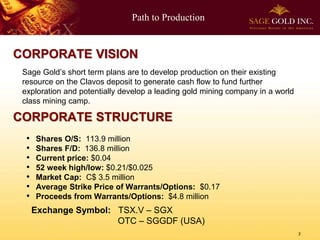

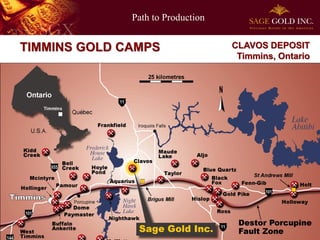

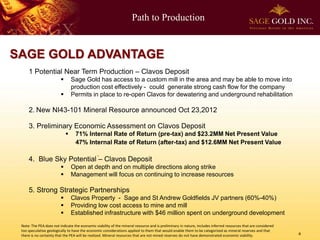

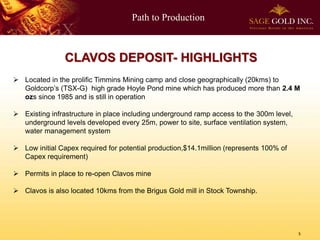

Sage Gold is developing the Clavos gold deposit in Timmins, Ontario with the goal of near-term production to generate cash flow. Key points:

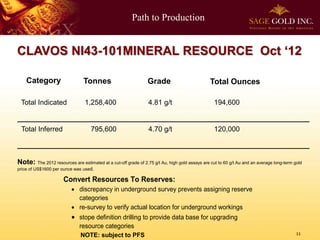

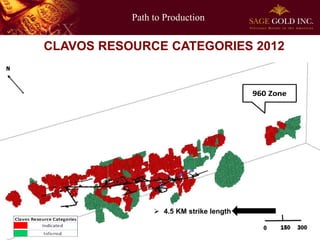

- Clavos has a NI 43-101 resource of 1.3M oz gold and permits to reopen the existing mine.

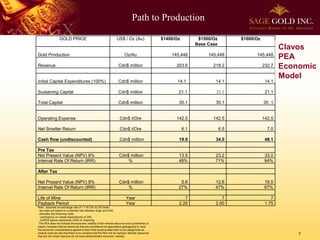

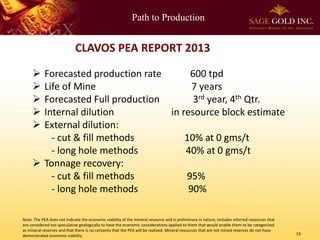

- A PEA shows strong economics for the project, with a pre-tax IRR of 71% and NPV of $23.2M at $1500/oz gold.

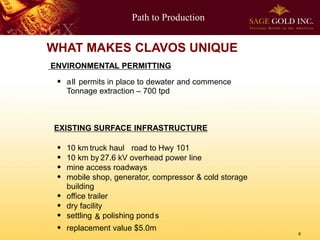

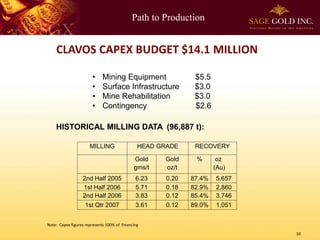

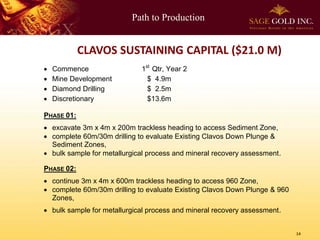

- Sage plans to dewater and rehabilitate the mine in 2013, then start initial tonnage extraction in late 2013 or early 2014 to achieve commercial production in 2015.

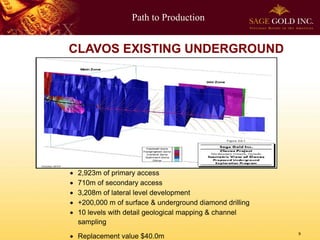

- Existing infrastructure and underground development will allow for potentially