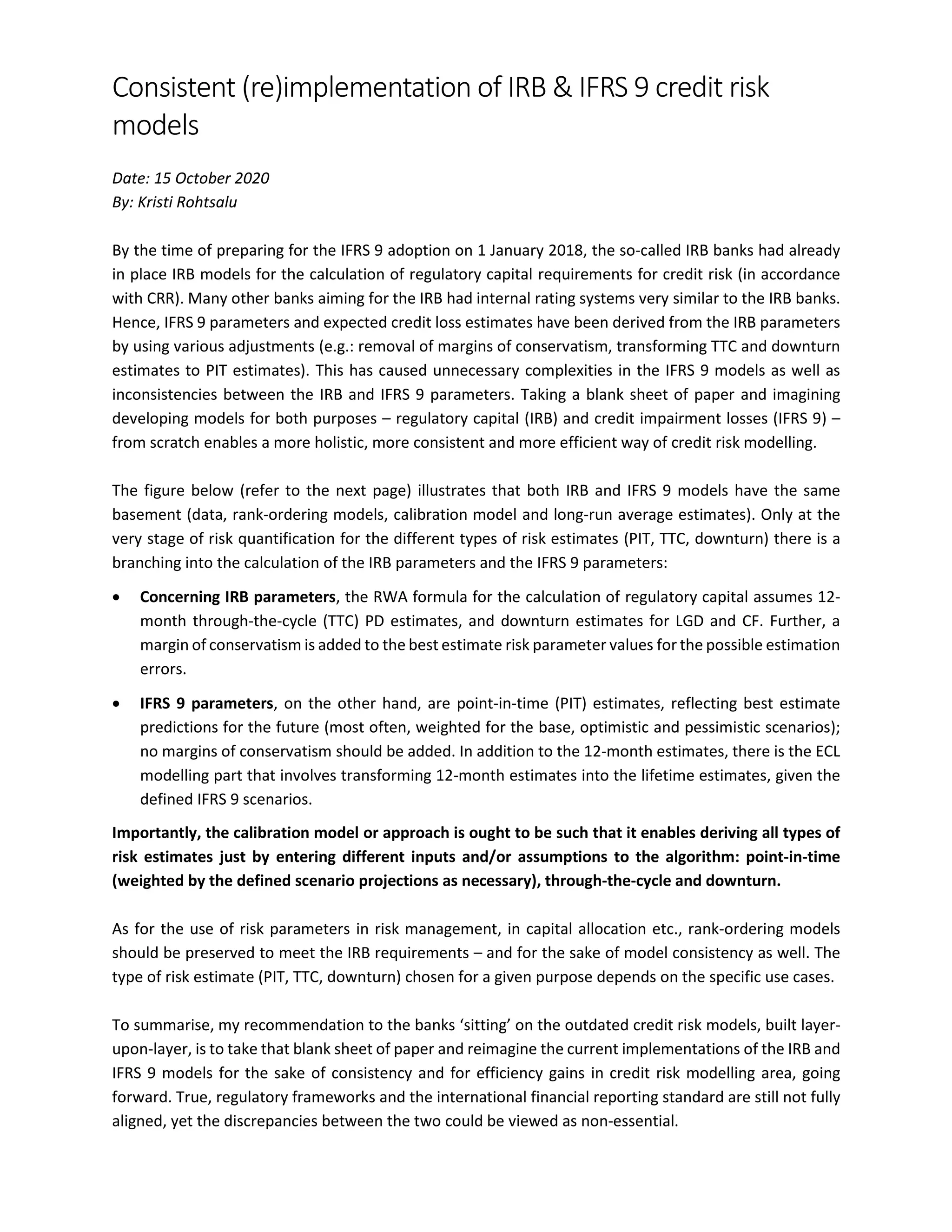

This document discusses consistent implementation of credit risk models for regulatory capital requirements (IRB models) and expected credit loss estimates (IFRS 9 models). While many banks derived IFRS 9 parameters from existing IRB models, this led to unnecessary complexity and inconsistencies. The document recommends developing both types of models together from scratch based on the same data and modeling approaches. This would result in more holistic, consistent, and efficient credit risk modeling where the models share a common basement but have different outputs tailored for regulatory capital versus impairment calculations.