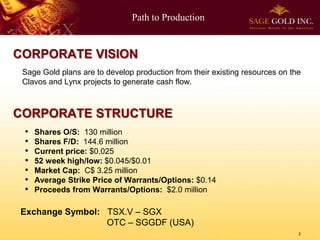

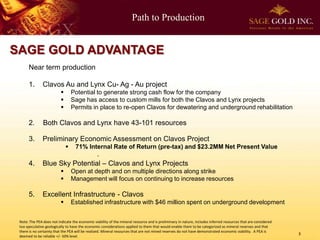

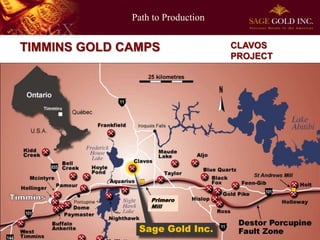

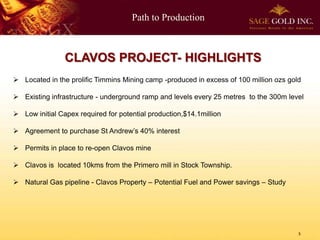

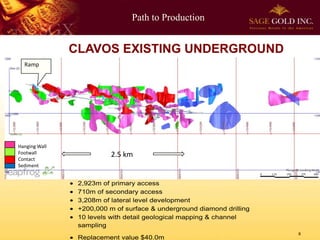

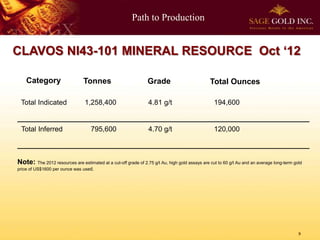

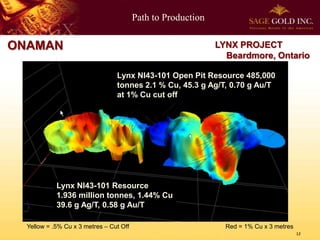

Sage Gold is a junior mining company focused on developing its Clavos gold and Lynx copper-silver-gold projects in Ontario, Canada into production to generate cash flow. Key points:

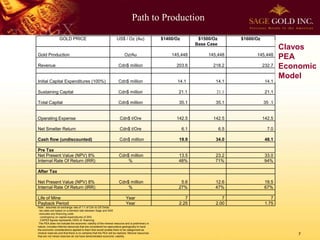

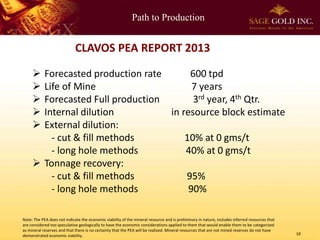

1) Sage plans to initially generate cash flow through developing production at its permitted Clavos gold project, which has an existing resource and positive