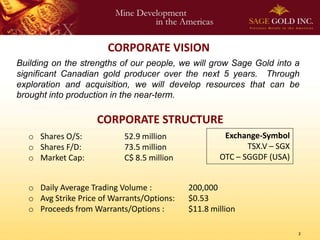

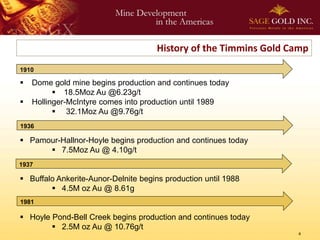

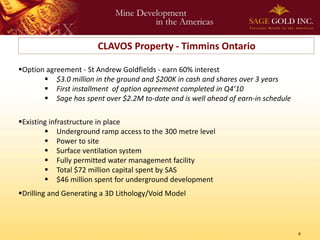

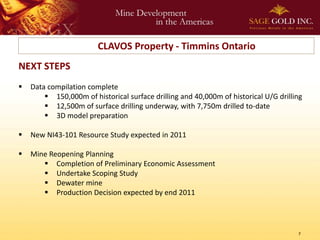

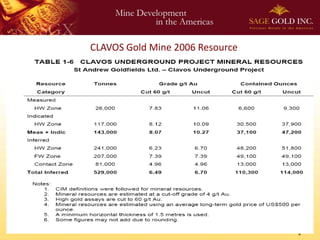

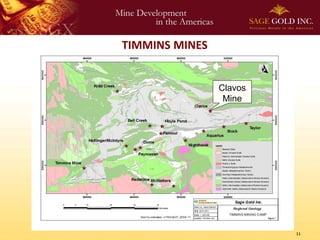

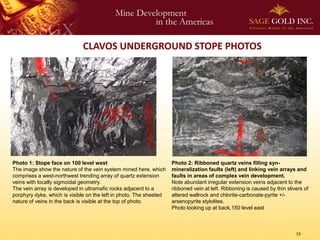

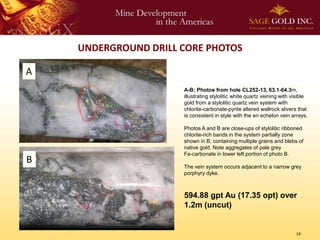

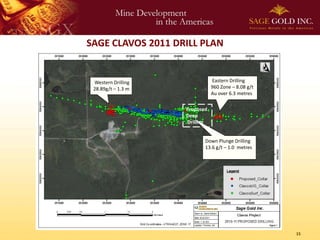

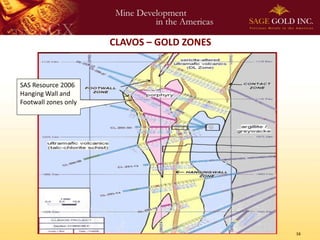

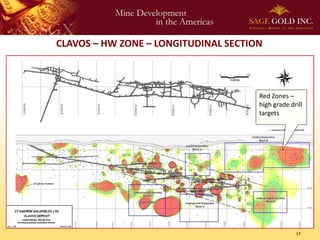

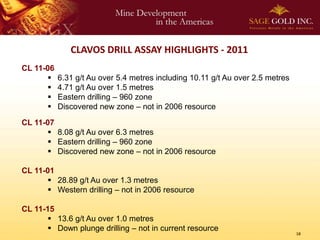

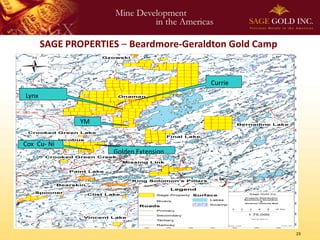

The document provides an overview of Sage Gold Corp., including forward-looking statements and risk factors to consider. It summarizes Sage Gold's corporate vision, structure, properties and projects. Specifically, it outlines plans to develop the Clavos gold mine in Timmins, Ontario, with existing infrastructure and a new resource study. It highlights drill results from 2011 indicating potential to increase resources and notes opportunities for near-term production.