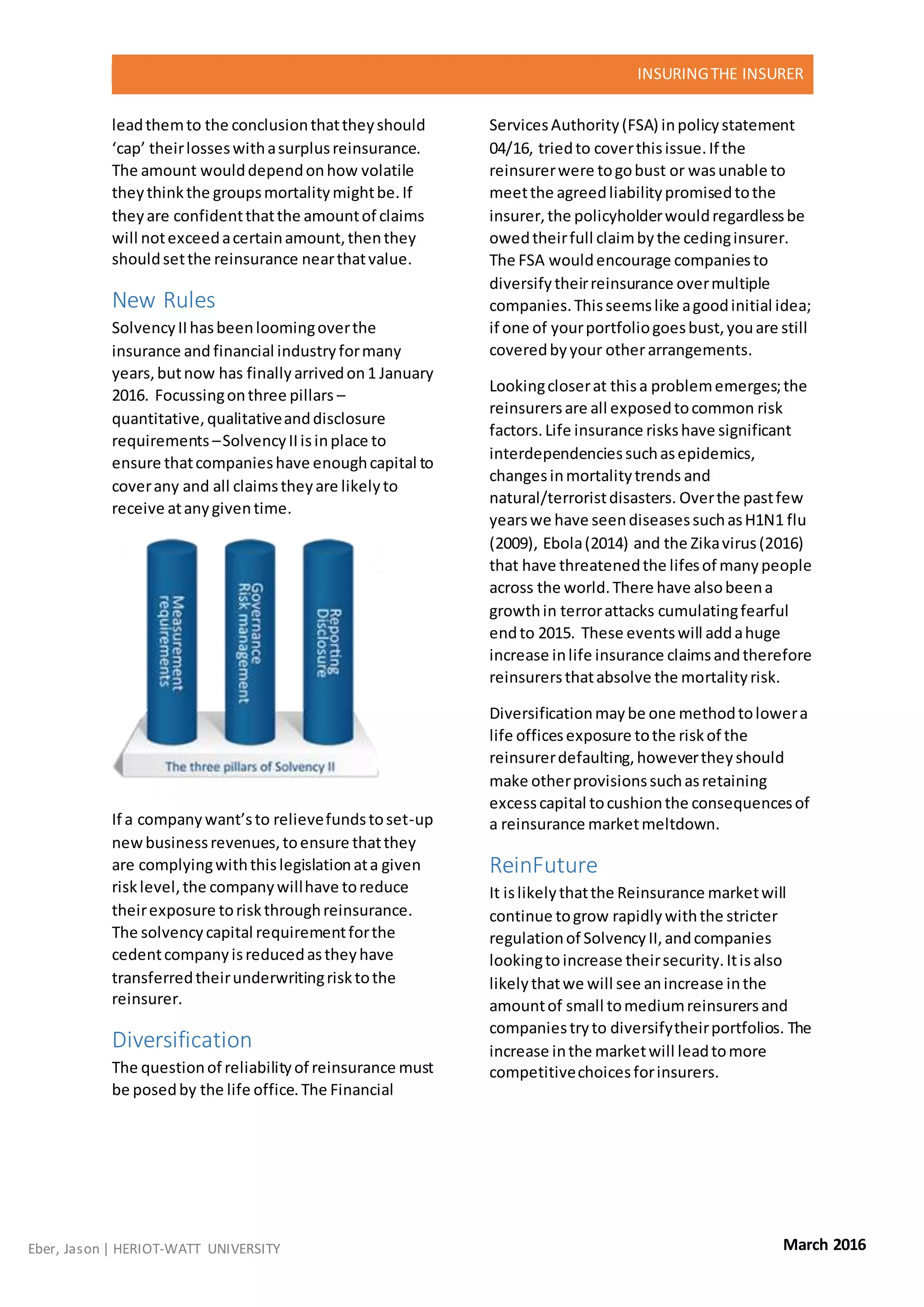

This document discusses reinsurance contracts that life insurance companies can use to mitigate risk. It describes different types of reinsurance contracts, including quota share reinsurance where claims are shared proportionally, and surplus reinsurance where the reinsurer pays claims above an agreed amount. The document also discusses how reinsurance allows insurers to comply with solvency regulations by reducing risk exposure, and how diversifying reinsurance among multiple companies can help mitigate the risk of a single reinsurer defaulting, though reinsurers still face common risks.

![INSURINGTHE INSURER

Eber, Jason | HERIOT-WATT UNIVERSITY March 2016

Bibliography

AmericanCouncil of Life Insurers.2003. Q&A: Life Reinsurance. [ONLINE] Available

at:https://www.acli.com/SiteCollectionDocuments/ACLI/004_Reinsurance_QandA.pdf. [Accessed08

March 16].

Kantakji. Reinsurance.[ONLINE] Available at: http://www.kantakji.com/media/3559/n115.pdf.

[Accessed07 March 16].The Institutes.2013. Types of reinsurance and reinsurance program

design. [ONLINE] Available

at:https://www.theinstitutes.org/comet/programs/are/assets/docs/ARe144.pdf. [Accessed08 March

16].

Investopedia. Finite Reinsurance.[ONLINE] Available

at:http://www.investopedia.com/terms/f/finitereinsurance.asp. [Accessed08 March 16].

AndrewJ.Barile .2005. What is Finite Risk Reinsurance? A Definitive Explanation. [ONLINE]

Available at: http://www.insurancejournal.com/magazines/features/2005/07/04/57827.htm. [Accessed

08 March 16].

ROBERT T. McCRORY . 1986. MORTALITY RISK IN LIFE ANNUITIES .[ONLINE] Available

at:https://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&ved=0ahUKEwiK0JD

llqfLAhWHhhoKHdj1AsAQFgg9MAU&url=https%3A%2F%2Fwww.soa.org%2Flibrary%2Fresearc

h%2Ftransactions-of-society-of-

actuaries%2F1984%2Fjanuary%2Ftsa84v3613.aspx&usg=AFQjCNHVlLS0srBtToEt7sEMB1efeL5q

JQ&bvm=bv.115339255,d.bGs&cad=rja. [Accessed08 March 16].

Paul Brett andDarshan Singh.2005. Life reinsurance credit . [ONLINE] Available

at:http://www.theactuary.com/archive/old-articles/part-6/life-reinsurance-credit-risk/. [Accessed08

March 16].](https://image.slidesharecdn.com/7d7680df-a458-4638-a1cb-e3389f0aea1f-160930121000/75/Life-Reinsurance-Article-Assessment-4-2048.jpg)