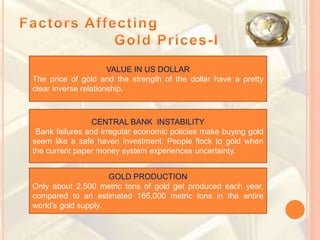

This document discusses factors that affect the price of gold, including global economic crises, inflation, interest rates, and central bank policies. It notes that gold is a finite natural resource, over half of which is used for jewelry. Major consumers of gold include India, China, and the United States. The price of gold fluctuates based on supply and demand dynamics.