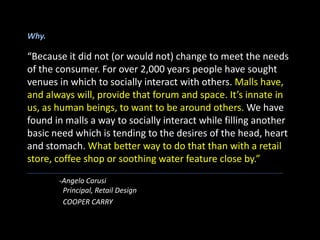

The document discusses the decline of shopping malls since 2010, attributing closures to market saturation and the inability to adapt to changing consumer behavior, rather than solely blaming e-commerce. Despite some malls struggling, statistics show that a significant majority remain healthy and continue to attract customers, particularly millennials who prefer physical shopping experiences. The text emphasizes that while malls face challenges, their success hinges on adapting to market demands and the social interaction they provide.