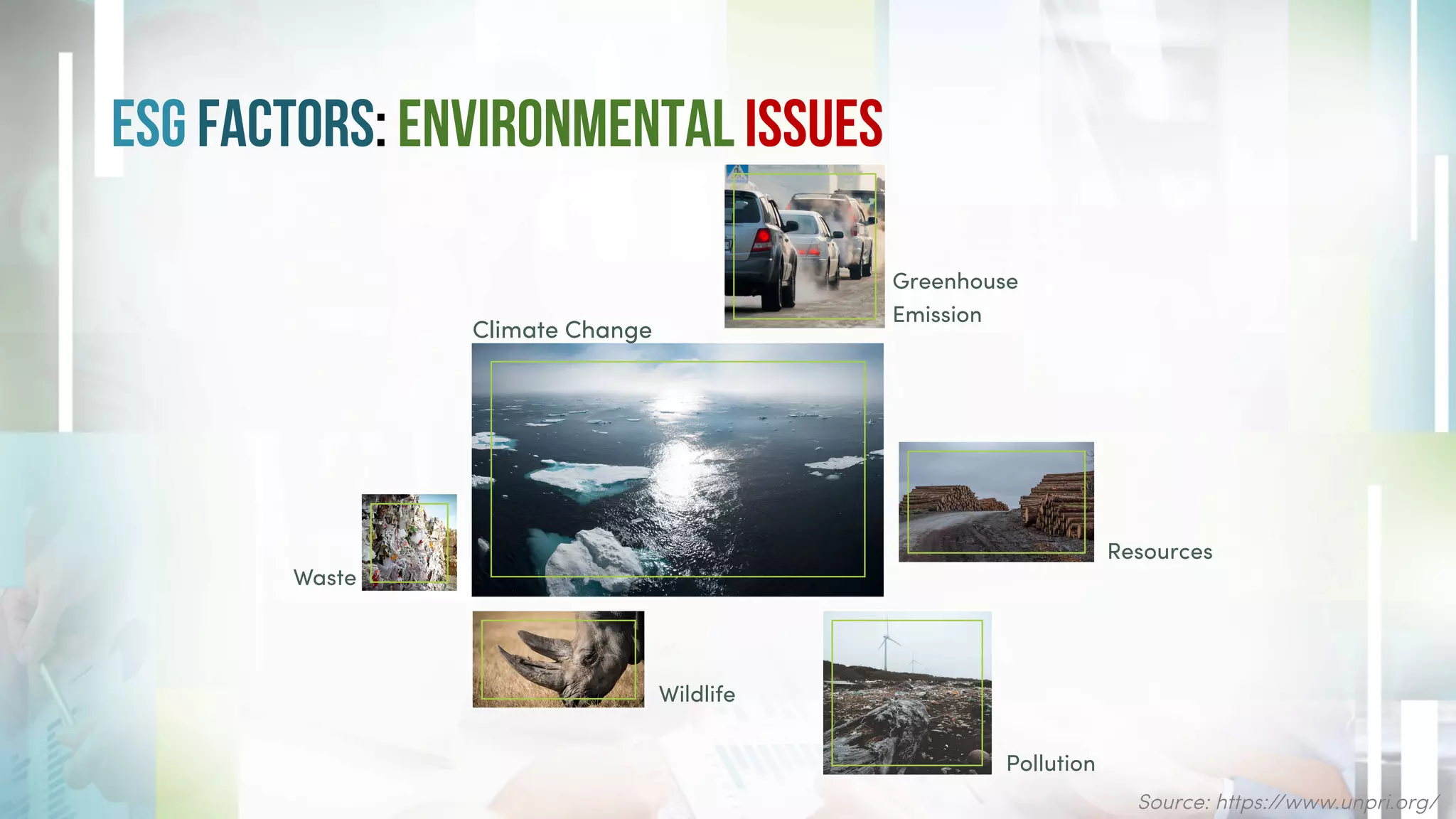

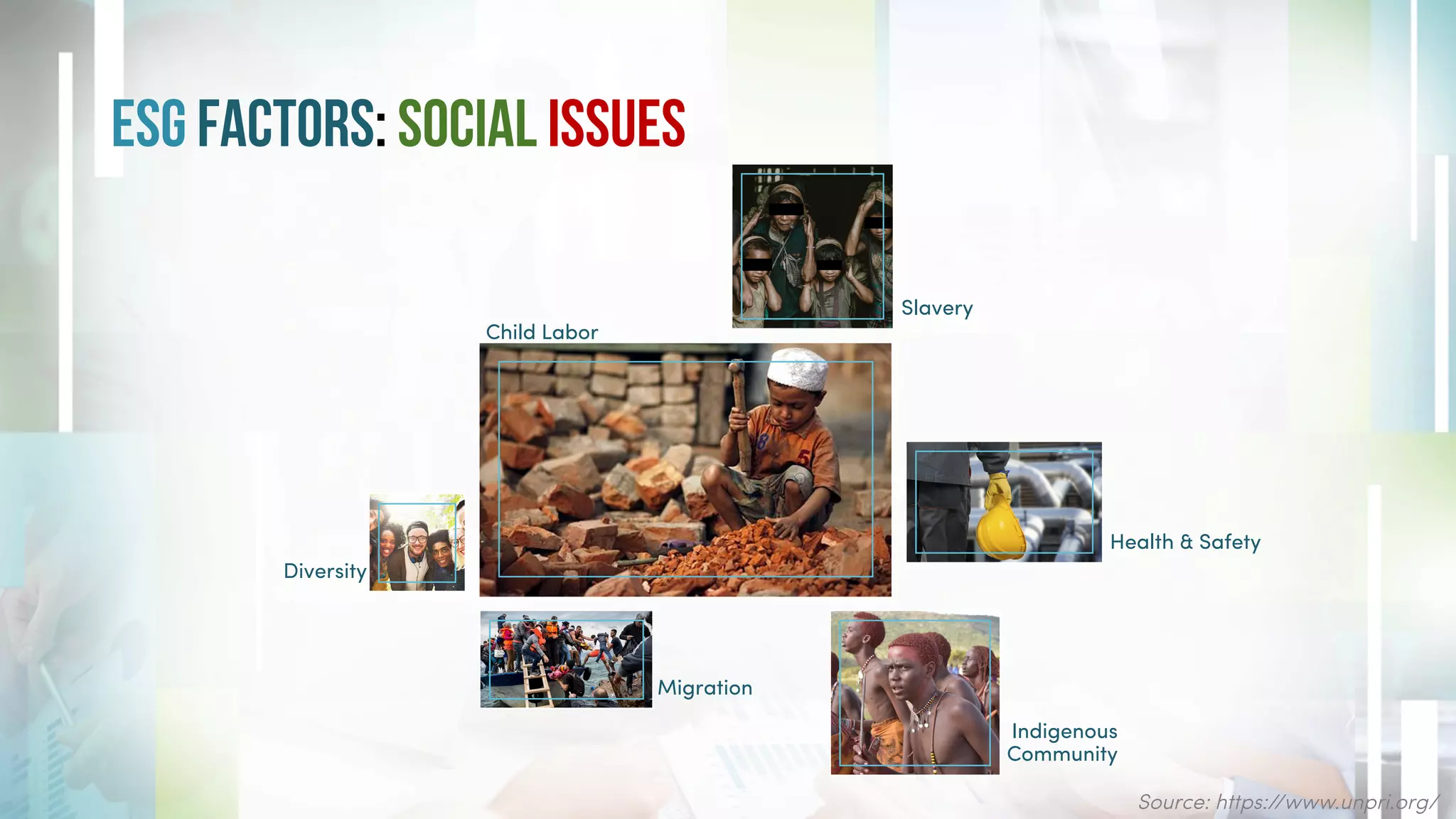

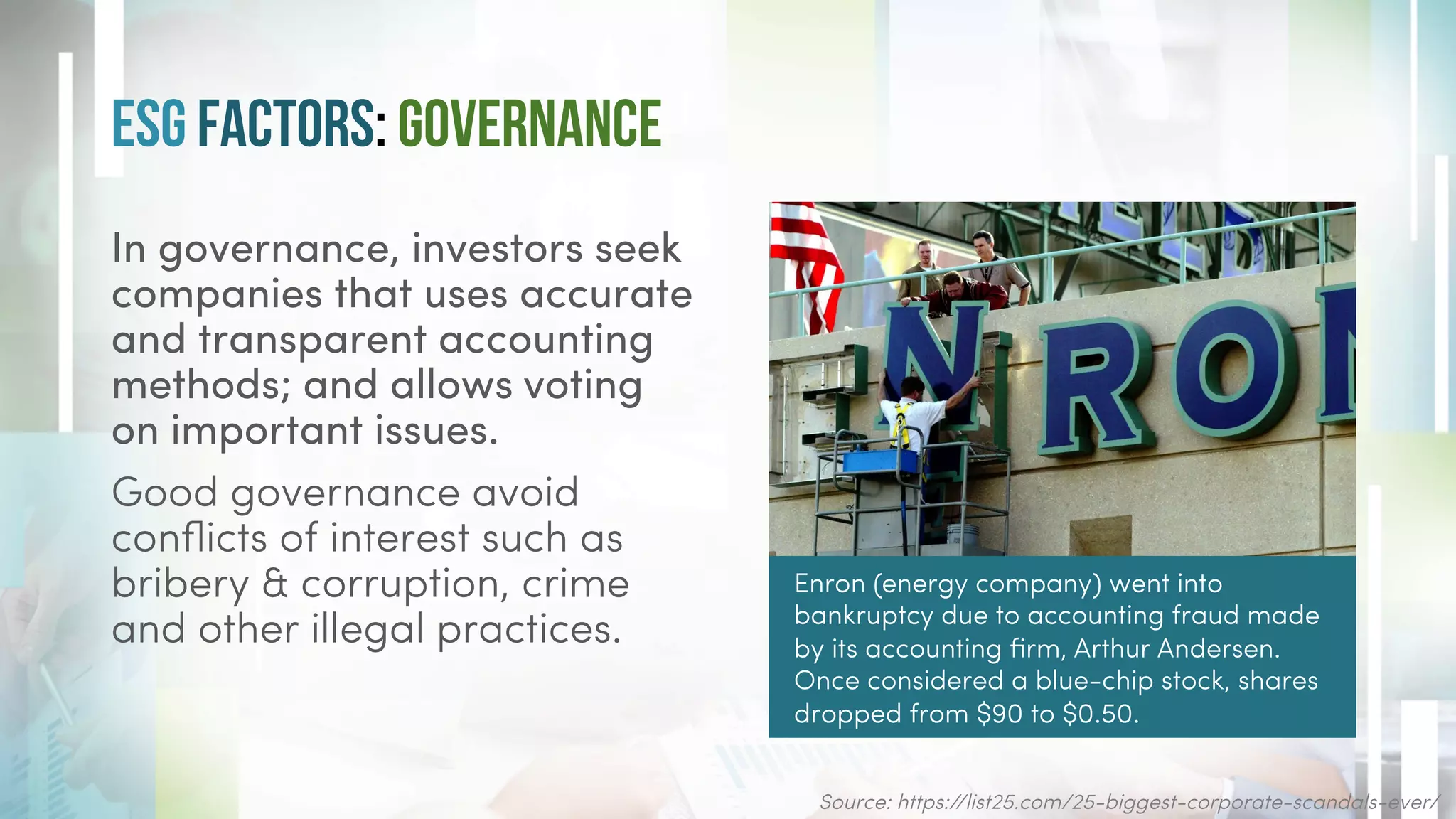

