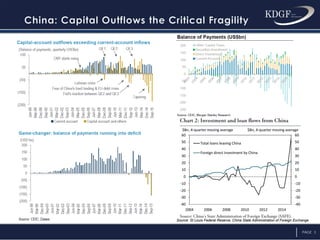

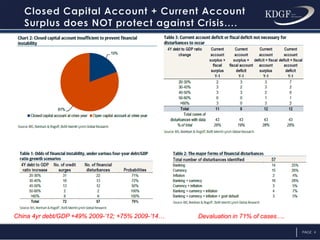

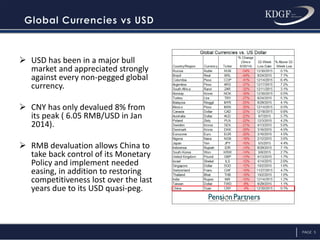

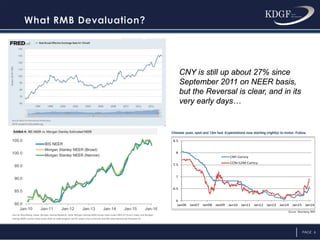

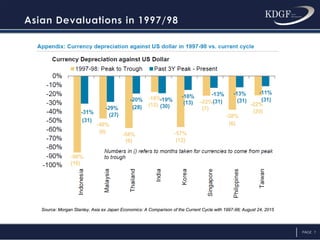

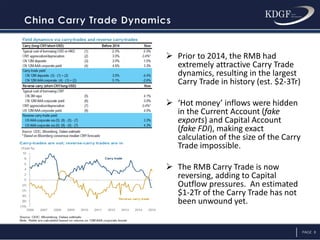

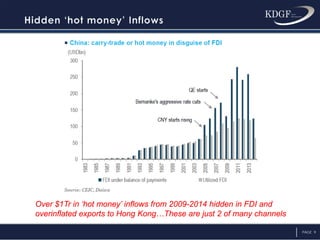

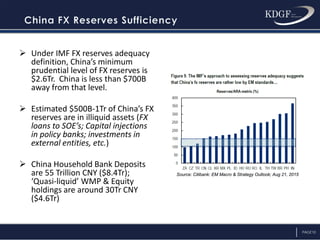

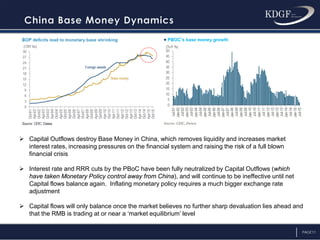

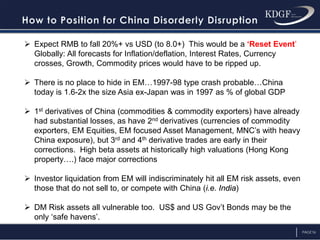

This document provides a summary of slides for a presentation on the risks facing China's economy and currency. It discusses the large capital outflows from China, the end of China's currency carry trade, declining foreign exchange reserves, and deflationary pressures. The document argues that China will be forced to allow greater depreciation of its currency, the renminbi, in order to regain control over monetary policy and restore competitiveness. It predicts a disorderly disruption in China could cause a 20% or greater fall in the renminbi and trigger widespread turmoil across emerging markets similar to the 1997 Asian financial crisis.