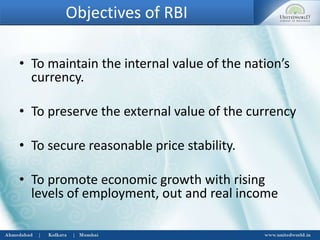

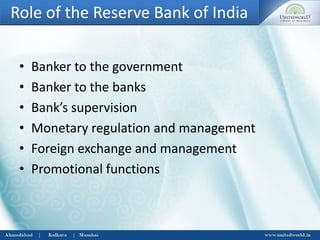

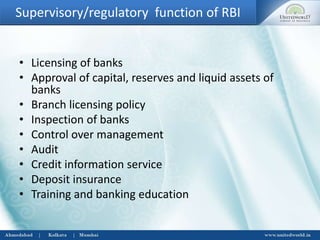

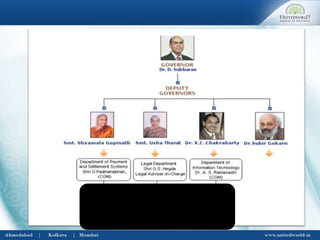

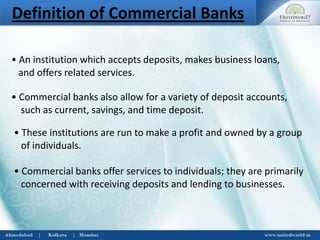

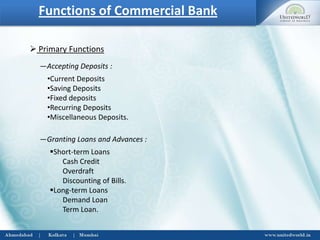

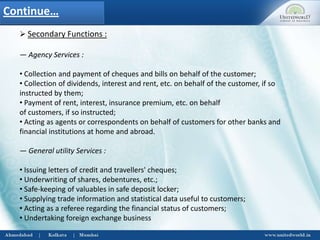

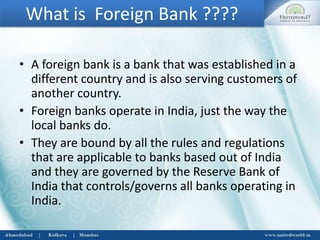

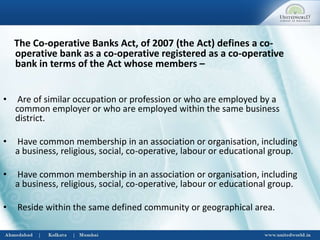

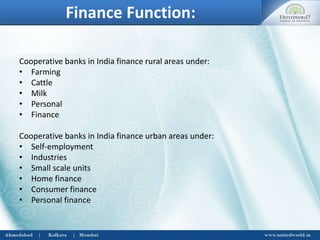

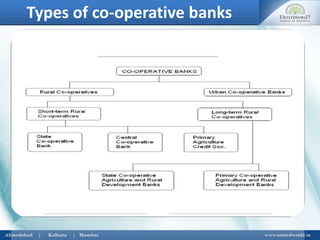

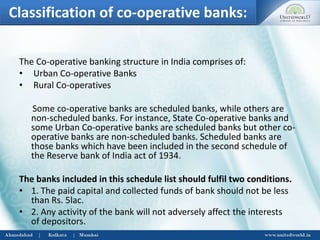

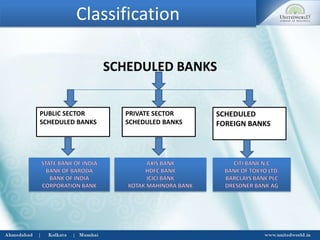

The document provides information about banks in India. It discusses the Reserve Bank of India (RBI), which was established in 1935 according to the RBI Act of 1934. The RBI formulates monetary policy and regulates other banks. It also discusses the objectives and functions of RBI, which include maintaining currency value and promoting economic growth. The document then covers commercial banks, their definition and functions, as well as nationalized commercial banks. It further discusses foreign banks operating in India, cooperative banks, scheduled banks and their classification.