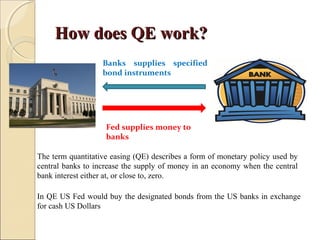

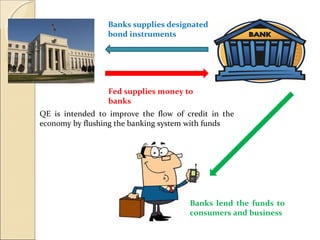

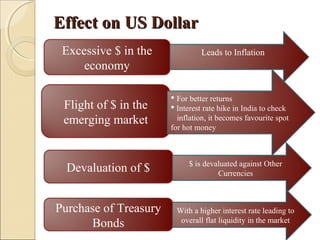

Quantitative easing is a monetary policy used by central banks to stimulate their economy by increasing the money supply. The central bank creates money to buy government bonds from banks in exchange for cash, increasing bank reserves. This is intended to improve credit flow. However, excessive money creation can cause currency devaluation and inflation. While quantitative easing aims to boost the domestic economy, it has international impacts like currency fluctuations, trade imbalances, rising commodity prices, and challenges for emerging markets and debtors.