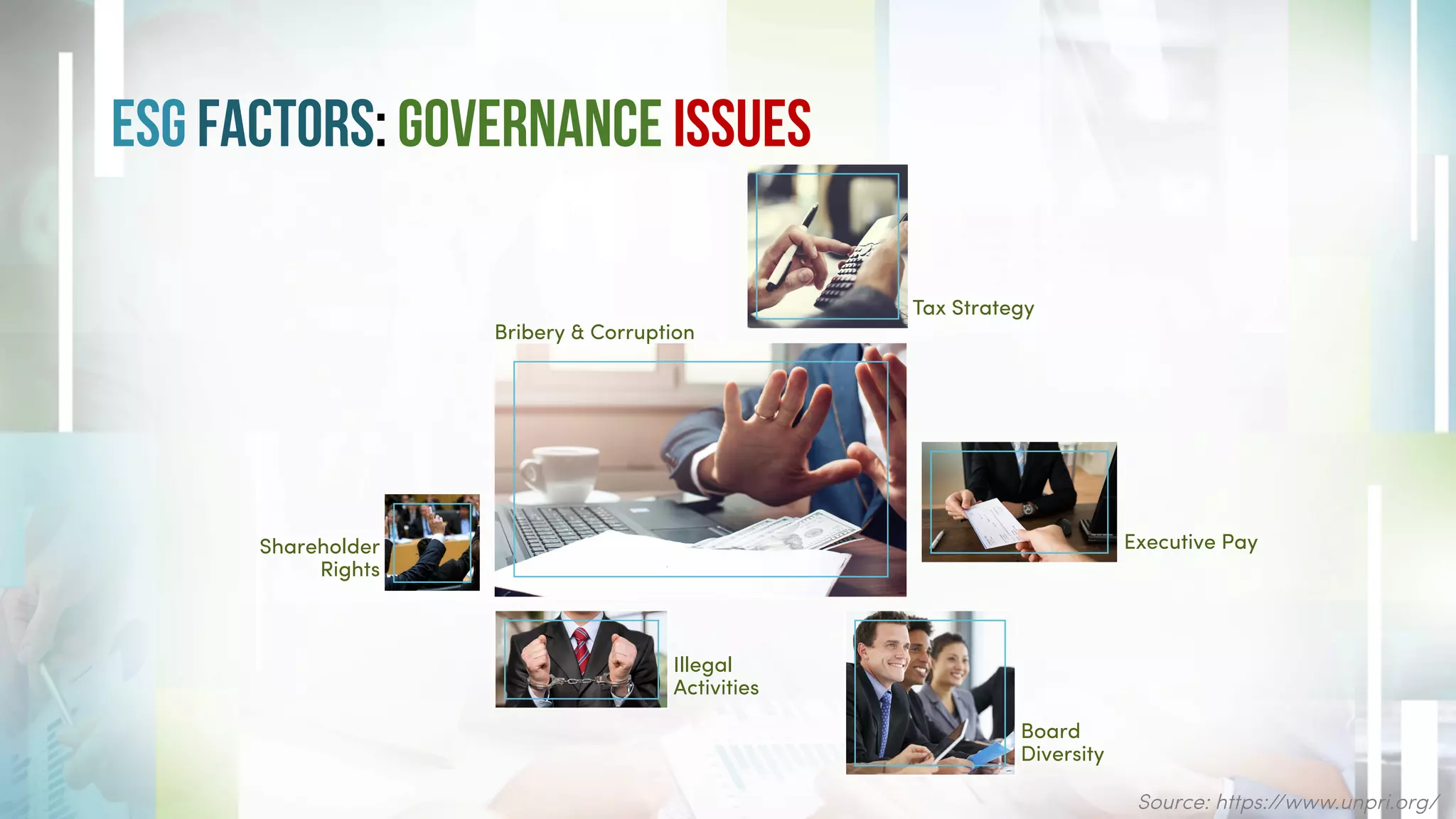

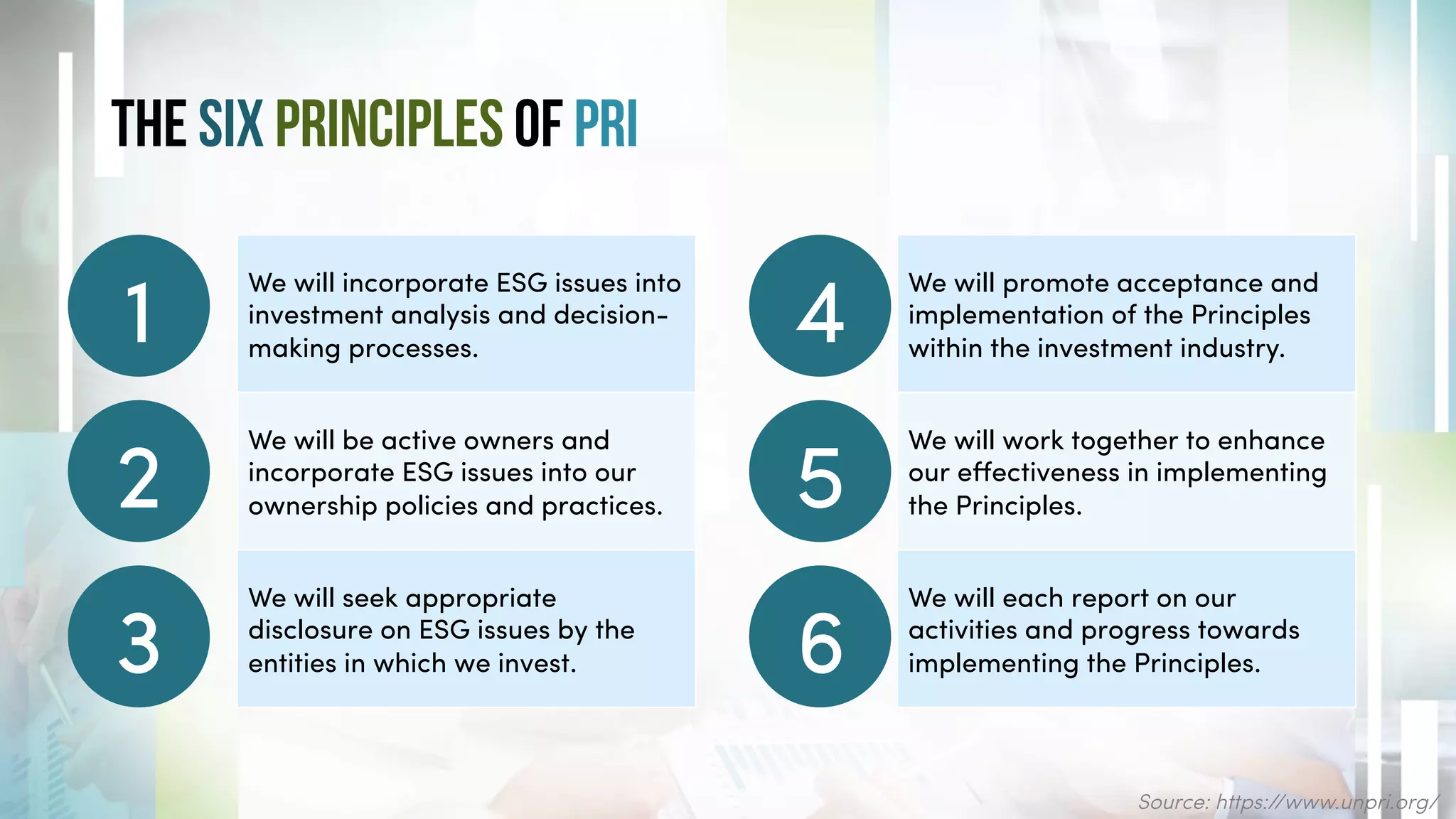

Responsible investment integrates environmental, social, and governance (ESG) factors into decision-making to manage risk and ensure sustainable returns. ESG criteria assess a company's ethical impact on sustainability, relationships, and governance practices. The Principles for Responsible Investment (PRI) promotes these practices, highlighting the benefits for businesses and investors, including improved brand image and reduced financial risks.